(All dollar amounts are in thousands of United States dollars unless otherwise indicated, except for shares, per ounce, and per share amounts)

VANCOUVER, BC, Aug. 11, 2023 /CNW/ – Metalla Royalty & Streaming Ltd. (“Metalla” or the “Company“) (TSXV: MTA) (NYSE American: MTA) announces its operating and financial results for the three and six months ended June 30, 2023. For complete details of the condensed interim consolidated financial statements and accompanying management’s discussion and analysis for the three and six months ended June 30, 2023, please see the Company’s filings on SEDAR (www.sedar.com) or EDGAR (www.sec.gov). Shareholders are encouraged to visit the Company’s website at www.metallaroyalty.com.

Brett Heath, President, and CEO of Metalla, commented, “In the second quarter of 2023, we strengthened our balance sheet through the completion of the amendment to expand and extend our convertible loan facility with Beedie Capital and through the sale of the JR mineral claims for $5.0 million. Production from El Realito and La Encantada was stronger than expected during the quarter, and we look forward to the balance of 2023.”

FINANCIAL HIGHLIGHTS

During the six months ended June 30, 2023, and the subsequent period up to the date of this news release, the Company:

- Acquired 1 stream and 5 royalties, to bring the total held as at the date of this press release to 82 precious metals assets, through the following transactions:

- Acquired an existing 2.5%-3.75% sliding scale Gross Proceeds (“GP“) royalty over gold, together with a 0.25%-3.0% Net Smelter Return (“NSR“) royalty on all non-gold and silver metals on the majority of Barrick Gold Corporation’s (“Barrick“) world-class Lama project in Argentina, from an arm’s length seller for aggregate consideration of $7.5 million. The transaction closed on March 9, 2023, at which time the Company paid the $2.5 million in cash, and issued 466,827 common shares of the Company (“Common Shares“) to the seller (valued at $5.3553 per share). The remaining $2.5 million, to be paid in cash or Common Shares, is payable within 90 days upon the earlier of a 2 Moz gold Mineral Reserve estimate on the royalty area or 36 months after the closing date;

- Acquired one silver stream and three royalties from Alamos Gold Corp. (“Alamos“) for $5.0 million in Common Shares valued at $5.3228 per share, representing the 20-day Volume-Weighted Average Price (“VWAP“) of shares of Metalla traded on the NYSE prior to the announcement of the transaction. The transaction closed on February 23, 2023, at which time the Company issued 939,355 Common Shares to Alamos. The stream and royalties acquired in this transaction include:

- a 20% silver stream over the Esperanza project located in Morales, Mexico owned by Zacatecas Silver Corp.;

- a 1.4% NSR royalty on the Fenn Gibb South project located in Timmins, Ontario owned by Mayfair Gold Corp.;

- a 2.0% NSR royalty on the Ronda project located in Shining Tree, Ontario owned by Platinex Inc.; and

- a 2.0% NSR royalty on the Northshore West property located in Thunder Bay, Ontario owned by New Path Resources Inc.

- Sold the JR mineral claims that make up the Pine Valley property, which is part of the Cortez complex in Nevada, to Nevada Gold Mines LLC (“NGM“), an entity formed by Barrick and Newmont Corporation (“Newmont“), for $5.0 million in cash. The Company will retain a 3.0% NSR royalty on the property. Sold the Conmee mineral claims that make up the Tower Mountain property to Thunder Gold Corp. (“Thunder Gold“) for 4,000,000 common shares of Thunder Gold, valued at $0.1 million upon closing. The Company will retain a 2.0% NSR royalty on the property;

- Announced a special dividend payment on the Common Shares, in the amount of C$0.03 per share, with a declaration date of July 10, 2023, a record date of August 1, 2023, and a payment date of September 15, 2023;

- For the three months ended June 30, 2023, received or accrued payments on 856 attributable Gold Equivalent Ounces (“GEOs“) at an average realized price of $1,945 and an average cash cost of $8 per attributable GEO. For the six months ended June 30, 2023, received or accrued payments on 1,783 attributable GEOs at an average realized price of $1,888 and an average cash cost of $7 per attributable GEO (see Non-IFRS Financial Measures);

- For the three months ended June 30, 2023, recognized revenue from royalty and stream interests, including fixed royalty payments, of $1.0 million, net loss of $0.5 million, and Adjusted EBITDA of negative $0.2 million. For the six months ended June 30, 2023, recognized revenue from royalty and stream interests, including fixed royalty payments, of $1.9 million, net loss of $1.8 million, and Adjusted EBITDA of $0.4 million. (see Non-IFRS Financial Measures);

- For the three months ended June 30, 2023, generated operating cash margin of $1,937 per attributable GEO, and for the six months ended June 30, 2023, generated operating cash margin of $1,881 per attributable GEO from the Wharf, El Realito, La Encantada, the New Luika Gold Mine (“NLGM“) stream held by Silverback Ltd. (“Silverback“), the Higginsville derivative royalty asset, and other royalty interests (see Non-IFRS Financial Measures);

