Nokia Oyj

NOK

has strengthened its partnership with

Microsoft Corporation

MSFT

to integrate Nokia MX Industrial Edge (MXIE) with Microsoft Azure Arc to unlock the capabilities of mission-critical applications for Industry 4.0 use cases. The integration will result in customers having seamless access to the Azure ecosystem on the MXIE platform, permitting them to run applications in the traditional cloud and on their premises.

Microsoft’s Azure Arc allows central management of a wide range of resources, performs virtual machine lifecycle management, and meets governance and compliance standards for applications, infrastructure and data. Also, Azure Arc offers simplified management and faster app development services, making it easy to monitor and secure Windows and Linux servers, SQL Server, and Kubernetes clusters across data centers.

The Nokia MXIE, a future-ready solution, has the capacity to integrate the agility and simplicity of an edge-as-a-service model to speed up the transformation of operational technology. It is specifically designed to meet the mission-critical needs of asset-intensive industrial environments. The expanded collaboration with Microsoft is likely to generate incremental revenues for Nokia in the long run.

The performance of Industry 4.0 mission-critical applications will also be enhanced via the collaboration. The Industry 4.0 mission-critical application is helping cities, industries and governments unfold a more resilient and sustainable future.

Nokia has made significant process on its three-phased journey of value creation. Its focus on capital allocation and technology leadership is expected to help it profit. The company is also witnessing healthy momentum in its focus area of software and enterprise. This augurs well for the licensing business.

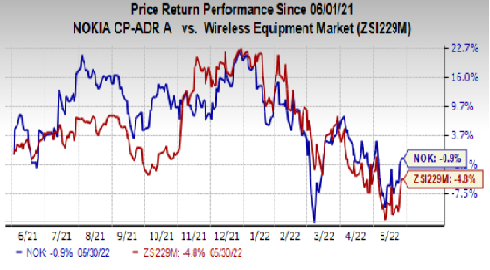

Image Source: Zacks Investment Research

Nokia has lost 0.9% over the past year compared with the

industry

’s decline of 4.8%.

It currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Better-Ranked Stocks to Consider

Coupa Software Incorporated

COUP

, currently carrying a Zacks Rank #2 (Buy), is part of the broader Zacks Computer and Technology sector. Coupa Software has a long-term earnings growth expectation of 22.32%.

Coupa Software’s smart and efficient spend-control programs, which provide enhanced reporting and analytics, have been the primary reasons behind its expanding clientele.

SAP SE

SAP

, presently carrying a Zacks Rank #2, is a key pick for stock investors. SAP has a long-term earnings growth expectation of 5.89%.

SAP, with its Rise with SAP solution, was adopted by clients, including Accenture, Canon Production Printing, Exide Industries Limited, NEC Corporation, Qinqin Food, Rising Auto and TELUS.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report