4 Growth Stocks To Watch In The Stock Market This Week

While the

stock market

seems to be giving back yesterday’s gains, investors continue to ponder about what stocks to buy now. For the most part,

growth stocks

could be a viable play despite the current volatility in the market. This would be the case as companies in this sector are focused on, well, growth. Notably, some of the best growth stocks in the market are more or less in highly competitive industries. As such, there would be no shortage of exciting news for investors to consider today.

For instance, we could look at the likes of tech firms like

Palantir

(

NYSE: PLTR

). Given the growing importance and use-cases for tech in our world today, the sector is home to many top growth stocks. Namely, PLTR stock is making waves in the stock market today thanks to the company’s latest contract. Yesterday, Palantir won an $823 million contract with the U.S. Army. Through this agreement, the company’s artificial intelligence (AI)-based platform, Gotham, will act as the operating system for “defense decision making”. This would mark yet another positive step for Palantir as its extensive partnership network with the government continues to grow.

At the same time, there would be a focus on companies in the electric vehicle (EV) market as well. In particular,

General Motors

(

NYSE: GM

) will be hosting its annual Investor Day today. This will likely see CEO Mary Barra and colleagues provide some insight into GM’s long-term plans. No doubt, growth stocks continue to live up to their namesakes regardless of the state of the stock market now. Could one of these top

growth stocks

be trading at discounts?

Best Growth Stocks To Buy [Or Sell] In October 2021

-

Nike Inc.

(

NYSE: NKE

) -

CrowdStrike Holdings

(

NASDAQ: CRWD

) -

Microsoft Corporation

(

NASDAQ: MSFT

) -

PayPal Holdings Inc.

(

NASDAQ: PYPL

)

Nike Inc.

To start things off, we have

Nike

, a growth company that boasts a very high brand loyalty. The company designs and manufactures footwear, apparel, equipment and accessories. In fact, it is one of the world’s largest suppliers of athletic shoes and apparel with revenue in excess of $37 billion for its fiscal year 2020. The company has headquarters in Oregon and employs over 70,000 people worldwide. NKE stock currently trades at $147.97 a piece as of 12:54 p.m. ET.

A recent survey of 10,000 U.S. teens released on Tuesday placed the company in the top spot among their favorite footwear and apparel brands. Furthermore, Wedbush analysts also revealed their optimism around the company, initiating coverage on 18 footwear and apparel stocks while giving Nike an outperform rating. Last month, the company also reported its fiscal 2022 first-quarter results. Accordingly, its revenues for the quarter were $12.2 billion, up by 16% compared to a year earlier. It also saw its Nike Brand digital sales increase by a cool 29%. Also, diluted earnings per share for the quarter was $1.16, a 22% increase year-over-year. All things considered, is NKE stock worth adding to your portfolio right now?

Read More

CrowdStrike Holdings Inc.

CrowdStrike

is a cybersecurity technology company with headquarters in California. It has essentially reinvented security for the cloud era and its CrowdStrike Falcon platform is built to detect threats and stop breaches. Also, its platform is the first multi-tenant, cloud-native, intelligent security solution that is capable of protecting workloads across on-premise, virtualized, and cloud-based environments running on a variety of endpoints such as laptops, desktops, and servers. CRWD stock currently trades at $248.85 as of 12:55 p.m. ET and is up by over 70% in the past year alone.

The company on Tuesday announced a partnership with

UiPath

(

NYSE: PATH

), a leading enterprise automation software company. The two companies will deliver a new level of security protection and visibility with the UiPath Robotic Process Automation (RPA) platform and the Falcon platform. Ultimately, the partnership will provide joint customers with fortified protection, a first-of-its-kind integration that has unparalleled coverage to defend against all types of attacks. This would include malware and sophisticated nation-state attacks. With this exciting piece of news, should investors consider CRWD stock a buy?

[Read More]

Best Lithium Battery Stocks To Buy Now? 4 To Know

Microsoft Corporation

Microsoft

is a multinational tech company that provides computer software, consumer electronics, and personal computers. Its Microsoft Windows line of operating systems is one of the most used in the world. The company is also one of the world’s largest software makers by revenue. Furthermore, its flagship hardware products are the Xbox video game consoles and the Microsoft Surface personal computers. MSFT stock currently trades at $289.21 as of 12:55 p.m. ET and has enjoyed gains of over 40% in the past year.

The company has officially released Windows 11 this week in its stable form worldwide and is free for existing Windows 10 users on compatible PCs. It has a wide number of new features for productivity and connecting with friends and families. It also allows its users to refocus their workflow with its new multi-tasking tools like Snap layouts and Desktops. With that being said, is MSFT stock a top growth stock to consider buying right now?

[Read More]

3 Top Pot Stocks To Watch After The SAFE Banking Act Update

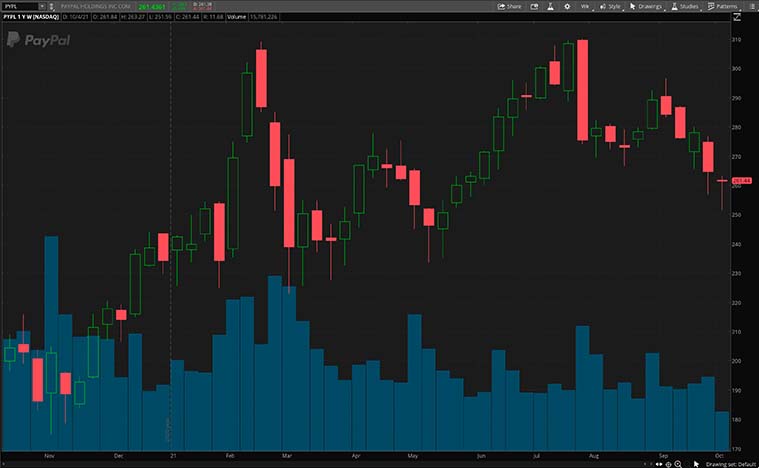

PayPal Holdings Inc.

Another company to note among growth stocks now would be

PayPal Holdings

. Overall, most would be familiar with the fintech giants’ offerings. As an industry leader, PayPal continues to cater to the financial service needs of consumers across the globe today. It has and continues to do so as the ongoing global pandemic drives demand for its services towards newer highs. For a sense of scale, PayPal caters to over 400 million consumers and merchants in over 200 global markets. According to its latest fiscal quarter report, this adds up to a whopping $311 billion in total payment volumes.

As it stands, PYPL stock currently trades at $261.17 a share as of 12:56 p.m. ET. This would be after gaining by over 180% since its pandemic era low. Even with these gains, the company does not seem to be slowing down anytime soon. As of yesterday, PayPal users now have access to cashback promotions via the company’s Honey service. For some context, Honey is an online shopping tool that helps users save money by automatically applying coupons at checkout. By and large, PayPal appears to be hard at work bolstering existing integrations between its services. Could this make PYPL stock a top buy for you?