Israel-based biopharmaceutical company RedHill Biopharma Ltd – ADR (NASDAQ:$RDHL) saw its stocks rise after the company’s release of the results from its Phase III clinical trial named GUARD. GUARD tested the performance of using RHB-102 (labelled BEKINDA) to treat patients with acute gastroenteritis and gastritis, and yielded positive results.

Robert Silverman, Lead Investigator of GUARD, commented on the positive phase III trial:

“If approved by FDA, BEKINDA® may become the new standard of care helping us treat patients quickly and effectively in both the emergency and outpatient settings,” he said. Acute gastroenteritis and gastritis is a relatively common illness that affects almost 179 million people in the US each year, he added.

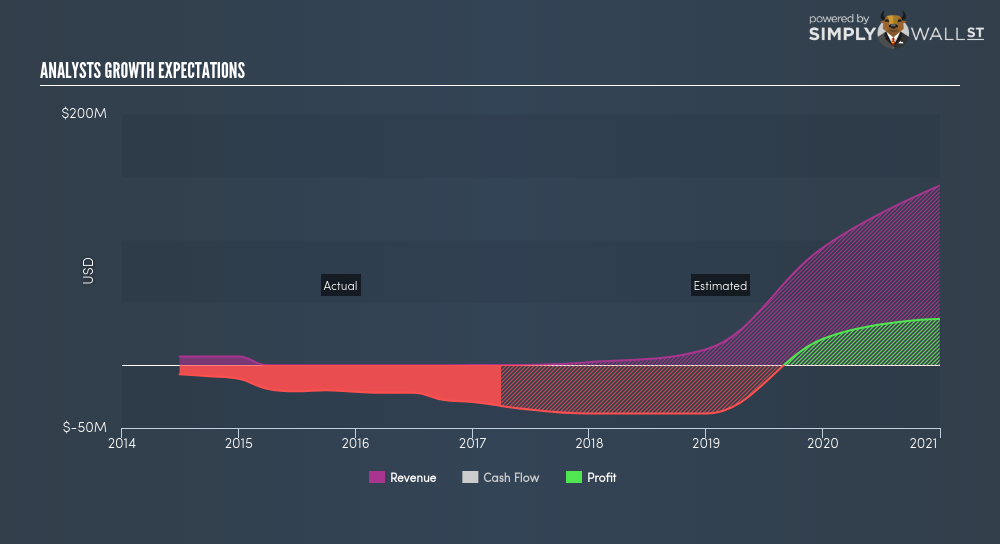

The announcement can change RedHill’s status as a highly volatile share; the company’s market capitalization is currently just over $150 million and many did not expect it to have any products to sell on markets — much less make any large revenues — any time soon. If the GUARD study continues to deliver positive, safe, and effective data for its final phase of study, the drug could be on its way to gaining marketing approval from the FDA.

More Products Coming?

While investors may be clamouring for RedHill shares due to the potential that BEKINDA has to be the company’s first commercial product, other drugs such as RHB-104 and RHB-105 are also in its Phase III study and carries high potential to be on the market as well.

RHB-104 is a combination of antibiotics that is taken orally. The drug was developed to treat Crohn’s disease with the hypothesis that the illness is caused by Mycobacterium avium subspecies paratuberculosis (MAP). While there are still several things to do before the hypothesis can be confirmed — including a partner study with Quest Diagnostics to find MAP in whole blood — if Redhill could find a cure for a life-changing and painful illness such as Crohn’s, it could mean massive success and recognition for the company.

RHB-105 is a drug developed to treat gastric ulcers. Current treatment for the illness is only effective in only a third of those who has it, but with the RHB-105 showing successful results from its first Phase III study, this could very well change. Like BEKINDA and RHB-104, if the final study shows the same success and effectiveness and gains marketing approval from the FDA, the valuation of Redhill could increase dramatically.

Featured Image: koreabizwire.com