New development approach reduces pre-production capital and lowers mine’s development risk

- Trident maiden Ore Reserve includes a small open pit; this new approach lowers both the cost and execution risk of the mine’s development

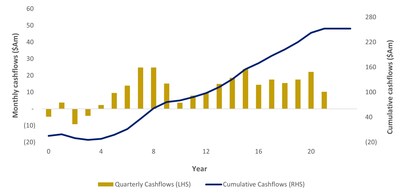

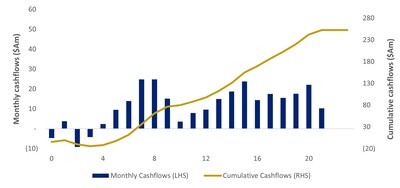

- Cashflows from the open pit reduces the maximum upfront capital drawdown to A$15m, from A$36m noted in Catalyst’s July 2023 Scoping Study1

- Trident’s key life of mine metrics are:

|

Metric |

Base case # |

Spot case (A$3,400/oz) |

|

|

Pre-production max. capital drawdown |

A$m |

19 |

15 |

|

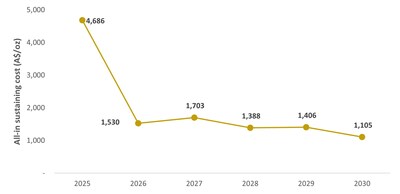

AISC (life of mine) |

A$/oz |

1,578 |

1,592 |

|

Mine life (LOM) |

yrs |

5.5 |

5.5 |

|

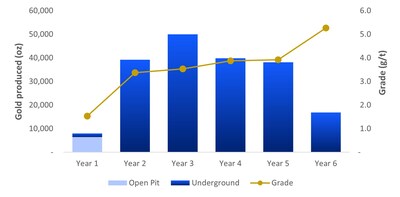

Average annual UG production |

koz |

37 |

37 |

|

Average annual free cash flow |

A$m |

29 |

53 |

|

NPV7 (pre-tax) |

A$m |

100 |

198 |

|

IRR (pre-tax) |

% |

146 % |

327 % |

|

# Base case price assumptions aligned with Ore Reserve – A$2,700/oz for underground, A$3,200/oz for open pit. |

|

Financial figures shown pre-tax due to Trident being only one satellite deposit within Catalyst’s broader portfolio. |

- Approvals well progressed; first ore targeted mid-2025

- Trident’s Resources and Reserves are:

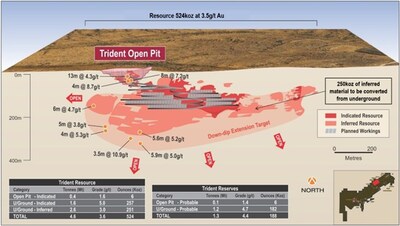

- Mineral Resource estimate: 4.6Mt at 3.5 g/t Au for 524koz

- Ore Reserve estimate: 1.3Mt at 4.5 g/t Au for 188koz

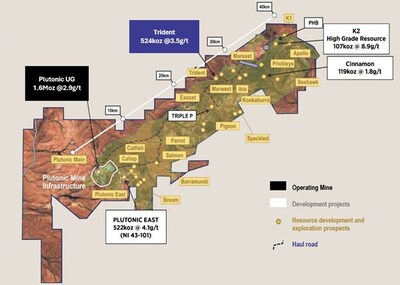

- Trident ore is to be trucked along the pre-existing haul road to Plutonic’s under-utilised processing plant

- Potential to increase Trident’s mine life through infill drilling of 250koz inferred Resource not currently included in the mine plan

- The revised development approach has a more manageable upfront capital profile; Catalyst’s strong operational cashflows from existing operations, and improving balance sheet, provide it with flexibility to fund Trident’s development

The production profile underpinning the production target is supported by 85% of probable Ore Reserves and 15% of inferred material. There is a low level of geological confidence associated with inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of indicated Mineral Resources or that the production target itself will be realised. The Inferred material does not have a material effect on the technical and economic viability of the Project.

PERTH, Australia, July 22, 2024 /PRNewswire/ – Catalyst Metals Limited (Catalyst or the Company) (ASX: CYL) is pleased to announce the maiden Ore Reserve Estimate (ORE) for the Trident Deposit (“Trident” or the “Project”). The ORE forms the basis for Catalyst’s updated development plan for Trident.

The Trident ORE is 1.3 Mt at 4.5 g/t Au for 188koz and includes an open pit ORE of 0.1Mt at 1.4g/t Au for 6koz. Supporting this ORE is a maiden Mineral Resource Estimate at the Trident open pit of 0.4Mt at 1.6g/t for 16koz Au.

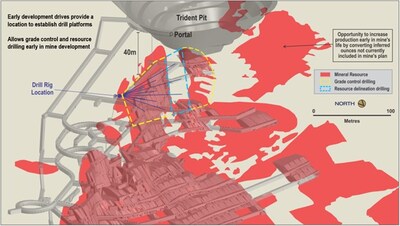

This small open pit will be the basis of Catalyst’s new development strategy and the Trident underground portal will be established within this pit. This development plan significantly changes the upfront capital profile for Trident.

At A$3,200/oz gold prices, the open pit generates positive net cashflow from 6koz of gold. These cashflows offset Trident pre-production capital costs and reduce the upfront cash drawdown to $15m, from $36m noted in the Catalyst’s Trident Scoping Study1.

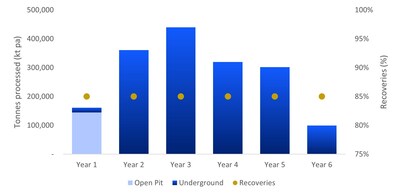

Surface mining is scheduled over a period of seven months (817k BCM in total movement) with the underground scheduled thereafter for 58 months (total Project life of 65 months). Only Indicated Mineral Resource is extracted within the open pit (Ore Reserve of 6.4koz) with the underground Production Target LOM containing 15% Inferred Mineral Resources (Ore Reserve of 182koz and Production Target LOM of 212koz).

The ore is then to be trucked down the pre-existing haul road to the Plutonic ROM before processing through the existing Plutonic Plant. The Plutonic plant has spare mill capacity to process Trident’s ore. No further capital is required to process this ore through the plant.

The Trident Operation will use other shared infrastructure with the Plutonic Operation located ~25 km to the south-west – including administration, travel and accommodation services.

Not considered in this Trident development strategy are the impact of cashflows currently being generated from existing Catalyst operations. These cashflows will further assist the company in managing Trident’s development.

While Catalyst has been reducing debt and improving its balance sheet from operating cashflow, it has also managed to lower the capital costs of two near term development projects – Plutonic East and Trident. This has led to a more balanced company with an attractive organic growth profile.

|

_________________________ |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

1 Refer to Catalyst Metals’ ASX announcement 19 July 2023 “Trident Scoping Study demonstrates Plutonic’s potential” |

Catalyst’s Managing Director & CEO, James Champion de Crespigny, commented:

“The stable operating platform at Plutonic has afforded our team the time to optimise Trident’s development. As a result, we have seen the capital requirements for the development of this new

underground mine reduce significantly.

“Last week we announced the capital costs to restart the Plutonic East underground were also reducing. These two near term low cost development projects, and Catalyst improving balance sheet, make for both a more balanced company well positioned to materiality increase gold production.”

Trident Development History

Catalyst acquired the Trident project through its acquisition of ASX listed Vango Mining in 2023. Vango had previously completed a pre-feasibility study on Trident’s Resource – at the time estimated to be 400koz @ 8 g/t Au.

In July 2023, soon after acquisition, Catalyst released a Scoping Study contemplating a decline from the existing Marwest pit into the Trident orebody. This was based on the then Resource, ie. 400koz at 8 g/t Au.

Subsequently, Catalyst drilled 44 diamond holes, allowing it to update the Mineral Resource. That updated resource – 508koz at 3.7 g/t gold – is the basis for this study.

Catalyst has spent a further A$5m on project development works – Resource, hydrology, geotechnical and metallurgical drilling along with accompanying study and permitting activities.

Continuously improving operating performance at Plutonic since the release of the July 2023 Scoping Study has provided time for Catalyst to evaluate alternative development options.

One of the alternative options Catalyst has evaluated, and now intends to move forward with, is a small open pit (or large box cut), followed by a portal and decline directly above the Trident underground orebody. A box cut to support this development option was similar in capital cost to the Marwest decline option evaluated in the July 2023 Scoping Study however it presented a lower execution risk.

