Halliburton Company

HAL

entered an agreement with Chariot Limited to offer drilling services for the latter’s Anchois gas appraisal well within the Lixus license off Morocco’s coast.

The Lixus offshore license covers an area of 2,390 square kilometers, with water depths ranging from the coastline to 850 meters.

Per the terms of the agreement, Halliburton will provide a range of services, which involve project management, directional drilling and logging while drilling, drilling fluids materials, and engineering services. The company will also provide cementing, pumping, materials and engineering services, wireline logging services, and drill bits and coring services.

The purpose of the contract is to unlock the development of the discovered sands by validating the gas resource volumes, reservoir quality and well productivity. It also aims to provide a future production well for the Anchois field development and deepen the well into additional low-risk prospective sands to develop a larger resource base for long-term growth.

The development options for the Anchois gas field involved a subsea-to-shore concept. The concept consists of subsea production wells tied to a subsea manifold, from which a subsea flowline and umbilical connect the field to an onshore Central Processing facility. Gas is processed and delivered into the Maghreb-Europe Gas pipeline from the Central Processing facility through an onshore gas flowline.

At present, the Anchois-1 gas discovery has recoverable resources of 361 billion cubic feet (bcf), with 690 bcf prospective resources. Earlier this month, Chariot hired the Stena Don semi-submersible rig to drill for the Anchois appraisal well. Drilling operations are expected to start in December and would take up to 40 days.

Company Profile & Price Performance

Headquartered in Houston, TX, Halliburton is one of the largest oilfield service providers.

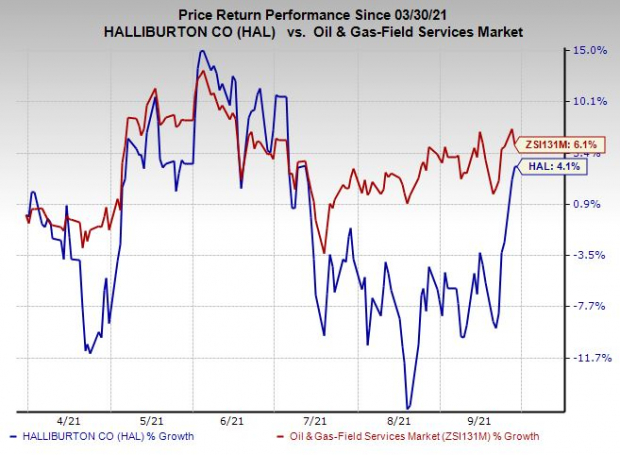

Shares of the company have underperformed the

industry

in the past six months. The stock has gained 4.1% compared with the industry’s 6.1% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

The company currently carries a Zack Rank #3 (Hold).

Some better-ranked players in the energy space are

Continental Resources, Inc.

CLR

and

Chesapeake Energy Corporation

CHK

, each currently flaunting a Zacks Rank #1 (Strong Buy), and

Royal Dutch Shell plc

(

RDS.A

), carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

In the past 60 days, the Zacks Consensus Estimate for Continental’s 2021 earnings has been raised by 25.5%, while that for Chesapeake has been increased by 19.1%.

Shell’s earnings for 2021 are expected to increase 17.2% year over year.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report