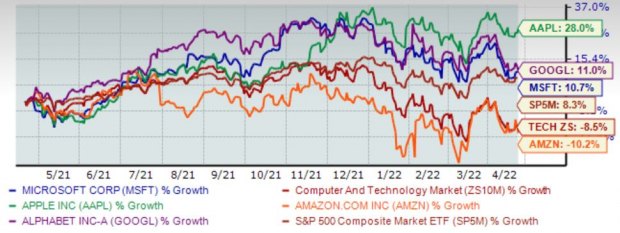

Tech stocks have tumbled year-to-date, with many high-flying companies vastly underperforming the general market. Below is a chart that illustrates the year-to-date performance of four major tech stocks – Apple

AAPL

, Amazon

AMZN

, Alphabet, Inc.

GOOGL

, and Microsoft

MSFT

– while also comparing the S&P 500 and the Zacks – Computer and Technology Sector’s performance.

Image Source: Zacks Investment Research

As we can see, it’s been a rough year for tech. In fact, Apple (AAPL) is the only tech stock on the list showing a higher level of defense than the general market year-to-date. Near the bottom of the chart with the worst year-to-date performance is Microsoft (MSFT).

However, when looking at performance over the past year, we can see that Microsoft is actually the second-best performer. Amazon is the only tech stock on the list that hasn’t outpaced the general market in the same timeframe.

Image Source: Zacks Investment Research

While Microsoft has been generally strong over the last year, the current year-to-date performance represents a slight recent disconnect from its tech peers. MSFT is slated to release its 2022 Q3 results next Tuesday after the bell rings, so let’s analyze critical aspects heading into the report and see if shares stand to rebound.

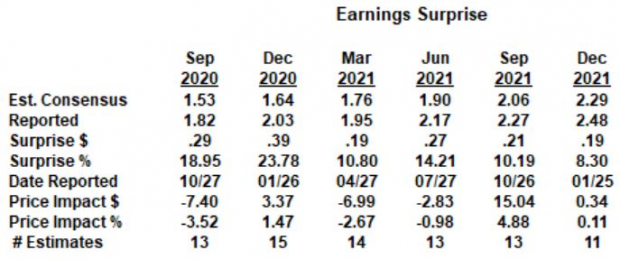

Previous Earnings Price Impact

In its 2021 Q2 earnings release, MSFT reported earnings of $2.48 per share, which handily beat the Zacks Consensus Estimate by 8%. It seems that the market was expecting more; shares moved upwards just 0.11% following the report.

In fact, Microsoft’s share price has only increased in value three times out of its last six earnings reports, despite exceeding EPS estimates in each one. The most significant share price impact occurred in its 2021 Q1 report, where shares climbed nearly 5% following the report in an October month that the tech-heavy Nasdaq gained 7%. With the Nasdaq struggling year-to-date (down close to 16%), a solid earnings release may not be enough to snap the downtrend.

Image Source: Zacks Investment Research

Growth Drivers

For Q3, metrics that investors should keep a keen eye on include Microsoft’s cloud revenue (Azure) and its gaming services revenue. These are two critical growth drivers moving forward; the videogame industry is booming, and cloud computing is continuously becoming a vital aspect of technology.

MSFT cloud revenues tallied $22 billion in its latest quarter, a remarkable 32% year-over-year increase. As of now, Microsoft is the second-largest provider of cloud-based infrastructure behind Amazon. Additionally, MSFT’s gross margin for its cloud services increased by $2.3 billion, or 21% in 2022 Q2, driven by growth in Azure and other cloud services.

In Q2, revenue from its gaming services increased by $411 million, or 8%, benefitting from the launch of its Xbox Series X|S and stay-at-home orders. Additionally, with its acquisition of Activision Blizzard

ATVI

in January, Microsoft intends to publish all Activision Blizzard games onto its Xbox Game Pass, a service with over 25 million subscribers that costs a low monthly fee of $9.99. ATVI’s gaming library, which has over 400 million monthly active players, is expected to boost Microsoft’s gaming revenue moving forward.

Q3 Estimates

For Q3, the Consensus Estimate Trend has moderately changed over the last 90 days, currently reflecting quarterly earnings of $2.18 per share vs. EPS of $1.95 in 2021 Q3. Additionally, one analyst has downwardly revised their EPS estimates for Q3 over the last 60 days.

The Zacks Consensus Estimate for Q3 revenue is sitting at roughly $49 billion, reflecting a year-over-year top-line expansion of a notable 17%. In 2022 Q2, MSFT raked in $45 billion and beat revenue estimates by nearly 3%, driven by robust adoption of Azure cloud offerings.

Unfavorable forex is expected to stunt revenue growth by 2% for the upcoming quarter. Productivity and Business Processes revenue are forecasted between $15.6 – $15.85 billion; strong momentum in Office 365 is expected to drive growth in this segment.

Cloud services and commercial products are expected to grow in the low double-digit range, driven by demand for Microsoft 365 and advanced security solutions. Additionally, gaming revenues are forecasted to grow in the single digits, but MSFT states that supply constraint issues of the Xbox Series S|X could potentially affect growth in its gaming segment.

Overall, Microsoft stands to capitalize on solid, well-established trends within its segments. However, usage and revenue of the company’s products surged widely due to pandemic restraints, and Microsoft sees this as a factor that could cool down growth rates moving forward.

Apple

Another tech giant, Apple

AAPL

, is also slated to release quarterly results next week. Over its last four quarters, Apple has acquired a notable 20% average EPS surprise, and in its latest report, AAPL beat estimates by double-digits at 11%.

Analysts forecast quarterly EPS of $1.44, boosted by three positive estimate revisions over the last 60 days and reflecting year-over-year earnings growth of 3%. Earnings are forecasted to grow by nearly 10% for the current fiscal year.

The Zacks Consensus Sales Estimate for AAPL sits at $94 billion compared to $89.6 billion in sales for the year-ago quarter. Additionally, heading into the quarterly report, Apple has an ESP Score of 0.54%.

Apple is a Zacks Rank #2 (Buy) with an overall VGM Score of a B.

Bottom Line

With the tech-heavy Nasdaq retreating considerably year-to-date, tech stocks have been selling off nearly all throughout 2022. Nobody has a magic crystal ball that tells them where the market heads next, but until tech stocks snap their downtrends, it may be beneficial for investors to wait before buying shares of these high-flying companies.

Fundamentally, Microsoft has consistently displayed strong growth rates, and EPS estimates have been creeping up. However, the company’s top line was boosted by a surge of stay-at-home orders and other restraints that caused the world to shift online.

The year-to-date performance of tech stocks steers me away from being aggressive at the moment, but, overall, I believe that Microsoft is a stellar investment for the long term. Microsoft is currently a Zacks Rank #3 (Hold) with an overall VGM Score of a D.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report