A drill campaign was then initiated in 2024 so to better understand the extent of known mineralisation in the area proposed for the box cut. Encouragingly, the results of this drilling delineated a small open pit Ore Reserve which at a A$3,200/oz gold price generates positive cashflow. This Reserve sits within the large box cut or small open pit shown in Figure 1.

This new approach to Trident’s development results in the portal being within 30m of the orebody. It makes for a more manageable project for Catalyst; it reduces up front capital expenditure and has lower cash drawdown. More importantly however, the revised portal location better positions the mine for future grade control drilling, ventilation, haulage and in-mine resource development and exploration.

Summary of consulting parties used in Trident Ore Reserve and Development Plan

Catalyst engaged multiple different consultants in preparing Trident’s development plan. They comprise:

|

# |

Consultant |

Discipline |

|

1 |

Entech |

Mine design and engineering |

|

2 |

Peter O’Bryan and Associates Pty Ltd |

Geotechnical |

|

3 |

RPM |

Environment and permitting |

|

4 |

IMO, Metlab and Extreme Metallurgy |

Metallurgical studies |

|

5 |

MineBuild |

Permitting and mine readiness studies |

|

6 |

Cube Consulting |

Geology/Resources |

Table 1: Key metrics for Trident Production Target

|

Base case # |

Spot case (A$3,400/oz) |

||

|

Pre-production cash drawdown |

$Am |

19 |

15 |

|

AISC (life of mine) |

A$/oz |

1,578 |

1,592 |

|

Life of mine (LOM) |

yrs |

5.5 |

5.5 |

|

Payback (after open pit ceases) |

yrs |

1.9 |

1.4 |

|

Inferred Resource in LOM |

% |

15 % |

15 % |

|

Inferred Resource in payback period |

% |

10 % |

12 % |

|

Average annual UG production |

koz |

37 |

37 |

|

Average annual free cash flow |

$Am |

29 |

53 |

|

NPV7 (pre-tax) |

$Am |

100 |

198 |

|

IRR (pre-tax) |

% |

146 % |

327 % |

|

# Base case price assumptions aligned with Ore Reserve. A$2,700 for Underground and A$3,200 for Open Pit. |

|

Financial figures shown pre-tax due to Trident being only one satellite deposit within Catalyst’s broader portfolio. |

The production profile underpinning the Production Target is supported by 85% of Probable Ore Reserves and 15% of inferred Mineral Resource.

There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the Production Target itself will be realised. The Inferred material does not have a material effect on the technical and economic viability of the Project.

Production and cost estimates of the Trident project are outlined below.

Table 2: Life of mine operating costs Trident development

|

Operating costs (Life of Mine) |

Value ($ million) |

Value ($/t ore) |

|

Total Open Pit |

15 |

102 |

|

Ore development |

39 |

25 |

|

Stoping |

71 |

46 |

|

Mine Services and Overheads |

113 |

73 |

|

Surface Haulage |

15 |

10 |

|

Grade Control |

12 |

8 |

|

Processing |

32 |

21 |

|

General and Administration |

7 |

4 |

|

Total Underground |

303 |

188 |

Table 3: Life of mine capital costs Trident development

|

Capital (Life of Mine) |

Value ($ million) |

Value ($/t ore) |

|

Infrastructure |

16 |

11 |

|

Decline |

11 |

7 |

|

Access, Ventilation, Escapeway |

4 |

3 |

|

Mine Overheads |

14 |

9 |

|

Tailings Sustaining |

5 |

3 |

|

Total |

51 |

33 |

Trident Mineral Resources

Table 4: Trident Mineral Resource Estimate (includes Trident Underground MRE previously reported)

|

Deposit |

Measured |

Indicated |

Inferred |

Total |

||||||||

|

Tonnes |

Grade |

Gold (koz) |

Tonnes |

Grade |

Gold (koz) |

Tonnes |

Grade |

Gold (koz) |

Tonnes |

Grade |

Gold (koz) |

|

|

Open Pit |

– |

– |

– |

0.4 |

1.6 |

16 |

– |

– |

– |

0.4 |

1.6 |

16 |

|

Underground2 |

– |

– |

– |

1.6 |

5.0 |

257 |

2.6 |

3.0 |

251 |

4.2 |

3.7 |

508 |

|

Total |

– |

– |

– |

2.0 |

4.2 |

273 |

2.6 |

3.0 |

251 |

4.6 |

3.5 |

524 |

|

Notes: |

|

|

1. |

Mineral Resource reported within Shape Optimiser (SO) shapes at 1.5g/t Au cut-off. SO inputs include: |

|

2. |

Mineral Resources reported above 0.5 g/t Au within an open pit optimisation shell. Pit optimisation inputs include: |

|

3. |

Numbers may not add up due to rounding |

The Trident deposit sits approximately 25km to the north-east of the Plutonic Gold Mine.

The estimation approach for the open pit Trident MRE reported here was primarily based on domains defined by geological, structural and mineralisation characteristics. This differs from the previous MRE approach where the continuity and volume of estimation domains were largely subjected to pseudo economic and mining criteria at an elevated cut-off grade. The Catalyst estimation approach has allowed the full grade-tonnage distribution of the mineralised domains, including additional lower grade material, to be incorporated into the MRE.

The Trident MRE has been undertaken with a focus on delineating areas of the MRE with Reasonable Prospects for Eventual Economic Extraction (RPEEE). An underground Shape Optimiser (SO) evaluation has been applied to ensure that only cohesive groups of blocks that satisfy RPEEE are included in the MRE.

|

______________________________ |

|

|

2 Refer to Catalyst Metals’ ASX announcement 8 December 2023 “Plutonic and Trident Resources and Reserves – Updated” |

Trident Ore Reserves

Table 5: Trident Ore Reserve Estimate

|

Deposit |

Proved |

Probable |

Total |

||||||

|

Tonnes |

Grade |

Gold (koz) |

Tonnes |

Grade |

Gold (koz) |

Tonnes |

Grade |

Gold (koz) |

|

|

Open Pit |

– |

– |

– |

0.1 |

1.4 |

6 |

0.1 |

1.4 |

6 |

|

Underground |

– |

– |

– |

1.2 |

4.7 |

182 |

1.2 |

4.7 |

182 |

|

Total |

– |

– |

– |

1.3 |

4.5 |

188 |

1.3 |

4.5 |

188 |

|

Notes: |

|

|

1. |

Underground Ore Reserves are estimated at a 2.0 g/t Au cut-off (modified and diluted grade); |

|

2. |

Underground stope optimisation assumptions take into account operating mining, processing/haulage and G&A costs, excluding capital. |

|

3. |

Underground stope optimisations apply a 3.0m minimum mining width with 1.5m of total dilution in flat lying <40 degree dipping areas, and 1.0 m of dilution in steeper >40 degree dipping areas. Further dilution of 5% was applied to all paste filled stopes. Mining recovery of 92.5% and 95% were applied in the flat lying and steeper dipping areas respectively. |

|

4. |

Open pit Ore Reserves have a cut-off grade ranging from 0.6 – 0.7 g/t (modified and diluted grade), with dilution of 17% – 21% and mining recovery of 93%. |

|

5. |

The Ore Reserves are estimated using a Metallurgical Recovery = 83.5%; Royalties = 2.5%; Gold Price = AUD$2,700/oz. |

|

6. |

The open pit Ore Reserve does not qualify as a standalone Ore Reserve, and are reported as part of the total Trident Ore Reserve required for access to the underground. |

|

7. |

Numbers may not add up due to rounding. |

An Ore Reserve Estimation is the economically mineable part of a Measured and/or Indicated Mineral Resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted.

The declaration of Trident Ore Reserve Estimation is based on the Company’s internal studies which demonstrate economic viability of the orebody. The Ore Reserves classification reflects the Competent Person’s view of the deposit. Only Probable Ore Reserves have been declared and are based on Indicated Mineral Resources following consideration of modifying factors.

Additional information relating to the Reserve is provided in this announcement in accordance with ASX Listing Rule 5.9.1 (Section 13) and Section 4 JORC Code Table 1 which are both contained in this announcement.

1. Mining

The Trident Mine Plan is based on extracting an initial small open pit (exploiting the near surface projection of Trident ore system) with subsequent portal and decline development into the Trident Underground Mine. There has been no historical mining of this ore system.

Surface mining is scheduled over a period of seven months (817k BCM in total movement) with the underground scheduled thereafter for 58 months (total Project life of 65 months). Only Indicated Mineral Resource is extracted within the open pit (Ore Reserve of 6.4koz) with the underground Production Target LOM containing 15% Inferred Mineral Resources (Ore Reserve of 182koz and Production Target LOM of 212koz). See Table 6 for full details.