- For the three months ended June 30, 2023, recognized payments due or received (not included in revenue) from the Higginsville derivative royalty asset of $0.7 million, and for the six months ended June 30, 2023, recognized payments due or received (not included in revenue) from the Higginsville derivative royalty asset of $1.4 million (see Non-IFRS Financial Measures);

- On May 27, 2022, the Company announced that it had entered into a new equity distribution agreement with a syndicate of agents to establish an ATM equity program (the “2022 ATM Program“) under which the Company may distribute up to $50.0 million (or the equivalent in Canadian Dollars) in Common Shares of the Company. From inception to the date of this press release, the Company distributed 1,328,078 Common Shares under the 2022 ATM Program at an average price of $5.01 per share for gross proceeds of $6.6 million, of which 279,430 Common Shares were sold during the three months ended June 30, 2023, at an average price of $4.34 per share for gross proceeds of $1.2 million;

- On May 19, 2023, the Company closed a second supplemental loan agreement (the “Supplemental Loan Agreement“) to amend its loan facility by:

- extending the maturity date to May 9, 2027;

- increasing the loan facility by C$5.0 million from C$20.0 million to C$25.0 million, of which C$21.0 million will be undrawn after giving effect to the C$4.0 million conversion described below;

- increasing the interest rate from 8.0% to 10.0% per annum;

- amending the conversion price of the fourth drawdown from C$11.16 per share to C$8.67 per share, being a 30% premium to the 30-day VWAP of the Company shares measured at market close on the day prior to announcement of the amendment;

- amending the conversion price of C$4.0 million of the third drawdown from C$14.30 per share to C$7.33 per share, being the 5-day VWAP of the Company shares measured at market close on the day prior to announcement of the amendment, and converting the C$4.0 million into shares at the new conversion price. Upon closing the Company issued Beedie 545,702 Common Shares for the conversion of the C$4.0 million;

- amending the conversion price of the remaining C$1.0 million of the Third Drawdown from C$14.30 per share to C$8.67 per share, being to the 30-day VWAP of the Company shares measured at market close on the day prior to announcement of the amendment; and

- All other terms of the loan facility remain unchanged.

- On March 30, 2023, the Company signed an amendment with the arm’s length seller of the Castle Mountain royalty to extend the maturity date of the $5.0 million loan from June 1, 2023, to April 1, 2024. As part of the amendment, on March 31, 2023, the Company paid all accrued interest on the loan, and effective April 1, 2023, the interest rate increased to 12.0% per annum, and the principal and accrued interest will be repaid no later than April 1, 2024. On July 7, 2023, the Company paid all accrued interest on the loan at the time and made a principal repayment of $4.3 million.

ASSET UPDATES

Below are updates during the three months ended June 30, 2023, and subsequent period to certain of the Company’s assets, based on information publicly filed by the applicable project owner:

La Encantada

On July 20, 2023, First Majestic Silver Corp. (“First Majestic“) announced production of 76 ounces of gold and 0.8 Moz of silver from La Encantada in the second quarter of 2023 and provided 2023 guidance in the range of 3.1 – 3.3 Moz silver. First Majestic also completed 1,950 meters of drilling on the property with the use of two underground rigs during the quarter.

Metalla received 233 GEOs from La Encantada for the second quarter of 2023.

Metalla holds a 100% GVR royalty on gold produced at the La Encantada mine limited to 1.0 Koz annually.

El Realito

On July 26, 2023, Agnico Eagle Mines Ltd. (“Agnico“) reported that gold production from La India totaled 17,833 oz gold for the second quarter of 2023. Mine production levels for the second quarter were good with grades higher than target. An investigation is ongoing for additional sulphide mineralization with a plan to drill 4,000 meters at the Chipriona target which is northwest and adjacent to El Realito royalty boundary.

Metalla holds a 2.0% NSR royalty on the El Realito deposit which is subject to a 1.0% buyback right for $4.0 million.

Wharf Royalty

On May 10, 2023, Coeur Mining Inc. (“Coeur“) reported first quarter production of 15.5 Koz gold and reiterated the full year guidance for Wharf. On February 16, 2022. Coeur has guided 2023 production to be in the range of 85 – 95 Koz. Successful exploration and infill drilling during the year allowed for a 7% increase, net of depletion, at Wharf where Proven & Probable Reserves totaled 908 Koz gold at 0.027 oz/t (0.84 g/t). Additionally, a total of 293 Koz gold at 0.02 oz/t (0.62 g/t) of Measured & Indicated Resources, and Inferred Resources stand at 63 Koz gold at 0.02 oz/t (0.62 g/t), were declared at Wharf. Exploration efforts in 2023 will focus on geological modelling and planning for 2024.

Metalla holds a 1.0% GVR royalty on the Wharf mine.

