Netflix

NFLX

remains in the doghouse after coming out with quarterly numbers that have put a question mark over its business model and the outlook for the entire streaming space.

The rude shock from the streaming giant has put the spotlight on other Tech leaders that are on deck to report March-quarter results this week. These include

Apple

AAPL

and

Amazon

AMZN

, which report after the market’s close on Thursday (4/28);

Microsoft

MSFT

and

Alphabet

GOOGL

reporting after the market’s close on Tuesday (4/26); and

Meta Platforms

FB

reporting after the market’s close on Wednesday (4/27).

Tech stocks were under the gun even before the Netflix bombshell, as sentiment had shifted on the group with the coming Fed policy change. Under this new monetary policy regime of shrinking liquidity and rising interest rates, high growth stocks like those in the Technology sector become less attractive. Or at least that is the perceived wisdom in the market and how these sectors are expected to behave.

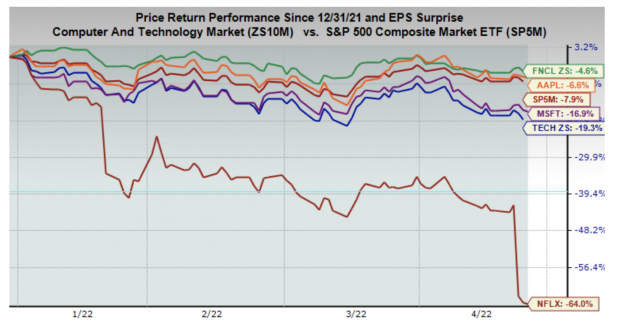

You can see this play out in the chart below that shows the year-to-date stock market performance of the Zacks Technology sector (the blue line). For comparison, the chart also includes the S&P 500 index, the Zacks Finance sector and Microsoft and Apple shares. I added Netflix to the mix to highlight what happens to a beloved stock that ends up disappointing.

Image Source: Zacks Investment Research

In fairness, Netflix doesn’t have a lot in common with the likes of Amazon, Apple, Alphabet or Microsoft. Its first-mover advantage afforded it the opportunity to capture a big slice of the emerging Streaming space, but it never enjoyed the type of moat around its business that Alphabet has in Search or Amazon has in Digital Sales.

A couple of things really stand out from the above chart. First, that the Technology sector is at the bottom of the heap — notwithstanding Netflix’s ‘doghouse’ placement. This is a reflection of the aforementioned sentiment issue with these stocks in a tightening Fed cycle. Second, the Finance sector is leading the Tech sector and also these Tech leaders, as it directly benefits from rising rates.

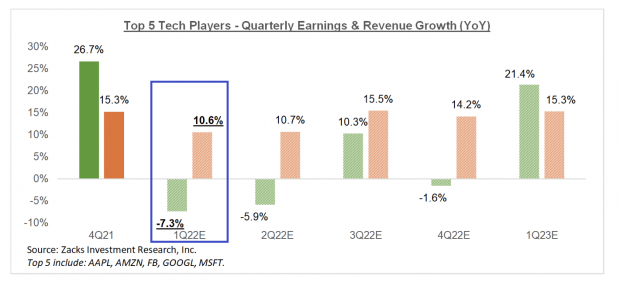

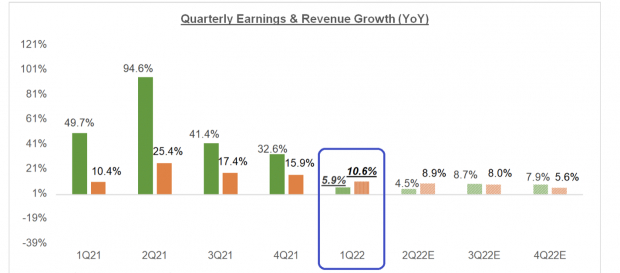

Take a look at the chart below that shows current consensus expectations for this group for the current and coming periods in the context of what they were able to achieve in 2021 Q4 and the preceding period.

We have highlighted the expected -7.3% earnings decline on +10.6% higher revenues for this group of 5 Tech leaders in 2022 Q1:

Image Source: Zacks Investment Research

As you can see here, revenues remain strong; it is the cost pressures that are weighing on earnings expectations. Needless to add that these Tech leaders are faced with compressed margins.

