Helix Energy Solutions (NYSE:HLX) shares are on momentum over the last three months, supported by improving market dynamic in the energy sector. The substantial growth in oil prices and increasing investments from offshore companies have been adding to trader sentiments.

Helix Energy Solution share price rose 10% in the last month alone, up 44% in the previous three months. HLX shares are currently trading around $8 – with a 52-week trading range of $5.06 – $8.70. Traders believe the business environment for oil and gas equipment and services companies is likely to remain stable in the following quarters, thanks to higher oil prices.

Helix Energy Solutions Group Inc is an energy services company that offers a variety of specialty products and services to the offshore energy industry.

Financials are Growing at Sharp Pace

Helix has been experiencing robust demand for its products and services. The company’s revenue increased to $164 million in the first quarter compared to its revenue of $104 million achieved last year. All three of its business segments generated year-over-year growth in the first quarter.

Its revenue from well Intervention segment, which is the largest revenue generation segment, doubled from the same period last year. The growth in well Intervention revenue was primarily due to a full quarter of Siem Helix 2 operations for Petrobras and full utilization of the Q4000. The company expects its well Intervention revenue to increase at the significant rate in the second quarter, driven by continued investments from offshore companies.

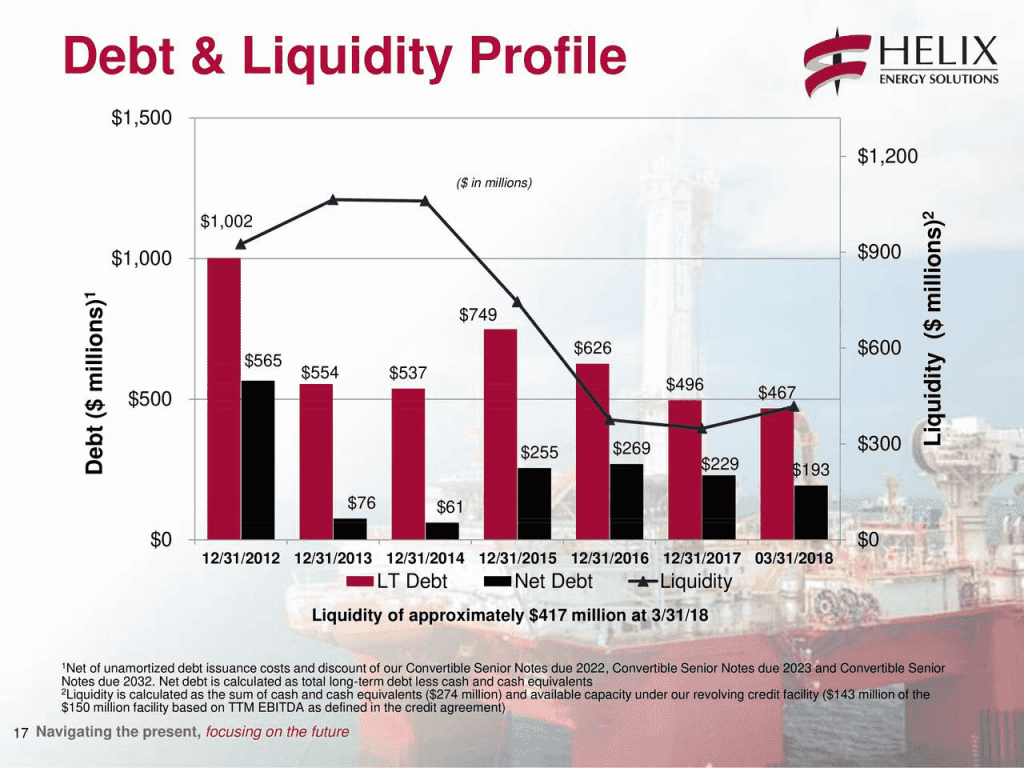

Liquidity Position is Stable

The company appears to be in a stable position to invest in growth opportunities. Helix ended the first quarter with cash and cash equivalents of approximately $274 million. It has also decreased its long-term debt to $467 million from $496 million that it had last year.

Helix Energy Solutions has also been generating sufficient cash to cover its capital requirements. Its operating cash flows of $41 million adequately covered capital requirements of $20 million in the first quarter.

>> Gibson Guitars: Bankrupt but Banking on Ukuleles?

Featured Image: Eniday