New Luika Silver Stream

On July 20, 2023, Shanta Gold Limited (“Shanta“) reported that it produced 19.3 Koz of gold at its NLGM in Tanzania in the second quarter of 2023. Shanta also reiterated their guidance of 66 – 72 Koz of gold from NLGM in 2023.

Metalla holds a 15% interest in Silverback, whose sole business is receipt and distribution of a 100% silver stream on NLGM at an ongoing cost of 10% of the spot silver price.

Wasamac

On July 26, 2023, Agnico reported that during the quarter, it advanced internal studies to assess potential production opportunities at Wasamac along with alternative processing scenarios at either LaRonde and Canadian Malartic mill. Agnico also stated that it was updating studies that were previously completed at Wasamac and believes it has the potential to be a low-cost mine with annual production of 150 – 200 Koz of gold with moderate capital outlays and initial production commencing in 2029. The results of the Wasamac internal evaluation will be reported through the first half of 2024.

Metalla holds a 1.5% NSR royalty on the Wasamac project subject to a buy back of 0.5% for C$7.5 million.

Garrison

On April 11, 2023, Moneta Gold Inc. (“Moneta“) announced the results of assays from historical drill core at Garrison. The sampling confirmed the continuity and extension of gold mineralized zones not currently included in the latest Mineral Resource estimate. Significant results include 1.87 g/t over 18 meters and 1.58 g/t gold over 18.5 meters at Garrcon and 13.5 g/t gold over 3.2 meters and 4.79 g/t gold over 3.75 meters at Jonpol.

Metalla holds a 2.0% NSR royalty on the Garrison project.

Amalgamated Kirkland Property

On July 26, 2023, Agnico reported infill drill results from the Amalgamated Kirkland deposit featuring highlights of 11.1 g/t gold over 5.1 meters and 10.4 g/t gold over 2.5 meters. Agnico is evaluating the opportunity to process near surface and AK ore at the LaRonde complex. Average annual production from the near surface deposit and AK deposit could be between 20 Koz and 40 Koz of gold, commencing in 2024. The results of an internal evaluation on the AK deposit will be reported in the first half of 2024.

Metalla holds a 0.45% NSR royalty on the Amalgamated Kirkland property.

Endeavor

On July 21, 2023, Polymetals Resources Inc (“Polymetals“) released an amended quarterly report reporting that significant progress has been made in preparing for a decision to restart operations at Endeavor, underpinned by a mine restart study scheduled for release during the December 2023 quarter, with targeted commencement of operations by mid-2024. In May 2023, Polymetals released an updated resource estimate for the Upper Main lodes at Endeavor where total Measured, Indicated and Inferred resources stand at 8.89 Moz silver at 528 g/t AgEq.

On March 28, 2023, Polymetals announced the execution of a share sale and purchase agreement in relation to the proposed acquisition of all of the issued share capital of Orana Minerals Pty Ltd., which is the sole shareholder of Cobar Metals Pty Ltd. (“Cobar Metals“). Cobar Metals has in turn entered into an agreement to purchase the Endeavor lead, zinc and silver mine in Australia via the acquisition of three project companies, including Cobar Operations Pty Ltd. (“Cobar Operations“). On May 12, 2023, Polymetals announced the completion of Polymetals acquisition of Orana Minerals Pty Ltd. was approved by Polymetals shareholders. As part of Polymetals proposed acquisition of the Endeavor mine, the Company entered into an agreement with the holder of the Endeavor mining tenements, Cobar Operations, by which the Company converted its 100% silver stream in the Endeavor mine to a 4.0% NSR royalty on all lead, zinc and silver produced from those tenements.

Metalla holds a 4.0% NSR royalty on all lead, zinc and silver produced from Endeavor.

Côté-Gosselin

On May 11, 2023, IAMGOLD Corporation (“IAMGOLD“) reported that it had completed 79.8% of the construction at the Côté Gold Project. Drill results reported in a new release on February 2, 2023, for the 2022 drill program continue to highlight the resource expansion potential of the Gosselin deposit both to the south of the recently declared 5 Moz Resource estimate, and at depth. Significant intercepts included 1.99 g/t gold over 342.2 meters, 1.29 g/t gold over 313 meters, 1.5 g/t gold over 181 meters and 0.66 g/t gold over 388.5 meters. Additional technical studies are planned to complete metallurgical test work and mining and infrastructure studies to review alternatives to optimize the inclusion of Gosselin into future Côté life-of-mine plans. Approximately 15.5 Km of drilling is planned in 2023 to further delineate and expand the Gosselin mineral resources.

Metalla holds a 1.35% NSR royalty that covers less than 10% of the Côté Reserves and Resources estimate and covers all of the 5 Moz gold Gosselin Resource estimate.

Fifteen Mile Stream

On July 27, 2023, St. Barbara Limited (“St Barbara“) reported a revised permitting timeline for Fifteen Mile Stream which targets development in fiscal 2026. In addition, St. Barbara has prioritized development of Fifteen Mile Stream with assessment of the relocation of the Touquoy processing plant now confirmed to be an attractive development option.

