We’ve faced some adverse action in the market over the last few days, with the major indexes currently sitting in the red for the week. Nonetheless, the show rolls on. On deck to unveil quarterly results on Thursday after the bell rings is the big player Amazon

AMZN

.

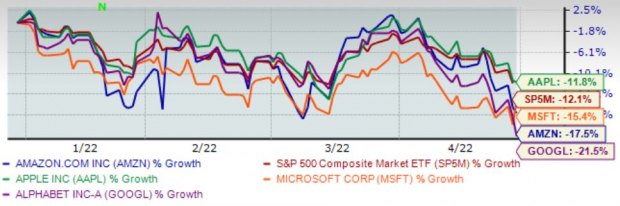

Year-to-date, Amazon shares have struggled to find their footing. The chart below illustrates the year-to-date performance of widely-regarded market leaders – Microsoft

MSFT

, Apple

AAPL

, and Alphabet

GOOGL

– while comparing the S&P 500 as well.

Image Source: Zacks Investment Research

It’s been a red year for tech. However, it’s been an even tougher stretch for Amazon shares, down nearly 18% and underperforming all names besides Alphabet.

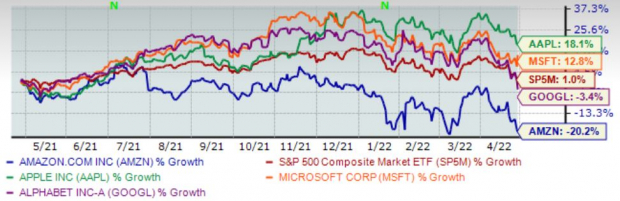

Once we stretch out the time frame to over the past year, the story remains almost the same; AMZN shares have completely broken off from the general market and have been in a downtrend since about the middle of November 2021.

Image Source: Zacks Investment Research

Supply-chain issues, rising labor costs, unionization talks, and skyrocketing energy prices have all played spoilsport for AMZN throughout the quarter, and investors are hopeful that a solid earnings release can provide the push needed to shift the tide in their favor. It’s time to analyze key metrics and estimates heading into the e-commerce giant’s quarterly report to see what’s in store.

Previous Share Reactions

Over the last five quarterly EPS beats, AMZN shares have moved upward just two times. The most significant upwards price reaction occurred in its latest quarterly report, where the company smoked the consensus EPS estimate by a staggering 613%, no doubt fueling the 4.6% rally that occurred.

Looking at what fueled the nearly 5% move from its latest quarterly release, Amazon reported it had benefitted from one of its strongest e-commerce seasons ever paired with extremely high web traffic levels.

If historical data proves accurate, it seems that Amazon will have to beat the quarterly consensus estimate extensively to send shares upward.

Earnings Surprise

Image Source: Zacks Investment Research

Amazon Web Services

A key metric for Amazon heading into its quarterly report is Amazon Web Services (AWS) revenue. AWS is the world’s most comprehensive and broadly adopted cloud platform with millions of customers, including fast-growing startups, large enterprises, and leading government agencies. These customers rely on AWS to lower business costs, become more agile in the cloud, and ramp up innovation.

AWS has the deepest functionality within its 200+ services, offering the widest variety of purpose-built databases for various applications. Companies including Meta Platforms

FB

and Best Buy

BBY

have recently selected AWS as their preferred cloud provider. Additionally, Nasdaq has shared its multi-year partnership to migrate its markets onto AWS to become the world’s first fully enabled, cloud-based exchange.

It has quickly become the company’s fastest-growing source of revenue, surging nearly 80% year-over-year from 2020 to 2021. Clearly, cloud computing is quickly becoming a critical aspect of technology, and almost all companies would like a piece of the pie. Luckily for Amazon, it has already fully established itself in this area.

For the quarter, net sales for AWS is pegged at $18.5 billion, a 45% increase when compared to the prior quarter’s reported value of $12.7 billion.

Microsoft & Google Cloud

Thankfully, with Microsoft

MSFT

and Alphabet

GOOGL

already releasing their quarterly results, we can dive into how their cloud computing business has performed to understand what to expect from AWS.

Microsoft’s cloud platform revenue paved the way for a robust earnings release. “Continued customer commitment to our cloud platform and strong sales execution drove better than expected commercial booking growth of 28% and Microsoft Cloud revenue of $23.4 billion, up 32% year-over-year,” said Amy Hood, executive VP, and CFO of MSFT.

Moving forward, MSFT also believes that digital technology such as the cloud will be a critical growth driver of the world’s economic output.

Microsoft is a Zacks Rank #4 (Sell) with an overall VGM Score of a D.

Although GOOGL missed EPS estimates, year-over-year growth in Google Cloud from the year-ago quarter was robust. The company raked in $5.8 billion in revenue from its cloud compared to $4 billion in 2021 Q1, a 44% increase.

Additionally, Google’s cloud revenue grew 47% year-over-year to $19.2 billion from 2020 to 2021 and is forecasted to bring in $26.7 billion for FY22.

Alphabet is a Zacks Rank #3 (Hold) with an overall VGM Score of an A.

Q1 EPS & Revenue Forecast

The upcoming quarter’s Consensus Estimate Trend has retraced marginally down to $8.73 per share over the last 60 days, with two analysts downwardly revising their estimates. With tough year-over-year comparisons from the year-ago quarter, quarterly earnings are forecasted to decrease by a notable 45%.

With COVID-19 fleeting, it’s no surprise to me that earnings are forecasted to decline; many people are returning to the outside world and are no longer forced to shop online, drastically affecting web traffic levels.

Revenue for the upcoming quarter is pegged at $117 billion, a solid 8% increase from the previous year’s quarter. However, the $117 billion estimate reflects a 15% decrease in sales from the prior quarter.

Once again, it’s not surprising to see quarterly revenue decline from the previous quarter’s value; AMZN benefitted greatly during the holiday season when web traffic was at an extremely high level.

Bottom Line

The market is sailing in rough waters at the moment, and Amazon has some very tough year-over-year comparisons to compete with. However, there are bright spots, such as the robust demand for AWS, a critical metric that will no doubt benefit Amazon in the long term as the world rapidly adopts cloud computing.

Additionally, in a shareholder-friendly move, Amazon announced a 20-for-1 stock split back in early March, which will significantly lower the barrier of entry for potential investors and provide ease for the stock price to once again multiply and provide considerable gains. Trading will begin on a split-adjusted basis on June 6th.

The entire market will no doubt be watching the company’s quarterly earnings like a hawk, and for a good reason – a better-than-expected earnings release could be the fuel needed to send AMZN shares back into an uptrend.

Heading into the report, I believe that investors should heed caution due to the current nature of the market and should instead wait to see if buyers step up. Amazon is currently a Zacks Rank #3 (Hold) with an overall VGM Score of a B.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report