Table 6: Trident Production Target LOM and Ore Reserve Summary

|

Deposit |

Ore Reserve |

Production Target Life of Mine (LOM) |

||||

|

Tonnes (Mt) |

Grade (g/t Au) |

Ounces (koz) |

Tonnes (Mt) |

Grade (g/t |

Ounces (koz) |

|

|

Open Pit |

0.1 |

1.4 |

6 |

0.1 |

1.4 |

6 |

|

Underground |

1.2 |

4.7 |

182 |

1.5 |

4.3 |

212 |

|

Total |

1.3 |

4.5 |

188 |

1.6 |

4.2 |

218 |

|

Note: Production Target is inclusive of Ore Reserve |

The Trident Operation will use shared infrastructure with the Plutonic Operation located ~25 km to the south-west. Shared infrastructure includes the Plutonic processing facility, administration, travel and accommodation services.

Entech Pty Ltd (Entech) were engaged by Catalyst Metals to undertake the design, scheduling, and costing of the underground mine and associated surface infrastructure. Mine Fill Pty Ltd (Mine Fill) were engaged to provide testwork, technical recommendations, and cost profiles for the proposed paste filling operation. Catalyst Metals completed the design, schedule, and costing associated with the open pit, with auditing completed by Entech. Conventional mining methods and equipment specifications were forecasted for both the open pit and underground operations.

Trident West Open Pit Mining

Typical Western Australian 120 t digger and 60 t articulated trucking fleet parameters were used for the surface mining operation – including mining widths and ramp specifications. Typical open pit grade control and drill and blast activities were incorporated into the schedule. The schedule has assumed a percentage of oxide material would require blasting activities, as well as the lower horizons of the transitional / fresh interface having smooth wall blasting.

Dilution and ore loss parameters were applied on the basis of using three representative bench dig blocks and cross referencing this against in situ inventories. The subsequent mining modifying factors were then applied across the entire pit.

Geotechnical aspects were integrated into the mine plan, honouring the recommendations made by Peter O’Bryan and Associates Pty Ltd. Parameters were primarily based on a 2019 test work campaign as well as reference to historical open pit excavations within the region (Marwest and Mareast). The 2019 campaign involved drilling, logging, and testing from four dedicated geotechnical PQ3 holes within the walls of the proposed open pit. The waste rock landform has been designed outside of the ‘Zone of Instability’ plane per Department of Energy, Mines, Industry Regulation and Safety (DEMIRS) Guidelines, with a final rehabilitated slope angle of 17-19 degrees.

Due to the short-term nature of the open pit (with mining forecasted in 2025) a higher gold price of A$3,200 was used in the optimisation and subsequent mine plan / schedule. Full details on the inputs are displayed in Table 7.

Table 7: Economic Inputs – Trident West Open Pit

|

Parameter / Input |

Value |

Comment |

|

Gold price |

A$3,200/oz |

Equivalent to $ 102.9/gram |

|

Private royalties |

N/A |

|

|

WA State Royalty |

2.5 % NSR |

|

|

Metallurgical recovery |

93% ox / 93% tr / |

Based on oxide state |

|

Surface haulage |

$10.8/ore t |

Varied based on moisture content and haulage distance |

|

Grade control |

$5.0/ore t |

Based on existing drilling density |

|

Processing |

$19.88/ore t |

Oxide state varied |

|

Direct Open Pit Mining |

$14.5/bcm |

Average cost for L&H, D&B and |

|

Technical Services |

$6.4/ore t |

Mining Engineering, Survey and |

|

Mobilisation / Demobilisation |

$494k / $130k |

Contractor |

Trident Underground Mining

The underground mine design, schedule and costings are representative of a typical Western Australian underground mine. Mining has been scheduled in various blocks to ensure multiple work fronts, with each block using a combination of top-down or bottom-up.

Production rates, fleet requirements, manning levels, and mining costs are built from a combination of inputs from first principles calculations, industry experience, and the existing Plutonic operation. Mining operations were assumed to be owner-operator by Catalyst. Dedicated geological, hydrology, backfill and geotechnical studies have been completed and form key input parameters for the mine design, schedule and costings.

The Trident orebody has two distinct geometrical aspects: a sub-horizontal orientation which dips between 20° and 30° and a sub-vertical orientation which dips at more than 60°. Resultantly sub level intervals of 10 and 15m vertically were chosen to accommodate the orebody characteristics and geotechnical recommendations. The geotechnical work completed by Peter O’Bryan & Associates found that a stope hydraulic radius (HR) of 3.0 – 3.5 was recommended at Trident, given the anticipated ground conditions. The selected strike length of 10 m with sublevel spacing between 10 m and 15 m results in an HR range of ~3.0 – 3.5. This also accounts for the orebody dip and resulting hanging-wall span.

The below table displays mining factors associated with the two sub level inputs.

Table 8: MSO parameters

|

Stoping Parameter |

10m level |

15m level |

|

Stoping cut-off grade (g/t Au) |

2.0 |

2.0 |

|

Minimum mining width (m) |

3.0 |

3.0 |

|

Vertical level interval (m) |

10 |

15 |

|

Section length (m) |

2.5 |

2.5 |

|

Minimum FW dip angle (°) |

40 |

40 |

An integrated LOM design was prepared using Deswik mine planning software. To ensure overall mine production rates are achievable, activities associated with the mining works were scheduled in a logical sequence.

Longhole stoping with paste fill was selected as the preferred mining method at Trident. This is a well-understood mechanised mining method used in mining operations globally. It is proposed that longhole stoping with paste fill will use longitudinal extraction with multiple stopes taken in panels along strike. The proposed mining sequence will be a combination of bottom-up and top-down extraction.

The use of paste fill as a backfill method will allow more selectivity in extraction, higher extraction ratio which can be regulated with the paste fill cement content, as well as flexibility in extraction sequence, allowing multiple mining fronts to achieve higher production rates.

Table 9: Economic Inputs – Trident Underground

|

Parameter / Input |

Value |

Comment |

|

Gold price |

A$2,700/oz |

Equivalent to $86/gram |

|

Private royalties |

N/A |

|

|

WA State Royalty |

2.5 % NSR |

|

|

Metallurgical recovery |

83.5% fresh |

|

|

Surface haulage |

$9.8/ore t |

|

|

Grade control |

$8.1 ore t |

Based on infilling to a 7.5m density |

|

Processing |

$18.9/ ore t plus $3.5/ ore t |

Processing plus tailings dam replacement |

|

G&A |

$1.39M / an |

|

|

Paste Fill |

$88.0+10.3/m3 of paste |

Onsite dry tailings plant plus dry tailings reclaim costs |

|

Direct Operating Underground Mining |

$152 / ore t |

Operating costs for underground mining (excluding paste fill) |

Modifying factors were applied to the stope shapes during the optimisation process.

Table 10: Modifying Factors

|

Parameter |

Dilution (%) |

Recovery (%) |

|

Development ore headings |

No additional unplanned dilution above |

100 |

|

<40° dipping stopes |

1.0m HW + 0.5m FW PLUS 5% paste |

92.5 |

|

>40° dipping stopes |

0.5m HW + 0.5m FW PLUS 5% paste |

95 |

The dilution allowance at Trident is for unplanned dilution of the stope shape, in addition to dilution from mining against paste fill. The schedule makes allowance for a 5% dilution factor for the vertical and horizontal exposures formed when mining against paste fill. This is additional to the dilution factored during the optimisation process.

During the optimisation process, dilution of 1.0 m of hanging-wall and 0.5 m of footwall was applied in the flatter-dipping 10 m sublevel stopes. For the 15 m sublevel stopes, 0.5 m of dilution was allowed for on both hanging-wall and footwall.

Recovery allowances of 92.5% and 95% were applied to stopes in flat-dipping (orebody<40°) and steep-dipping (>40°) stoping areas, respectively. These recovery factors allow for bogging losses, and in shallower-dipping stopes it is accepted that there will be minor additional ore loss.

Assumptions for mine equipment requirements have been derived from industry experience, benchmark rates, and first principles calculations. Table 11 provides a summary of the peak number of units required for mine development and production.

This represents the equipment necessary to perform the following duties:

- Excavate the lateral and decline development in both ore and waste;

- Install all ground support, including rockbolting and surface support;

- Maintain the underground road surfaces;

- Drill, charge and bog (including remote bogging) all stoping ore material;

- Backfill material;

- Drill slot rises for production stoping;

- Install all underground services for development and production.