Metalla holds a 1.0% NSR royalty on the Fifteen Mile Stream project, and 3.0% NSR royalty on the Plenty and Seloam Brook deposits.

Fosterville

On July 26, 2023, Agnico reported that gold production from Fosterville for the second quarter of 2023 totalled 81.8 Koz gold. Drilling during the second quarter of 2023 totaled 20.6 Km and mainly targeted the Lower Phoenix deep extension drilling. During 2023, Agnico plans to spend $20.8 million for 105,300 meters of drilling, and development of exploration drifts to replace Mineral Reserve depletion and to add Mineral Resources in the Lower Phoenix, Cygnet and Robbins Hills areas. Agnico will spend another $4.4 million for 11,300 meters of underground and surface exploration with the aim of discovering additional high-grade mineralization at Fosterville.

Metalla holds a 2.5% GVR royalty on the northern and southern extensions of the Fosterville mining license and other areas in the land package.

Tocantinzinho

On June 13, 2023, G Mining Ventures (“G Mining“) reported that the Tocantinzinho project is 30% complete and remains on track and on budget for commercial production in H2-2024.

Metalla holds a 0.75% GVR Royalty on Tocantinzinho.

Lama

On August 8, 2023, Barrick reported that a geological review of results received from drilling in the first quarter of 2023 was ongoing to generate new drill targets. Total exploration, evaluation and project expenses for the whole Pascua-Lama project totaled $7 million for the second quarter of 2023.

Metalla holds a 2.5%-3.75% GP royalty on gold and a 0.25%-3.0% NSR royalty on all other metals (other than gold and silver) at Lama.

Castle Mountain

On August 2, 2023, Equinox Gold Corp. (“Equinox“) reported a surface exploration program of geological mapping and channel sampling was ongoing with the primary goal to sample previously identified mineralization exposed on surface such that data can be used in future Mineral Resource estimation. The mine permitting amendment plan was submitted to the lead county and BLM agencies which reviewed the plan for completeness in early 2023. Work on the preliminary draft Environmental Impact Statement will begin in 2024. A total of $1.7 million was spent on Phase 2 permitting and optimization for the quarter.

Metalla holds a 5.0% NSR royalty on the South Domes area of the Castle Mountain mine.

Akasaba West

On July 26, 2023, Agnico announced that the Akasaba West project remained on schedule through the second quarter with achievement of commercial production expected to occur in the first quarter of 2024.

Metalla holds a 2.0% NSR royalty on the Akasaba West project subject to a 210 Koz gold exemption.

Del Carmen

The Company owned a 0.5% NSR royalty on the Del Carmen project that was owned and operated by Barrick. In July 2023, the Company was notified that Barrick has terminated its agreement to explore and exploit the Del Carmen property and as a result of the termination the 0.5% NSR royalty owned by Metalla had also been terminated. The Company considered the termination of the royalty as an indicator of impairment on its Del Carmen royalty and conducted an impairment analysis to estimate the recoverable amount. As a result of the analysis, the Company fully impaired the royalty to $Nil as at June 30, 2023, and recorded an impairment charge of $1.3 million.

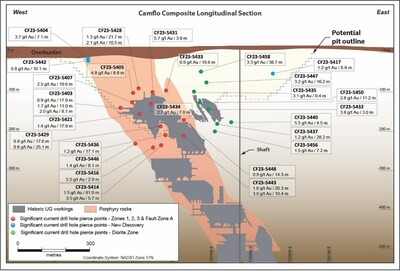

Camflo

On June 20, 2023, Agnico reported that it completed more than 14,000 meters of drilling on Camflo, which marks the first exploration drill program since the 1.6 Moz past-producing deposit was closed in 1992. Significant results reported over multiple zones include 1.5 g/t gold over 81 meters, 3.3 g/t gold over 38.7 meters, 3.2 g/t gold over 16.2 meters, 3.7 g/t gold over 7.1 meters, and 1.6 g/t gold over 20.3 meters.

The second phase of exploration drilling at Camflo will test for potential lateral extensions of mineralization and infill known zones. Agnico believes the mineralization could be mined via an open-pit and processed at the Canadian Malartic Mill, 4 Km away.

Metalla holds a 1.0% NSR royalty on the Camflo mine, located ~1km northeast of the Canadian Malartic operation.

Plomosas

On March 20, 2023, GR Silver Mining announced an updated Mineral Resource estimate for the Plomosas project. At the Plomosas Mine area, total Indicated Resources are 31 Moz at 200 g/t silver equivalent (“AgEq“) and Inferred Resources are 17 Moz at 175 g/t AgEq. The San Juan-La Colorada Area has an Indicated Resource of 1 Moz at 204 g/t AgEq and an Inferred Resource of 16 Moz at 180 g/t AgEq.

