Meritor, Inc.

MTOR

has recently signed a collaborative agreement with ConMet, per which, Meritor will manufacture purpose-built trailer suspensions and brakes, and tire inflation systems to work with ConMet’s PreSet PluseHub.

The trailblazing system will allow the production of zero-emission refrigerated trailers. In order to deliver a wholesome electrified trailer solution, Meritor is redesigning its trailer suspension and drum brake, keeping in mind the compatibility aspect with ConMet’s eHub. The companies will jointly evaluate the application of advanced technologies that cater to the evolving e-mobility market trends.

This partnership is testimony to the eOptimized products solution by Meritor and its dedicated efforts to bring zero-emission solutions to the commercial vehicle industry.

Notably, Meritor is to be acquired by

Cummins

CMI

by 2022 end. The deal, which comes at a time when the demand for climate-friendly transport is on the rise, will reinforce Cummins’ electric and hybrid vehicle parts offerings. It has a purchase price of $3.7 billion, out of which Cummins will pay $2.58 billion in cash. Per the agreement, the company will pay $36.50 per share in a combination of cash and debt to Meritor. The valuation price is at a premium of 48% above MTOR’s closing price on Feb 18, 2022.

The most vital aspect of the buyout is its address to mitigating climate concerns. It harps on the pressing need to incorporate de-carbonized solutions into product offerings to reduce environmental impact. Meritor’s market reputation will empower Cummins to be a provider of integrated powertrain solutions across combustion and electric power applications. By aiding Meritor’s investment in electrification and integrating development within its New Power business, Cummins seeks to offer market-leading solutions.

In its last-quarter earnings call, Meritor’s guidance has remained the same for fiscal 2022. Sales are projected in the range of $4.1-$4.3 billion. The company projects adjusted earnings per share to be in the band of $3.25-$3.75. Cash flow from operations is anticipated in the range of $275-$320 million and free cash flow in the band of $175-$200 million.

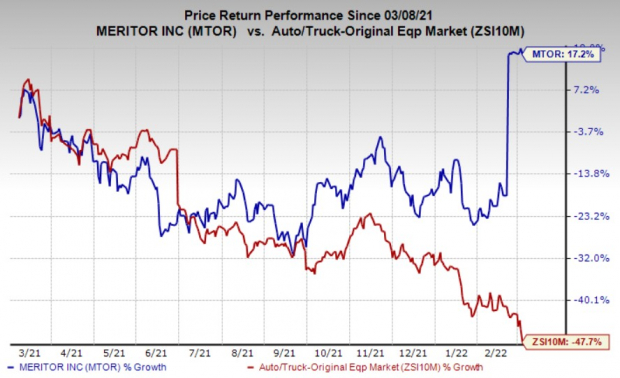

Shares of MTOR have gained 17.2% over the past year against its

industry

’s 47.7% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, MTOR has a Zacks Rank #4 (Sell).

Better-ranked players in the auto space include

Tesla

TSLA

and

Harley-Davidson

HOG

, both sporting a Zacks Rank #1 currently. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Tesla has an expected earnings growth rate of 40.7% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised around 20.5% upward in the past 60 days.

Tesla’s earnings beat the Zacks Consensus Estimate in all of the trailing four quarters. TSLA pulled off a trailing four-quarter earnings surprise of 33.26%, on average. The stock has also rallied 48.9% over a year.

Harley-Davidson has an expected earnings growth rate of 1.9% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised around 21.7% upward in the past 60 days.

Harley-Davison’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. HOG pulled off a trailing four-quarter earnings surprise of 77.59%, on average. The stock has rallied 5.7% over a year.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report