Table 11

|

Equipment |

Maximum quantity |

|

Sandvik DD422i Twin-boom jumbo |

2 |

|

Sandvik LH517 Loader |

2 |

|

Sandvik TH663i Truck |

2 |

|

Sandvik DL432i Drill |

1 |

|

Charmec MC605 Charge Up |

1 |

|

Normet MF50VC Fibrecrete Sprayer |

1 |

|

Normet LF700 Agitator Truck |

1 |

|

Sandvik 34R Raisebore |

1 |

|

Cat 12H Grader |

1 |

|

Volvo VL120 UG IT |

1 |

|

Volvo VL90 Workshop IT |

1 |

|

Cat D4 Dozer |

1 |

|

Cat 740 Watercart |

1 |

|

Toyota Landcruiser Light Vehicle |

8 |

An integrated LOM design was prepared using Deswik mine planning software. The software incorporates functionality to export all design and block model interrogation data, including volumes, tonnes, grades, and segment lengths, to the scheduler. Graphical sequencing is exported for the critical links between all development and production activities.

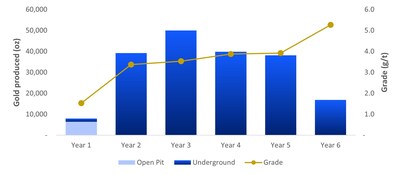

The mine is planned to produce at a peak rate of ~420,000 tpa, with an average peak stoping rate of ~40,000 t/month. The mine life is approximately five years, with peak production reached in the third year of production.

To ensure overall mine production rates are achievable, activities associated with the mining works were scheduled in a logical sequence.

The following major constraints on the underground scheduling are noted:

- Ensure a smooth ramp-up to steady ore production;

- Minimise variations in development rates and production to avoid additional project costs due to under-utilisation of equipment;

- Establish capital development at an appropriate interval ahead of production activities to defer capital spend;

- Commence stope production only once the main return airway and secondary egress is established.

2. Metallurgy and Processing

Extensive metallurgical test work of the Project has been undertaken historically by previous owners. This test work focused on gravity and cyanidation recovery. Test work has been conducted on RC and diamond drilled fresh ore composites, and transitional and oxide composites.

Catalyst engaged Independent Metallurgical Operations (IMO) and its partner Metallurgy Pty Ltd (Metlab) to conduct a DFS-level testwork study designed by IMO and Extreme Metallurgy on presented diamond core samples. The aim of the program was to define the performance of the Trident Underground ore through the established Plutonic 1.8 Mtpa gravity/CIL plant.

Table 12: Sample Compositing Overview

|

Met Sample ID |

Hole ID |

Selected Intervals (m) |

Interval |

Type/Origin |

Total Comp |

Test work |

|

23TRI MET001 |

TRD0037 |

145-146, 154-155, |

4 |

Half core |

20.3 |

BBWi only |

|

TRD0038 |

136-137, 138-140, |

4 |

||||

|

23TRI MET002 |

TRD0047 |

132-133, 134-135, |

7 |

Half core |

16.71 |

|

|

23TRI MET003 |

TRD0050 |

180-181, 187-189, |

7 |

Half core |

16.45 |

|

|

23TRI MET004 |

TRD0046 |

138-152 |

14 |

Half core in |

35.35 |

BRWi only |

|

23TRI MET006 |

TRD0042 |

189-199 |

10 |

Coarse crush |

18.6 |

Head Assay, |

|

23TRI MET007 |

TRD0047 |

148-157 |

9 |

Half Core |

23.23 |

|

|

23TRI MET008 |

TRD0048 |

148-162 |

14 |

34.82 |

||

|

23TRI MET009 |

TRD0041 |

169-187 |

18 |

41.55 |

Bond Ball Work Index (BBWi) test work was conducted on MET001, 002 and 003 composites at a closed screen size of 106µm (Table 16). The resulting BBWi’s ranged from 11.65 to 13.34 kWhr/t indicating the ore is relatively soft and in line with the 2019 ALS program (Table 13). A single Bond Rod Work index (BRWi) test was conducted on MET004 returning a significantly higher value than the previous BBWi’s implying an upfront SAG mill with scats crushing functionality will benefit overall comminution.

Below table 13 displays the gravity and cyanidation recovery testwork results.

Table 13: Gravity/Leach Test work Summary

|

Composite |

Units |

TRI MET006 |

TRI MET007 |

TRI MET008 |

TRI MET009 |

||||

|

Leach Test |

# |

LT01 |

LT02 |

LT03 |

LT04 |

LT05 |

LT06 |

LT07 |

LT08 |

|

P80 Grind Size |

µm |

106 |

75 |

106 |

75 |

106 |

75 |

106 |

75 |

|

Assayed Head Grade |

g/t |

4.25 |

4.25 |

2.91 |

2.91 |

12.12 |

12.11 |

2.44 |

2.45 |

|

Calculated Head Grade |

g/t |

4.10 |

3.95 |

2.86 |

2.90 |

11.11 |

11.34 |

2.35 |

2.25 |

|

Gravity Recovery |

% |

4.7 % |

4.8 % |

1.8 % |

1.8 % |

4.0 % |

3.9 % |

3.3 % |

3.4 % |

|

24hr Au Ext’n |

% |

80.5 % |

84.5 % |

74.7 % |

74.7 % |

81.4 % |

79.7 % |

78.4 % |

85.2 % |

|

48hr Au Ext’n |

% |

84.7 % |

85.4 % |

77.5 % |

80.8 % |

86.4 % |

86.9 % |

84.3 % |

86.1 % |

|

Residue Grade |

g/t |

0.63 |

0.58 |

0.64 |

0.56 |

1.51 |

1.48 |

0.37 |

0.31 |

|

Cyanide Consumption |

kg/t |

0.25 |

0.25 |

0.15 |

0.19 |

0.09 |

0.13 |

0.20 |

0.25 |

|

Lime Consumption |

kg/t |

0.80 |

0.90 |

0.64 |

0.92 |

1.05 |

1.02 |

1.06 |

1.06 |

All composites displayed similar gravity and leach characteristics with only marginal improvement through a finer grind (P80 106 to 75µm). Composites with a lower bismuth content displayed the highest grind sensitivity. Gravity recoveries were very low as was predicted through early mineralogical studies where visible gold was 1 to 2µm in size. This will negate the need for a gravity circuit if treated solely.

Approximately 90% of the leachable component entered solution within the first 4 hours in most tests irrespective of grind size. The dissolution curves did not plateau with leaching evident between 24 and 48hrs at conditions reflective of a typical CIL plant. Historical test work was conducted at elevated cyanide concentrations (1000 – 2000 ppm CN) therefore likely inflated realistic recoveries. The higher cyanide concentrations resulted in enhanced dissolution of gold from the bismuth and telluride sulphide minerals which was not the case at DFS leach conditions.

Lime and cyanide consumption rates were both very low when compared to Western Australian peers due to the excellent site water quality. For DFS tests the free cyanide concentration after 48 hours still exceeded 300 ppm indicating that a lower initial cyanide concentration is possible for free milling ores.

The test work indicated that implementing an average 83.5% metallurgical recovery is both prudent and auditable. The recovery is reflective of the current Plutonic processing plant’s capacity, grind sizing of 75 µm, as well as a Trident blend average percentage of 18%, however, further test work and optimisation of the processing plant could result in higher recoveries

Concentrations of silver and other deleterious elements have been noted as low across different ore types including fresh, transitional and weathered ore.

3. Site Infrastructure

The surface infrastructure at Trident will be established close to the mining footprint. The accommodation village, airstrip and processing facilities are being shared with the existing Plutonic operation. Trident is located approximately 25km to the north-east of Plutonic.

The infrastructure requirements are based on input from Catalyst, Entech and other third-party consultants. Catalyst has generated the site layout in consultation with their operations team, considering effective implementation of the mine plan and safety or regulatory requirements.

Infrastructure specifications and costs have been sourced from vendor quotations based on the mine plan requirements.

Surface ore haulage at Trident consists of ore being transported from a nearby temporary ROM stockpile to the ROM stockpile at the Plutonic processing facility. On the back haul, road trains will travel to the Rainbow Trout open pit and load with dry tailings which is transported to Trident’s dry tailings storage for feed to the paste fill plant. All road networks are existing, and cost allowance has been made for refurbishment and ongoing maintenance which are not anticipated to be significant works.