Metalla holds a 2.0% NSR royalty on the Plomosas property subject to a buy back of 1.0% for $1.0 million.

Tower Mountain

On June 12, 2023, Thunder Gold reported they expanded the footprint at Tower Mountain adding 2,575 hectares. On May 15, 2023, Thunder Gold reported final results from the 4,000 meter phase one drilling program at Tower Mountain with significant results of 0.59 g/t gold over 36.3 meters, 0.53 g/t gold over 24.5 meters and 0.56 g/t gold over 10.5 meters.

On April 25, 2023, Thunder Gold announced they intersected 941 g/t over 1.5 meters with visible gold in the core at the Thunder Gold property. Additional highlights include 0.77 g/t gold over 23 meters and 1.26 g/t gold over 17.5 meters.

Metalla holds a 2.0% NSR royalty on the Tower Mountain property.

Montclerg

On June 27, 2023, GFG Resources Inc. reported high grade intervals at the Montclerg Gold Project located 48 km east of the Timmins Gold District. Significant intercepts include 9.97 g/t gold over 8.1 meters and 4.09 g/t gold over 4.1 meters. Additionally, 1 Km east of the main MC Central Zone, multiple zones of mineralization were intersected with a highlight of 1.93 g/t gold over 10.6 meters.

Metalla holds a 1.0% NSR royalty on the Montclerg property.

Detour DNA

On July 26, 2023, Agnico reported a drill hole two kilometers west of the open pit mineral reserves with a highlight of 2.8 g/t gold over 14.4 meters, further demonstrating continuity of mineralization along the Detour horizon past the area identified for underground mining potential.

Metalla holds a 2.0% NSR royalty on the Detour DNA property which is approximately 7 km west of the Detour West reserve pit margin.

Green Springs

On July 27, 2023, Contact Gold Corp. announced the first drill results from the 2023 drill program where significant step-out results include 5.06 g/t gold over 10.7 meters within 1.97 g/t gold over 35.05 meters and 1.14 g/t gold over 27.43 meters at the X-Ray Zone.

Metalla holds a 2.0% NSR royalty on the Green Springs project.

QUALIFIED PERSON

The technical information contained in this news release has been reviewed and approved by Charles Beaudry, geologist M.Sc., member of the Association of Professional Geoscientists of Ontario and of the Ordre des Géologues du Québec and a director of Metalla. Mr. Beaudry is a QP as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101“).

ABOUT METALLA

Metalla is a precious metals royalty and streaming company. Metalla provides shareholders with leveraged precious metal exposure through a diversified and growing portfolio of royalties and streams. Our strong foundation of current and future cash-generating asset base, combined with an experienced team gives Metalla a path to become one of the leading gold and silver companies for the next commodities cycle.

For further information, please visit our website at www.metallaroyalty.com

ON BEHALF OF METALLA ROYALTY & STREAMING LTD.

(signed) “Brett Heath”

President and CEO

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accept responsibility for the adequacy or accuracy of this release.

Non-IFRS Financial Measures

Metalla has included certain performance measures in this press release that do not have any standardized meaning prescribed by International Financial Reporting Standards (IFRS) including (a) attributable gold equivalent ounces (GEOs), (b) average cash cost per attributable GEO, (c) average realized price per attributable GEO, (d) operating cash margin per attributable GEO, and (e) adjusted EBITDA. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company’s performance and ability to generate cash flow.

(a) Attributable GEOs

Attributable GEOs are a non-IFRS financial measure that is composed of gold ounces attributable to the Company, plus an amount calculated by taking the revenue earned by the Company in the period from payable silver ounces attributable to the Company divided by the average London fix price of gold for the relevant period, plus an amount calculated by taking the cash received or accrued by the Company in the period from the derivative royalty asset divided by the average London fix gold price for the relevant period. Included in the calculation of attributable GEOs is any cash received from the Higginsville price participation royalty, which is accounted for as a derivative royalty asset, as such any payments received under this royalty are treated as a reduction in the carrying value of the asset on the Company’s statement of financial position and not shown as revenue on the Company’s statement of profit and loss. However, operationally as the Company receives payment similar to the Company’s other royalty interests, the results have been included for more accurate comparability and to allow the reader to accurately analyze the operations of the Company. The Company presents attributable GEOs as it believes that certain investors use this information to evaluate the Company’s performance in comparison to other streaming and royalty companies in the precious metals mining industry who present results on a similar basis. The Company’s attributable GEOs for the three and six months ended June 30, 2023, were as follows:

|

Three months |

Six months |

||

|

ended |

ended |

||

|

Attributable GEOs during the period from: |

June 30, 2023 |

June 30, 2023 |

|

|

Higginsville |

377 |

730 |

|

|

Wharf |

159 |

511 |

|

|

El Realito |

233 |

401 |

|

|

La Encantada |

55 |

81 |

|

|

NLGM |

32 |

60 |

|

|

Total attributable GEOs |

856 |

1,783 |

(b) Average cash cost per attributable GEO

Average cash cost per attributable GEO is a non-IFRS financial measure that is calculated by dividing the Company’s total cash cost of sales, excluding depletion by the number of attributable GEOs. The Company presents average cash cost per attributable GEO as it believes that certain investors use this information to evaluate the Company’s performance in comparison to other streaming and royalty companies in the precious metals mining industry who present results on a similar basis. The Company’s average cash cost per attributable GEO for three and six months ended June 30, 2023, was:

|

Three months |

Six months |

||

|

ended |

ended |

||

|

June 30, 2023 |

June 30, 2023 |

||

|

Cost of sales for NLGM |

$7 |

$12 |

|

|

Total cash cost of sales |

7 |

12 |

|

|

Total attributable GEOs |

856 |

1,783 |

|

|

Average cash cost per attributable GEO |

$8 |

$7 |

(c) Average realized price per attributable GEO

Average realized price per attributable GEO is a non-IFRS financial measure that is calculated by dividing the Company’s revenue, excluding any revenue earned from fixed royalty payments, and including cash received or accrued in the period from derivative royalty assets, by the number of attributable GEOs sold. The Company presents average realized price per attributable GEO as it believes that certain investors use this information to evaluate the Company’s performance in comparison to other streaming and royalty companies in the precious metals mining industry that present results on a similar basis. The Company’s average realized price per attributable GEO for three and six months ended June 30, 2023, was:

|

Three months |

Six months |

||

|

ended |

ended |

||

|

June 30, 2023 |

June 30, 2023 |

||

|

Royalty revenue (excluding fixed royalty payments) |

$859 |

$1,840 |

|

|

Payments from derivative assets |

742 |

1,411 |

|

|

Revenue from NLGM |

64 |

116 |

|

|

Sales from stream and royalty interests |

1,665 |

3,367 |

|

|

Total attributable GEOs sold |

856 |

1,783 |

|

|

Average realized price per attributable GEO |

$1,945 |

$1,888 |

(d) Operating cash margin per attributable GEO

Operating cash margin per attributable GEO is a non-IFRS financial measure that is calculated by subtracting the average cast cost price per attributable GEO from the average realized price per attributable GEO. The Company presents operating cash margin per attributable GEO as it believes that certain investors use this information to evaluate the Company’s performance in comparison to other streaming and royalty companies in the precious metals mining industry that present results on a similar basis.

(e) Adjusted EBITDA

Adjusted EBITDA is a non-IFRS financial measure which excludes from net income taxes, finance costs, depletion, impairment charges, foreign currency gains/losses, share based payments, and non-recurring items. Management uses Adjusted EBITDA to evaluate the Company’s operating performance, to plan and forecast its operations, and assess leverage levels and liquidity measures. The Company presents Adjusted EBITDA as it believes that certain investors use this information to evaluate the Company’s performance in comparison to other streaming and royalty companies in the precious metals mining industry who present results on a similar basis. However, Adjusted EBITDA does not represent, and should not be considered an alternative to net income (loss) or cash flow provided by operating activities as determined under IFRS. The Company’s adjusted EBITDA for three and six months ended June 30, 2023, was:

|

Three months |

Six months |

||

|

ended |

ended |

||

|

June 30, 2023 |

June 30, 2023 |

||

|

Net loss |

$(487) |

$(1,843) |

|

|

Adjusted for: |

|||

|

Royalty interest impairment |

1,302 |

1,302 |

|

|

Gain on sales of mineral claims |

(5,093) |

(5,093) |

|

|

Interest expense |

342 |

657 |

|

|

Finance charges |

45 |

78 |

|

|

Loss on extinguishment of loan payable |

1,417 |

1,417 |

|

|

Income tax provision |

1,044 |

1,243 |

|

|

Depletion |

514 |

913 |

|

|

Foreign exchange loss |

154 |

222 |

|

|

Share-based payments |

570 |

1,467 |

|

|

Adjusted EBITDA |

$(192) |

$363 |

Refer the Company’s MD&A for the three and six months ended June 30, 2023, which is available on SEDAR at www.sedar.com, for a numerical reconciliation of the non-IFRS financial measures described above. The presentation of these non-IFRS financial measures is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Other companies may calculate these non-IFRS financial measures differently.

Technical and Third-Party Information

Metalla has limited, if any, access to the properties on which Metalla holds a royalty, stream or other interest. Metalla is dependent on (i) the operators of the mines or properties and their qualified persons to provide technical or other information to Metalla, or (ii) publicly available information to prepare disclosure pertaining to properties and operations on the mines or properties on which Metalla holds a royalty, stream or other interest, and generally has limited or no ability to independently verify such information. Although Metalla does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. Some information publicly reported by operators may relate to a larger property than the area covered by Metalla’s royalty, stream or other interests. Metalla’s royalty, stream or other interests can cover less than 100% and sometimes only a portion of the publicly reported mineral reserves, resources and production of a property.

