Currently, Aurora Cannabis Inc. (TSXV:$ACB), which is a medical marijuana producer and distributor, has a large number of in-the-money warrants that can be exercised soon.

For those new to marijuana investing, or the stock market in general, a warrant is a financial tool that allows investors the right to buy shares in a company at an established price until a certain date. Warrants will differ from options because a company has to issue new shares whenever a warrant is exercised. This results in a dilution of the earnings per share (EPS) the company produces, as there is now an increase in shares to which the earnings are designated. Warrants can be a helpful tool for companies looking to raise their capital, but it is important to keep in mind that there is the risk of dilution.

Aurora Cannabis (TSXV:$ACB)

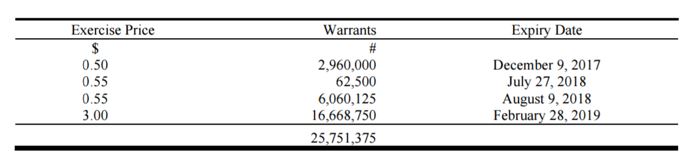

As of right now, Aurora Cannabis is trading at $2.02 per share as at market close, June 6, 2017. On May 15, 2017 Aurora disclosed their earnings for the third quarter of 2017. Currently, Aurora Cannabis has 25mm warrants pending, and the majority can be exercised soon.

Since Aurora has 332mm shares outstanding, it is expected that the warrants would increase the number of shares outstanding by roughly 7.5%, which would slightly affect the stock price is it is exercised. This is because investors are more than likely to sell off their shares as soon as possible, which would put a great amount of pressure on the price of the stock.

Keep in mind that for marijuana investment companies such as Aurora Cannabis, who had a net loss for the nine months ended in Q3 of 2017, the dilution would make Aurora look much better. This is mostly due to the loss being distributed over more shares, thus making the loss per share smaller. However, this is not a good thing as the pressure put on the price of the stock as well as the decreased ownership stake that is thrust upon investors.

Featured Image: twitter