Allowance for diesel storage and dispensing facilities for mining activities has been included in the surface layout and cost estimate. The cost estimate also includes separate diesel storage facilities for power generation.

Mine water will be supplied from the Mareast open pit, which is located 2.3km east of the Trident portal. A pontoon-style pump will be installed in the pit lake, and to ensure that solids content is minimised, the pump will be located away from the discharge pipeline feeding the void. Mine water will be temporarily stored in a series of 50kL tanks which will then feed the underground mine. Potable water supplies will be available from the Plutonic main administration and processing site. A regular water tank service will be scheduled to ensure sufficient supply.

The Trident paste facility will be located on the surface, above the surface expression of the deposit. Dry tailings will be carted to the facility for subsequent conditioning and use, with water supplied from the neighbouring Mareast open pit. The main underground power station, located adjacent to the paste plant, will provide power requirements.

A single surface magazine compound will be constructed for the Trident underground mine which will consist of a cleared area and fence. A surface magazine is available for use and is being relocated to Trident from the Plutonic operations.

All waste rock generated during underground mining is assumed to be trucked to surface for disposal on the waste dump. The Trident waste dump is an extension to the existing waste dump that was in place for the excavation of prior open pits.

4. Environmental, Social Impact and Permitting

The Trident deposit is located in a previously mined area and Catalyst’s proposed development footprint has been designed within existing disturbance envelopes to the extent possible. All required baseline studies have been completed for the Trident Project and permitting and approvals are underway.

Western Australian legislation imposes limits and obligations on proponents without any approval requirements. This legislation includes:

- Biodiversity Conservation Act 2016;

- Contaminated Sites Act 2003;

- Environmental Protection (Noise) Regulations 1997;

- Environmental Protection (Controlled Waste) Regulations 2004;

- Environmental Protection (Unauthorised Discharge) Regulations 2004;

- Environmental Protection (NEPM-NPI) Regulations 1998;

- Mine Rehabilitation Fund Act 2012.

The project has been designed to comply with environment regulations. A site compliance register that includes all statutory and reporting obligations will be developed as the project progresses to operations.

5. Trident Operating and Capital Cost Estimate

Catalyst plans to mine the Trident deposit on an owner-operator basis. Given the similarities in operational framework between the existing Plutonic operations and Trident, Plutonic’s historical mining costs have been used as an input to the mining cost estimate.

The Trident deposit’s proximity to Plutonic allows many synergies, including existing infrastructure, an existing employee pool, and systems and structures in place to run an underground mining operation.

Costs related to mining activities such as the use of shotcrete and paste fill planned for Trident but not used at Plutonic, were estimated from vendor quotations. The capital infrastructure costs and operating costs not taken from the Plutonic cost base were estimated using recently obtained vendor quotations.

Table 14: Trident Underground Infrastructure capital costs

|

Description |

Value ($ million) |

|

Mobilisation, Establishment, Power Generation |

8.8 |

|

Raisebore Shaft Sinking |

0.1 |

|

Primary Fan |

0.8 |

|

Primary and Secondary Pumping |

0.6 |

|

Substations |

0.8 |

|

Safety Plant and Equipment |

0.4 |

|

Survey Equipment |

0.3 |

|

Paste Plant and Underground Reticulation |

3.9 |

|

Total |

15.7 |

Table 15: Trident Underground Sustaining capital costs

|

Description |

Value ($ million) |

|

Infrastructure |

16.5 |

|

Decline |

10.9 |

|

Cap Access |

1.8 |

|

Ventilation |

1.5 |

|

Escapeway |

0.2 |

|

Other |

1.0 |

|

Fleet |

3.5 |

|

Operators |

8.0 |

|

Capital Mine Services |

2.5 |

|

Capital Mine Overheads |

1.8 |

|

Total |

47.6 |

Table 16: Trident Underground operating costs

|

Description |

Value ($/t ore) |

|

Ore Drive |

25.1 |

|

Stope |

44.7 |

|

Operators |

38.0 |

|

Operating Mine Services |

12.1 |

|

Operating Mine Overheads |

10.6 |

|

Surface Haulage |

9.8 |

|

Grade Control |

8.1 |

|

Total Operating |

148.4 |

6. Financial Evaluation

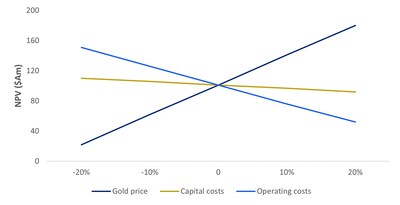

Mining cost estimates were developed by Entech and Catalyst using recent actual operating costs from the Plutonic Gold operations. The rates were assembled as a fully variable schedule of rates, which were applied to mining physicals. A gold price of $2,700/oz for the underground and $3,200/oz for the open pit form the basis of the Base Case.

The Ore Reserve has been assessed across a reasonable sensitivity range and remains financially viable. Financial viability is not reliant on any Inferred Mineral Resource.

Catalyst Spot Case adopts a $A3,400/oz gold price. Management considers this a reasonable assumption which is lower than the spot price at the time of this announcement.

Table 17: Key metrics for Trident development

|

Base case |

Spot case (A$3,400/oz) |

||

|

NPV7 (Pre-tax) |

A$m |

100 |

198 |

|

IRR (Pre-tax) |

% |

146 % |

327 % |

|

Pre-production capital |

A$m |

19 |

15 |

|

AISC (life of mine) |

A$/oz |

1,578 |

1,592 |

|

Life of mine (LOM) |

yrs |

5.5 |

5.5 |

|

Payback period |

yrs |

1.9 |

1.4 |

|

Inferred Resource in LOM |

% |

15 % |

15 % |

|

Inferred Resource in payback period |

% |

10 % |

12 % |

|

Average annual production |

koz |

37 |

37 |

|

Average annual free cash flow |

A$m |

29 |

53 |

|

# Base case price assumptions aligned with Ore Reserve. A$2,700 for Underground and A$3,200 for Open Pit. |

|

Financial figures shown pre-tax due to Trident being only one satellite deposit within Catalyst’s broader portfolio. |

The production profile underpinning the production target is supported by 85% of probable Ore Reserves and 15% of inferred material.

There is a low level of geological confidence associated with inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of indicated Mineral Resources or that the production target itself will be realised.

7. Additional studies, timeline to development and future work plans

The approval process for Trident Underground is well underway, with the remaining permits expected to be granted in the second half of CY24. The company has progressed with approval studies and surveys for the open pit, with the expectation that submissions to the relevant Government departments will be undertaken in the third quarter of CY24.

The company will look to issue a tender process to suitable open pit contractors in the second half of CY24, with scheduled execution in the first half of CY25.

Pre-emptive dewatering activities are scheduled to commence in the fourth quarter of CY24, ensuring groundwater levels are reduced in the localised area for subsequent open pit and underground operations.

Additional work will be undertaken in respect of underground planning as Catalyst moves toward execution. This will include additional optimisation of the mine plan to target higher grade areas of the mine earlier in its life, geotechnical studies and further studies to refine Catalyst’s approach to the paste fill option.

8. Funding

The Trident development has a maximum drawdown of $15m (at a A$3,400/oz gold price).

The Company considers that there is a reasonable basis to assume that future funding will be achievable based on the following:

- The Project has demonstrated strong technical and economic fundamentals;

- The Project generates robust cashflows at both current, and lower, gold prices;

- The company is currently generating positive cashflows from existing operations; and

- The Company and its Directors have a strong record of raising capital, both in debt and equity markets.

There is no certainty that Catalyst will be able to source funding when required and it is possible that such funding may be dilutive or otherwise affect the company’s shares.

This announcement has been approved for release by the Board of Directors of Catalyst Metals Limited.

Competent person’s statement

The information in the report to which this Mineral Resource Statement is attached that relates to the estimation and reporting of gold Mineral Resources at the Trident West Open Pit deposit is based on information compiled by Mr Andrew Finch, BSc, a Competent Person who is a current Member of Australian Institute of Geoscientists (MAIG 3827). Mr Finch, Geology Manager, at Catalyst Metals Ltd has sufficient experience relevant to the style of mineralisation and deposit type under consideration and to the activities being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Mr Finch consents to the inclusion in the report of matters based on his information in the form and context in which it appears.

The information in this report that relates to Ore Reserves is based on and fairly represents information and supporting documentation compiled by Ross Moger BASc (Mining Engineering), a Competent Person who is a Member of the Australasian Institute of Mining and Metallurgy. Ross Moger is a full-time employee of Entech Pty Ltd. Ross Moger has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC 2012).