Unless otherwise indicated, the technical and scientific disclosure contained or referenced in this press release, including any references to mineral resources or mineral reserves, was prepared in accordance with Canadian NI 43-101, which differs significantly from the requirements of the U.S. Securities and Exchange Commission (the “SEC“) applicable to U.S. domestic issuers. Accordingly, the scientific and technical information contained or referenced in this press release may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

“Inferred mineral resources“ have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Historical results or feasibility models presented herein are not guarantees or expectations of future performance.

Cautionary Note Regarding Forward-Looking Statements

This press release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements“) within the meaning of applicable securities legislation. The forward-looking statements herein are made as of the date of this press release only and the Company does not intend to and does not assume any obligation to update or revise them except as required by applicable law.

All statements included herein that address events or developments that we expect to occur in the future are forward-looking statements. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as “plans“, “expects“, “is expected“, “budgets“, “scheduled“, “estimates“, “forecasts“, “predicts“, “projects“, “intends“, “targets“, “aims“, “anticipates“ or “believes” or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions “may“, “could“, “should“, “would“, “might“ or “will“ be taken, occur or be achieved. Forward-looking statements in this press release include, but are not limited to, statements regarding: future events or future performance of Metalla; the completion of the Company‘s royalty purchase transactions; the Company‘s plans and objectives; the Company‘s future financial and operational performance; expectations regarding stream and royalty interests owned by the Company; the satisfaction of future payment obligations, contractual commitments and contingent commitments by Metalla; the future achievement of any milestones in respect of the payment or satisfaction of contingent consideration by Metalla; the payment of the special dividend and the anticipated timing thereof; the future sales of common shares under the 2022 ATM Program and the value of the gross proceeds to be raised; the future availability of funds, including drawdowns pursuant to the Company‘s loan facility (as amended or supplemented); the effective interest rate of drawdowns under the Company’s loan facility (as amended or supplemented) and the life expectancy thereof; the future conversion of funds drawn down by Metalla under its loan facility (as amended or supplemented); the payment of the principal and accrued interest on the Castle Mountain loan ; the completion by property owners of announced drilling programs, capital expenditures, and other planned activities in relation to properties on which the Company and its subsidiaries hold a royalty or streaming interest and the expected timing thereof; production and life of mine estimates or forecasts at the properties on which the Company and its subsidiaries hold a royalty or streaming interest; future disclosure by property owners and the expected timing thereof; the completion by property owners of announced capital expenditure programs; the expected 2023 production guidance at La Encantada; the intended improvements for the heap leach pads at El Realito; the completion of 4,000 meters of exploration drilling by Agnico at the Chipriona deposit at El Realito; the expected 2023 production at Wharf; the focus of the exploration efforts at Wharf in 2023; the expected 2023 production guidance at NLGM; the assessment of the Wasamac project by Agnico, and the reporting of the results of their internal evaluation and the anticipated timing thereof; the expected production potential at Wasamac and the expected timing of commencement of production; expected activities at the Tower Gold Project, and the timing thereof; the production potential at the AK deposit and the anticipated timing thereof; the reporting of the results of an internal evaluation on the AK deposit and the timing thereof; the release of a mine restart study for Endeavor and the anticipated timing thereof; the recommencing of operations at the Endeavor mine and the anticipated timing thereof; the completion of Polymetals acquisition of Orana Minerals Pty Ltd.; additional technical studies planned to complete test work and studies to optimize inclusion of Gosselin into future Côté life-of-mine plans; the planned drilling for 2023 at Gosselin; St. Barbara’s plans regarding development of Fifteen Mile Stream including the timing thereof, the expected expenses by Agnico at Fosterville, and the completion of capitalized drilling, development of exploration drifts, and underground and surface exploration; the start of commercial production at Tocantinzinho and the anticipated timing thereof; phase two optimization, engineering and permitting, including the timing and costs thereof at Castle Mountain; the beginning of the preparation of a preliminary draft Environmental Impact Statement for Castle Mountain and the timing thereof; the expected timing of start of production at Akasaba West; the second phase of exploration drilling at Camflo, and test for potential lateral extensions of mineralization and infill known zones; Agnico’s belief regarding open-pit mining and location of processing at Camflo; the anticipated drill program at Camflo property and the anticipated timing thereof; results of the 2023 drill program at Green Springs; the amount and timing of the attributable GEOs expected by the Company in 2023; the availability of cash flows from the Wharf, Higginsville, El Realito, NLGM and La Encantada royalties and streams; royalty payments to be paid to Metalla by property owners or operators of mining projects pursuant to each royalty interest; the future outlook of Metalla and the mineral reserves and resource estimates for the properties with respect to which the Metalla has or proposes to acquire an interest; future gold and silver prices; other potential developments relating to, or achievements by, the counterparties for the Company’s stream and royalty agreements, and with respect to the mines and other properties in which the Company has, or may acquire, a stream or royalty interest; costs and other financial or economic measures; prospective transactions; growth and achievements; financing and adequacy of capital; future payment of dividends; future public and/or private placements of equity, debt or hybrids thereof; and the Company‘s ability to fund its current operational requirements and capital projects.