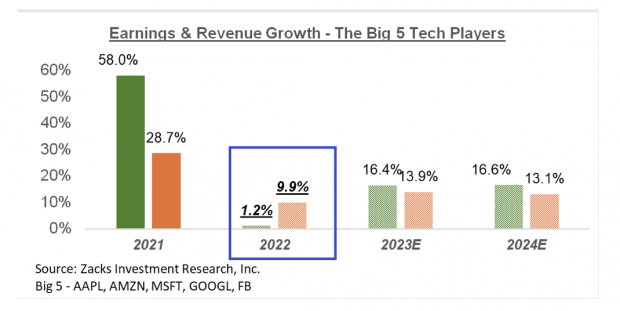

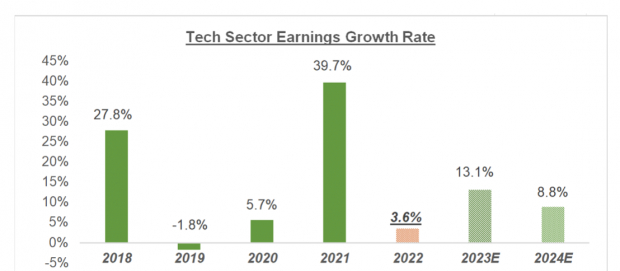

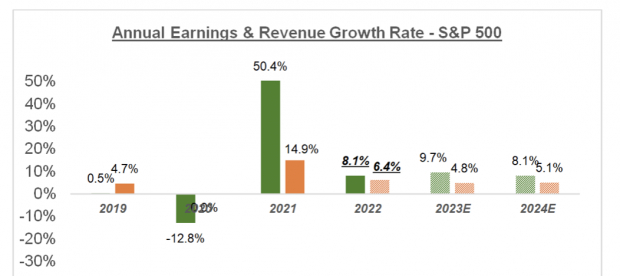

The chart below shows the group’s earnings and revenue growth on an annual basis:

Image Source: Zacks Investment Research

Look at the chart and note the growth trend from 2022 to 2023. In other words, whether the growth trend for these companies is decelerating or not is a function of your holding horizon. These companies are impressive growth engines in the long run.

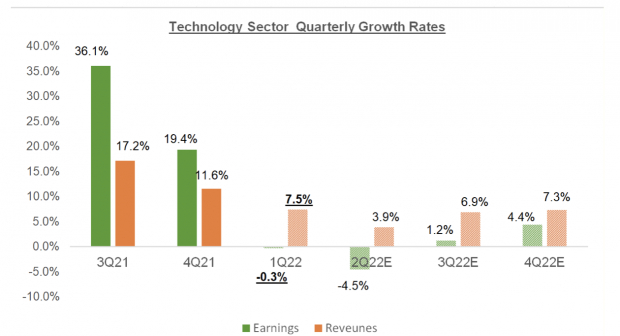

Beyond the “Big 5” Tech players, total Q1 earnings for the Technology sector as a whole are expected to be down -0.3% from the same period last year on +7.5% higher revenues.

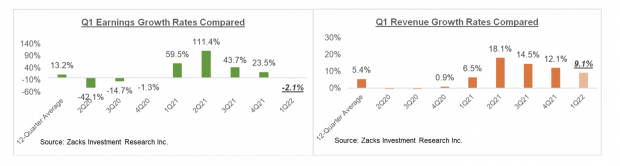

The dramatic-looking chart below shows the sector’s Q1 earnings and revenue growth expectations in the context of where growth has been in recent quarters and what is expected in the coming four periods.

Image Source: Zacks Investment Research

This big picture view of the Big 5, as well as the sector as whole, shows a decelerating growth trend. That said, unlike this “quarterly view,” the annual picture shows a lot more stability, as the chart below shows:

Image Source: Zacks Investment Research

The 2022 Q1 Earnings Season Scorecard

Total Q1 earnings for the 100 S&P 500 members that have reported results through Friday, April 22nd, are down -2.1% from the same period last year on +9.1% higher revenues, with 77% beating EPS estimates and 72% beating revenue estimates.

We get into the heart of the Q1 earnings season next week, with more than 700 companies reporting results, including 176 S&P 500 members. This week’s line-up of reports provide a representative cross section of all sectors, ranging from

Coke

KO

and

Pepsi

PEP

to

3M

MMM

and

Southwest

LUV

, in addition to the Tech leaders.

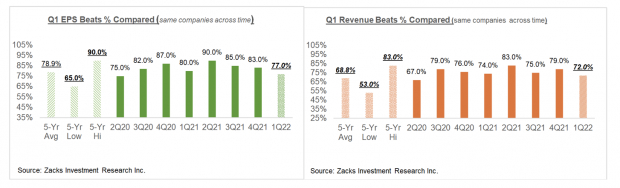

The comparison charts below put the 2022 Q1 earnings and revenue growth rates for these 100 index members in the context of what we had seen from the same group of companies in other recent periods:

Image Source: Zacks Investment Research

The comparison charts below show the Q1 EPS and revenue beats percentages for these 100 index members in a historical context:

Image Source: Zacks Investment Research

As we have been pointing out all along, companies are finding it hard to beat consensus estimates the way they had effortlessly been doing in the recent past. In fact, the Q1 beats percentages are the lowest since the second quarter of 2020.

Looking at Q1 as a whole, with actuals for these 100 index members and estimates for the still-to-come companies, total earnings are expected to be up +5.9% on +10.6% higher revenues.

Excluding the -14% decline in Finance sector earnings, the growth rate for the index improves to +12.2%. On the other hand, the Energy sector has a very robust earnings profile at present, with the sector expected to bring in +222.9% more earnings than the year-earlier period on +44.4% higher revenues.

Excluding the hefty Energy sector contribution, earnings for the remainder of the index would be up only +0.3% on +8.1% higher revenues:

Image Source: Zacks Investment Research

The chart below shows the comparable picture on an annual basis:

Image Source: Zacks Investment Research

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly

Earnings Trends report >>>> Positive Surprises at Covid Lows

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report