Ross Moger consents to the inclusion in the report of the matters based on his information in the form and context in which they are presented. This Ore Reserve estimate has been compiled in accordance with the guidelines defined in the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC 2012).

JORC 2012 Mineral Resources and Reserves

Catalyst confirms that it is not aware of any new information or data that materially affects the information included in the original market announcements and that all material assumptions and technical parameters underpinning the estimates in the relevant market announcements continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Persons findings are presented have not been materially modified from the original market announcements.

|

Section 1 Key Classification Criteria |

|

|

Trident Deposit |

|

|

(Criteria listed in the preceding section also apply to this section.) |

|

|

Criteria |

Commentary |

|

Sampling techniques |

• Reverse Circulation drilling comprises 98% of the drill holes underpinning the MRE, the other 2% are diamond drillholes. • RC drilling assays are from 1 m samples split on the cyclone for the ultramafics. 1 m splits are taken over entirety of each drill hole using a 1/8 riffle splitter. • Diamond drilling assays are from mostly half core and minor quarter core, NQ2 and HQ size core. This was considered to be sufficient material for a representative sample. Core samples were taken at 1 m intervals or at geological boundaries. • Historical RC samples were collected as 4 m composite spear samples. Mineralised zones were sampled at 1 m intervals using a 1/8 riffle splitter. |

|

Drilling techniques |

• Reverse Circulation drilling was conducted utilizing a 5.75 inch face sampling bit. • Diamond drilling was conducted utilising NQ2 core. Core was orientated by spear methodology. |

|

Drill sample recovery |

• RC drilling was bagged on 1 m intervals and an estimate of sample recovery has been made on the size of each sample. • Recovery in diamond drilling based on measured core was returned for each 3 m. • No assessment of RC chip sample recoveries was undertaken on historical data however a comprehensive historical review of sampling procedures was undertaken which indicates that standard procedures where enacted to ensure minimal sample loss. Where limited information on the recoveries has been recorded, they have been consistent with those noted by recent drilling. |

|

Logging |

• Reverse Circulation holes are logged on 1 m intervals. • Magnetic Susceptibility (KT 10) was recorded.

• Diamond holes were: logged in detail based on geological boundaries. logged on 1 m intervals for geotechnical data. photographed prior to cutting and sampling. Geotechnically logged including RQD, recovery and FF

• Historical drilling: o Previous work by Cube Consulting Ltd in 2023 included examining historical Geological logs (WAMEX) in both hard copy and digital files. Logging codes have varied, but careful reconstruction of the geological sections has shown good correlation with the broad lithological logging. o Historical procedures are generally similar to that used currently. |

|

Sub-sampling techniques and sample preparation |

• RC Drilling was sampled on 1 m samples using a cone splitter within the cyclone. • Half and quarter Diamond Core – Diamond drilling, on selected intervals of between 0.8-1.25 m length. • Sampling using a diamond saw. • Standards submitted every 20 samples of similar tenor to those expected in the sampling. • Blanks were inserted every 20 samples. • RC Drilling sampled on 1 m samples using a cone splitter within the cyclone. • In less prospective lithologies these 1 m samples were composited using a scoop over 4 m intervals. • Historical Drilling: o RC – 1 m samples collected at the rig using a 1:8 riffle splitter. Each sample was riffle split each 1 m sample to collect approximately 2 kg samples in calico bags, with the remaining sample retained on site in plastic bags. Four metre composite samples were also collected with any samples assaying greater than 0.1 g/t Au being re-split to 1 m intervals. o Core sampled was halved using a diamond saw and sampled at 1 m intervals, or to geological contacts. o Field duplicate sampling was completed by passing the bulk reject sample from the plastic bag through a riffle splitter. In addition, ¼ core was routinely submitted. Duplicate sample intervals were designated by the geologist. o Sampling procedures for the Resolute drilling were not available. |

|

Quality of assay data and laboratory tests |

• Samples analysed at ALS Laboratories using a 50 g Fire Assay method. • Samples are dried, crushed and pulverised prior to analysis. • Standards submitted every 20 samples of tenor similar to those expected in the sampling. • Blanks were inserted every 20 samples. • Historical Drilling: o Gold was analysed at Amdel in Perth using fire assay with a 50 g charge for Au. o Drilling programs carried out at Trident by HGAL have included ongoing QAQC procedures. These included the use of certified standards, blanks, check assay and duplicate sampling. o The various programs of QAQC carried out by HGAL have all produced results which support the sampling and assaying procedures used at the site. o Specific QAQC procedures for previous owners were unavailable. |

|

Verification of sampling and assaying |

• RC drilling is verified by the geologist first and then the database administrator before importing into the main database. • Historical checks done by Cube Consulting Ltd in 2023: • A comparison of the database as current with all data from the 2019 Annual Resource was conducted to ensure the data did not change. Any discrepancies were investigated and fixed. • Recent diamond drilling has twinned historical holes confirming assays and geological understanding. • Verification of assay and survey data was undertaken through the analysis of primary source data obtained through WAMEX. |

|

Location of data points |

• Downhole surveys are visually inspected for anomalous changes in drill trace, (i.e does the drill hole apparently bend inordinately). • All drill collars have been accurately located by a licensed surveyor using DGPS. Recent downhole survey data collected by Westdrill using an Axis Mining Technology Champ North Seeking Gyro tool. • Previous downhole survey data collected by REFLEX gyro tool and historically with Eastman cameras with follow-up down-hole surveys carried out by Surtron using gyroscopic survey equipment. |

|

Data spacing and distribution |

• Drill spacing of approximately 20 m (along strike) by 20 m (on section) was considered adequate to establish both geological and grade continuity. • Broader spaced drilling has also been modelled but with lower confidence. Some sections have closer spacing in high grade zones confirming the continuity and structural understanding. |

|

Orientation of data in relation to geological structure |

• The orientation of a majority of the drilling is approximately perpendicular to the strike and dip of the mineralisation and is unlikely to have introduced any sampling bias. • Certain holes have drilled parallel to key structures, but density of drilling and drilling on other orientations has allowed detailed geological modelling of these structures and hence any sampling bias in a single hole has been removed.

|

|

Sample security |

• Samples were bagged and labelled by company geologists or geological assistants and sealed in bulk bags with a security seal that remains unbroken when delivered to the lab. • No specific information has been obtained relating to historical sampling security. |

|

Audits or reviews |

• A review of standards, blanks and duplicates indicate sampling and analysis has been completed with no issues discovered. • Historical reviews of the database for the Trident area have been examined previously and a proportion of holes were compared to original data sources and found to be consistent wherever checked. |

|

Section 2 Reporting of Exploration Results |

|

|

Trident Deposit |

|

|

(Criteria listed in the preceding section also apply to this section.) |

|

|

Criteria |

Commentary |

|

Mineral tenement and land tenure status |

• Located in the Marymia – Plutonic Greenstone Belt ~218 km northeast of Meekatharra in the Midwest mining district in WA • M52/217 – granted tenement in good standing. • The tenement predates Native title interests, but is covered by the Gingirana Native Title claim. • The tenement is 100% owned by Vango Mining Limited and subsidiary Dampier (Plutonic) Pty Ltd. • Gold production will be subject to a 2.5% government royalty. |

|

Exploration done by other parties |

• Comprehensive drilling of the deposit was first undertaken by Resolute Limited from 1995 to 1998 completing approximately 263 RC and 37 DD holes. • From 1999 Homestake and then later Barrick Gold (2002) completed numerous drilling campaigns at Trident. • Dampier Gold completed RC and DD programs at Trident from 2012 until 2014 when Vango Mining took over the project completing 6 Diamond holes for 946 metres plus three RC holes for 747 metres. • Catalyst consolidated the belt in 2023 following the successful acquisition of Vango Mining and the merger with Superior Gold Inc. this was followed by Diamond drilling, completed in 2023. • In 2024 a RC program was completed which has been included in this MRE.

|

|

Geology |

• Gold mineralisation at Trident West is orogenic, hosted within a sheared contact zone in ultramafic rocks. High grade ‘shoots’ of mineralisation are associated with flexures in the mineralised host shear zones between steeply dipping structures. |

|

Drill hole Information |

Catalyst drilling • Location of drillholes based on historical reports and data, originally located on surveyed sites, and DGPS. • Northing and easting data generally within 0.1 m accuracy • RL data +-0.2 m • Down hole length =+- 0.1 m

Vango Drilling • Location of drillholes based on historical reports and data, originally located on surveyed sites, and DGPS. • Northing and easting data generally within 0.1 m accuracy • RL data +-0.2 m • Down hole length =+- 0.1 m