Such forward-looking statements reflect management’s current beliefs and are based on information currently available to management. Forward-looking statements are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties, and contingencies. Forward-looking statements are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Metalla to control or predict, that may cause Metalla’s actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: risks related to commodity price fluctuations; the absence of control over mining operations from which Metalla will purchase precious metals pursuant to gold streams, silver streams and other agreements or from which it will receive royalty payments pursuant to net smelter returns, gross overriding royalties, gross value royalties and other royalty agreements or interests and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined; risks related to exchange rate fluctuations; that payments in respect of streams and royalties may be delayed or may never be made; risks related to Metalla‘s reliance on public disclosure and other information regarding the mines or projects underlying its streams and royalties; that some royalties or streams may be subject to confidentiality arrangements that limit or prohibit disclosure regarding those royalties and streams; business opportunities that become available to, or are pursued by, Metalla; that Metalla‘s cash flow is dependent on the activities of others; that Metalla has had negative cash flow from operating activities in the past; that some royalty and stream interests are subject to rights of other interest-holders; that Metalla‘s royalties and streams may have unknown defects; risks related to Metalla‘s sole material asset, the Côté property; risks related to general business and economic conditions; risks related to global financial conditions, geopolitical events and other uncertainties; risks related to epidemics, pandemics or other public health crises, including COVID-19 global health pandemic, and the spread of other viruses or pathogens, and the potential impact thereof on Metalla‘s business, operations and financial condition; that Metalla is dependent on its key personnel; risks related to Metalla‘s financial controls; dividend policy and future payment of dividends; competition; that project operators may not respect contractual obligations; that Metalla‘s royalties and streams may be unenforceable; risks related to conflicts of interest of Metalla‘s directors and officers; that Metalla may not be able to obtain adequate financing in the future; risks associated with Metalla‘s 2022 ATM Program; risks related to Metalla‘s current credit facility and financing agreements; litigation; title, permit or license disputes related to interests on any of the properties in which Metalla holds, or may acquire, a royalty, stream or other interest; interpretation by government entities of tax laws or the implementation of new tax laws; changes in tax laws impacting Metalla; risks related to anti-bribery and anti-corruption laws; credit and liquidity risk; risks related to Metalla‘s information systems and cyber security; risks posed by activist shareholders; that Metalla may suffer reputational damage in the ordinary course of business; risks related to acquiring, investing in or developing resource projects; risks applicable to owners and operators of properties in which Metalla holds an interest; exploration, development and operating risks; risks related to climate change; environmental risks; that the exploration and development activities related to mine operations are subject to extensive laws and regulations; that the operation of a mine or project is subject to the receipt and maintenance of permits from governmental authorities; risks associated with the acquisition and maintenance of mining infrastructure; that Metalla‘s success is dependent on the efforts of operators‘ employees; risks related to mineral resource and mineral reserve estimates; that mining depletion may not be replaced by the discovery of new mineral reserves; that operators‘ mining operations are subject to risks that may not be able to be insured against; risks related to land title; risks related to international operations; risks related to operating in countries with developing economies; risks related to the construction, development and expansion of mines or projects; risks associated with operating in areas that are presently, or were formerly, inhabited or used by indigenous peoples; that Metalla is required, in certain jurisdictions, to allow individuals from that jurisdiction to hold nominal interests in Metalla’s subsidiaries in that jurisdiction; the volatility of the stock market; that existing securityholders may be diluted; risks related to Metalla‘s public disclosure obligations; risks associated with future sales or issuances of debt or equity securities; risks associated with the Company‘s loan facility; that there can be no assurance that an active trading market for Metalla‘s securities will be sustained; risks related to the enforcement of civil judgments against Metalla; risks relating to Metalla potentially being a passive “foreign investment company“ within the meaning of U.S. federal tax laws; and the other risks and uncertainties disclosed under the heading “Risk Factors“ in the Company‘s most recent Annual Information Form, annual report on Form 40-F and other documents filed with or submitted to the Canadian securities regulatory authorities on the SEDAR website at www.sedar.com and the U.S. Securities and Exchange Commission on the EDGAR website at www.sec.gov. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. We are under no obligation to update or alter any forward-looking statements except as required under applicable securities laws. For the reasons set forth above, undue reliance should not be placed on forward-looking statements.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/metalla-reports-financial-results-for-the-second-quarter-of-2023-and-provides-asset-updates-301898761.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/metalla-reports-financial-results-for-the-second-quarter-of-2023-and-provides-asset-updates-301898761.html

SOURCE Metalla Royalty and Streaming Ltd.

Featured image: DepositPhotos © belchnock