Historical Drilling • The majority of drill holes used in the resource estimate have been accurately surveyed by qualified surveyors using DGPS. Down hole surveys have been conducted at regular intervals using industry- standard equipment. • Where single shot cameras were used some magnetic units have affected the azimuth readings and these have not been used. Many holes have been surveyed using Gyro tools. • Approximately 100 holes have only planned collar coordinates or nominal down hole surveys.

|

|

Data aggregation methods |

• No exploration results are being reported as part of this MRE update.

|

|

Relationship between mineralisation widths and intercept lengths |

• Widths of mineralisation have been reported as downhole intervals and not as calculated horizontal widths, due to the complexity of the geometry of mineralisation. |

|

Diagrams |

• No significant discovery is being reported. Plan and long section maps, and sections relevant to the Mineral Resources are included in the body of this Report. |

|

Balanced reporting |

• No exploration results are being reported as part of this MRE update. |

|

Other substantive exploration data |

• No additional exploration data is included in this release. |

|

Further work |

• No new work is currently planned. |

|

Section 3 Estimation and Reporting of Mineral Resources |

|

|

Trident Deposit |

|

|

(Criteria listed in section 1, and where relevant in section 2, also apply to this section.) |

|

|

Criteria |

Commentary |

|

Database integrity |

• The Catalyst drillhole database is managed by a third party consultant EarthSQL in AcQuire software. • Trident data was exported to MS Access and audited before estimation. • Various validation checks in GEOVIA Surpac™ and Seequent Leapfrog Geo™ 3D software and data queries in MS Access were undertaken such as overlapping samples, duplicate entries, missing data, sample length exceeding hole length, unusual assay values and a review of below detection limit samples. A visual examination of the data was also completed to check for erroneous downhole surveys. • The data validation process identified no major drill hole data issues that would materially affect the MRE outcomes. • Database checks included the following: o Checking for duplicate drill hole names and duplicate coordinates in the collar table. o Checking for missing drill holes in the collar, survey, assay and geology tables based on drill hole names. o Checking for survey inconsistencies including dips and azimuths <0˚, dips >90˚, azimuths >360˚ and negative depth values. • Drill core photography was used to confirm the weathering profile in 4 holes. Core photography was not provided for holes that did not intersect mineralisation. • The 2024 MRE update includes 57 new reverse circulation drill holes. • The Trident database to May 17 2024 comprised 839 Collar records, 7,180 Survey records, 45,295 Assay records and 27,065 Lithology records. The compiled database used for resource estimation comprised 636 Collar records, 6,959 Survey records, 44,704 Assay records and 26,907 Lithology records.

|

|

Site visits |

• The Competent Person undertakes frequent site visits to the Plutonic Gold Operation and associated Marymia tenements. |

|

Geological interpretation |

• Current drilling of 57 reverse Circulation holes (2024) in addition to the 579 historic holes has allowed a detailed geological interpretation of the system. • Mineralisation in the Plutonic Belt regularly occurs as shallowly dipping, layer parallel lodes, although steep lodes and minor quartz-vein-hosted deposits also occur. Regionally within the greenstone belt, mineralised host rocks vary from amphibolites to ultramafics and banded iron formation (BIF). Lateritic and supergene enrichment are common throughout the Belt and has been mined locally. Biotite, arsenopyrite, and lesser pyrite/pyrrhotite are common minerals generally accepted to be associated with gold mineralisation. • Drilling density at Trident West is <20m x 20m and, although re-distribution of gold mineralization has occurred in the oxide zone of the deposit, the confidence in the geological interpretation in terms of grade distribution and volume is high, with a low to moderate degree of uncertainty regarding variability of orientation. • Mineralisation domains were interpreted primarily on geological logging and downhole geological contacts, based on lithology, grade distribution, major faults and geometry. • Interpretation of the mineralisation types was initially undertaken in Seequent Leapfrog Geo™ software using all available drill holes. Intercepts correlating to gold mineralisation and underpinned by strike continuity were independently identified and manually selected within Seequent Leapfrog Geo ™ prior to creation of an implicit intrusion model. • Existing mineralisation wireframes, pit design and site-based observations were used to evaluate geological, structural and mineralisation continuity. • A total of 103,221 m of drilling from 145 diamond and diamond tails, 449 RC drill holes and 42 aircore holes were available for interpretation of the MRE. This includes 57 Reverse circulation drill holes completed by Catalyst in 2024. • Catalyst considers confidence is moderate to high in the geological interpretation and continuity of the mineralisation domains. • The geological model is comprised of one distinct domain (1001) with two smaller domains (1002 and 1003) stacked above it. The zones shallowly dip to the northwest with a thickness of 1-10 m. Mineralisation has been delineated at a nominal 0.3g/t cut-off.

|

|

Dimensions |

• Mineralisation extends over a strike length (East – West) of approximately 250 m and down-dip up to 200 m. Mineralisation currently extends to a depth of approximately 100 m below surface. |

|

Estimation and modelling techniques |

• Interpretations used all available drill hole data domain intercepts were flagged and implicitly modelled in Seequent Leapfrog Geo™ software. • The domain intercepts were then imported into the MS Access database and prepared for compositing in Surpac.

Domain 1001 • Trident West gold mineralisation is characterised by several small, spatially concentrated populations of high gold grades (>10 g/t Au) that demonstrate limited spatial continuity (less than 10m). Raw Coefficients of Variation (CoV) are typically in the order of 2-3, indicating moderate to high variability. • The moderate to high grade variability and lack of spatial continuity of high grades requires a non-linear approach to deal with these high grades during estimation. A traditional approach of physical domaining, assay cutting, and linear estimation (IDW or OK) is considered inadequate in dealing with this complexity. • The estimation method combines Categorical Indicator Kriging (CIK) to define broad estimation domains, together with applying distance limiting at chosen grade thresholds to restrict the influence of the high-grade values during grade interpolation. • Prior to estimation, a reference surface for Domain 1001 was exported from Leapfrog. This is calculated as the best fit surface using the hanging wall and footwall surfaces. • The reference surface is imported into Surpac and a dip and dip-direction value of each triangle facets is imported into the Surpac block model to provide information for dynamic search and variogram model orientation during interpolation. Dynamic estimation is applied for estimating the CIK indicators and gold grades. • All DD and RC data was composited to 1m downhole. • Two Categorical Indicator values are determined for the Domain 1001: • A low-grade (LG) indicator of 0.2 g/t Au was assigned to differentiate between background ‘waste’ and low-tenor mineralisation. • A high-grade (HG) indicator of 0.8 g/t Au was assigned to define broad areas of consistent higher-tenor mineralisation. • A single Indicator variogram was modelled using an indicator value of 0.5 g/t Au, representing the approximate mid-point between the LG and HG indicator values. The indicator variogram exhibited a moderate nugget effect and demonstrated well-structured continuity up to 25m. The CIK indicators were estimated using Ordinary Kriging into a finely gridded block model with block dimensions of 1.25m x 1.25m x 1.25m. The small block size for the indicator process is beneficial for creating categorical sub-domains at resolution which can be used to accurately back-flag composite data. • Three categorical sub-domains were generated: low-grade (LG), medium-grade (MG) and high-grade (HG) areas. The HG sub-domain was based on an indicator probability threshold of 0.35 and the LG sub-domain was based on an indicator probability threshold of 0.65. The MG sub-domain is assigned to blocks that do not satisfy either the HG or LG sub-domain criteria. • The Trident West mineralisation exhibits a high-grade population beginning at around 8-10 g/t Au. This high-grade population occurs around the 98-99th percentile of the distribution. The 8-10 g/t Au population tends to occur in ‘clusters’ or relatively cohesive zones restricted to a local scale. • The three categorical block model sub-domains (HG, MG and LG) were used to ‘back-flag’ the 1m composites, thus creating a separate composite file for each sub-domain. • Assay top-cuts were applied to the composite files as follows: HG = 20 g/t Au MG = 4 g/t Au LG = 0.5 g/t Au • The assay top-cuts were generally above the 99.9th percentile of the distribution and were aimed at globally limiting extreme values only. Top-cuts are not used as the primary tool to control metal risk. The use of grade thresholds and distance limiting is considered a more objective and influential method in controlling metal risk, while better reflecting the actual localised occurrence of discontinuous high-grade gold mineralisation. • Grade variograms were initially attempted separately for the LG, MG and HG sub-domains, however, this resulted in poorly structured and incoherent variograms. It was decided to use a variogram modelled on the combined grade data. The combined grade variogram exhibited a low to moderate nugget effect (19%) with a maximum range of 25m. • Grade thresholds for distance limiting were determined from log-probability plots. A distance limit of 7.5m was applied to composite grades greater than or equal 8 g/t Au. Grades equal to or above 8 g/t Au are ignored in estimation when the true distance of the composite is further than 7.5m away from the block being estimated. The distance restriction of 7.5m was determined by spatial visual analysis. • Prior to grade estimation, sub-domain codes from the 1.25m resolution block model are imported into a Y=5m x X=5m x 2.5m resolution model and the proportion of LG, MG and HG is calculated for each 5m x 5m x 2.5m block. • The choice of a 5m x 5m x 2.5m block size reflects the likely mining selectivity achievable for a small to moderate scale open pit mining scenario. • Grade estimation for the LG, MG and HG sub-domains was undertaken in Surpac software using Ordinary Kriging with grade threshold distance limiting. Search routines and variogram orientations are drawn from the pre-populated dynamic search information recorded in each block. • Final block grades at a 5m x 5m x 2.5m block resolution were calculated by weighting the estimated grades for each sub-domain by the relevant domain proportion. • The parent estimation block size was 5m x 5m x 2.5m. A minimum of 2 and maximum of 12 (1 m composite) samples were used for each sub-domain estimate per block. Block discretisation was set at 3 E x 3 N x 3 RL points (per parent block). • A standardised search ellipse of 50m x 50m x 22.5m was used. Octant restrictions were not used. • Data spacing varied from <10m x 10m to 40m x 20m.

Domain 1002 and 1003 • Domains 1002 and 1003 were both small low-grade domains and gold grade was estimated using Ordinary Kriging in Surpac Software. It was considered that a more robust geological model with smoother and more continuous mineralised lodes will reduce the effects of higher CV. • Variograms were generated using composited drill data in Snowden Supervisor v8 software. • The ellipsoid search parameters were based on the variogram ranges, with the search ellipse dimensions similar to the variogram range, with anisotropies retained. Hard boundaries were used for the estimate. • To enable the use of dynamic variograms and search orientations during the estimation of gold, the reference surfaces for each domain were exported from the Leapfrog project. This is calculated as the best fit surface using the hanging wall and footwall surfaces. • A minimum of 2 and maximum of 12 (1 m composite) samples per block were used with no limit of samples per drillhole. The minimums and maximums were established through independent KNA on each major domain. Block discretisation was set at 3 E x 3 N x 3 RL points (per parent block). • Octant restrictions were not used, and estimates were into parent blocks, not sub-blocks. • Block sizes were selected based on drill spacing and the thickness of the mineralised veins. • Drill spacing was approximately 20m by 20m or closer. • Block dimensions were 5m x 5m x 2.5m (XYZ). Sub-celling in all domains was 1.25 m x 1.25 m x 1.25 m to accurately reflect the volumes of the interpreted wireframes. • The choice of a 5m x 5m x 2.5m block size reflects the likely mining selectivity achievable for a small to moderate scale open pit mining scenario. • Top cuts of 1.5g/t were applied to the data in both domains to control the effects of outlier high grade Au values that were considered not representative. The effect of the top cuts was reviewed with respect to the resulting Mean and CV values. • No deleterious elements were estimated or assumed. • Only gold grade was estimated. • The model was validated by comparing statistics of the estimated blocks against the composited sample data; visual examination of the of the block grades versus assay data in section and swath plots.

|

|

Moisture |

• All estimations were carried out using a ‘dry’ basis. |

|

Cut-off parameters |

• Trident West 2024 Mineral Resources are reported at a cut-off grade of 0.5 g/t Au within an open pit optimisation shell. The cut-off grade has been derived from current DFS open pit mining and processing costs and parameters. • Inputs into the pit optimisation and cut-off grade calculation include: Wall Angles = Oxide 39°, Transitional 45°, Fresh 52° Mining Cost (AUD$) = $5.5/t ore Processing and Surface Haulage Costs (AUD$) = Oxide $48/t, Transitional $49/t, Fresh $51.4/t Site Administration Cost = Included in mining and processing cost Metallurgical Recovery = 95% Royalties = 2.5% • Gold Price = AUD$3,200/oz |

|

Mining factors or assumptions |

• The Trident West 2024 Mineral Resource estimate is reported within an open pit optimisation shell using a gold price of AUD$3,200/oz. • Mining selectivity is assumed to be on 2.5m vertical benches with a 5m x 5m Selective Mining Unit (SMU). |

|

Metallurgical factors or assumptions |

• It is assumed the material will be trucked and processed at the Plutonic Gold Plant. Recovery factors are assigned based on lab test work. • No metallurgical assumptions have been built or applied to the resource model. |

|

Environmental factors or assumptions |

• A conventional storage facility is used for the process plant tailings. • The small amount of waste rock is stored in a traditional waste rock landform ‘waste dump’. Due to low sulphide content and the presence of carbonate alteration the potential for acid content is considered low. |

|

Bulk density |

• Density has been assigned to the resource models using interpreted weathering surfaces determined from drill hole logging. Bulk density values were determined by Cube in 2023 by statistically comparing data from 200 samples based on rock type and oxidation. • Oxide =1.8 • Transitional=2.4 • Fresh=2.9

|

|

Classification |

• Factors considered when classifying the model include: • The portions of the Trident West 2024 MRE classified as Indicated have been flagged in areas of the model where average drill hole spacing is 20m x 20m or closer. The drill spacing within the Indicated portion of the resource is appropriate for defining the continuity and volume of the mineralised domains, at a nominal 20 m drill spacing on 20 m sections. • The portions of the Trident West 2024 MRE classified as Inferred represent minor areas where geological continuity is present but not consistently confirmed by 20 m x 20 m drilling. • Further considerations of resource classification include; data type and quality (drilling type, drilling orientations, down hole surveys, sampling and assaying methods); geological mapping and understanding; statistical performance including number of samples, slope regression and kriging efficiency. • The Mineral Resource estimate appropriately reflects the view of the Competent Person. |

|

Audits or reviews |

• The geological interpretation, estimation parameters and validation of the resource model was peer reviewed by Catalyst staff. • No external reviews of the resource estimate had been carried out at the time of writing. |

|

Discussion of relative accuracy/ confidence |

• The relative accuracy of the Mineral Resource estimate is reflected in the reporting of the Mineral Resource as per the guidelines of the 2012 JORC Code. • The statement relates to the global estimates of tonnes and grade. |

|

Section 4 Estimation and Reporting of Ore Reserves |

|

|

Trident Reserve |

|

|

(Criteria listed in section 1, and where relevant in sections 2 and 3, also apply to this section.) |

|

|

Criteria |

Commentary |

|

Mineral Resource estimate for conversion to Ore Reserves |

• The Mineral Resource Estimate (MRE) used for the Trident open pit and underground Ore Reserve is described in Section 3. • Only the Indicated portion of the Mineral Resources are reported, and they are inclusive of the Ore Reserve. The Ore Reserves are a subset of the MRE and are spatially contained within the MRE. |

|

Site visits |

The Competent person has been to both the Trident and Plutonic mine sites in December 2022. |

|

Study status |

Underground • The underground Ore Reserve has been generated from a Feasibility Study. The study has had both internal Catalyst personnel and external consultants formulate the mine plan with appropriate geotechnical, hydrological, equipment, metallurgical and mining method information. Costs have been derived from Catalyst’s existing Plutonic Underground Mine, and where tailored processes, mining methods or equipment has been proposed for Trident, appropriate level of investigation has occurred. Environmental, social, and other factors have been considered with several permits and licenses in application. • Material modifying factors are based on the proposed underground mining methods and geotechnical assessment, in addition to industry standards and current performance at Catalyst’s Plutonic mine which employs similar mining methods. Open Pit • The open pit Ore Reserve has been generated from Prefeasibility level of assessment, appropriate for the size and scale of proposed operation. The study has had both internal Catalyst personnel and external consultants formulate the mine plan with appropriate geotechnical, hydrological, equipment, metallurgical and mining method information. Costs have been derived from external consultant databases, which reflect recent open pit Western Australian contractor costs and ancillaries. • Practical and equipment specific dig blocks were created in several of the proposed open pit benches to adequately estimate material modifying factors.

• Both underground and open pit studies demonstrate that the mine plan is technically achievable and economically viable taking into consideration the current known material modifying factors. |

|

Cut-off parameters |