General Motors

GM

recently announced that it will launch Canada’s first full-scale commercial electric vehicle (EV) manufacturing hub at its CAMI automotive assembly plant in Ingersoll, Ontario, with production scheduled to begin by the end of the year.

The EV production initiation at CAMI is part of the $2-billion investment that the company has pledged in Ontario, which also includes a plan to restart vehicle manufacturing at its assembly plant in Oshawa, which had been suspended in 2019.

To support GM in its Ingersoll and Oshawa efforts, and to facilitate research and development in the province, the Ontario and federal governments will each spend $259 million.

The efforts will ensure the production of a light-duty Chevy Silverado pickup at the company’s Oshawa plant. This will generate 2,600 new jobs since operations resumed at the plant.

The investment will empower the Ingersoll plant to become the company’s EV hub for its new all-electric commercial vehicle brand, BrightDrop, and will also function as the first full-scale EV production facility in Canada.

GM’s dedicated efforts are set to make North America a springboard for development and economic growth for the company.

GM’s big push toward EVs is noteworthy. It aims to introduce 30 new EV models by 2025, do away with tailpipe emissions from new light-duty vehicles by 2035 and become carbon neutral by 2040. Its key launches, including the GMC Hummer EV and Cadillac Lyriq crossover EV, are expected to buoy top-line growth. GM’s Factory ZERO and plants in Spring Hill and CAMI are setting the stage for the company’s electrification goals. GM’s Ultium Drive system is likely to scale up its e-mobility prowess. The BrightDrop venture, designed to offer an integrated ecosystem of electric first-to-last-mile products, is set to boost prospects. The launch of Ultium Charge 360, aimed at improving the charging experience, also bodes well. Besides the Ultium platform, which is set to rev up its electrification capabilities, GM’s Ultifi platform seeks to enable the firm to achieve leadership in software and services.

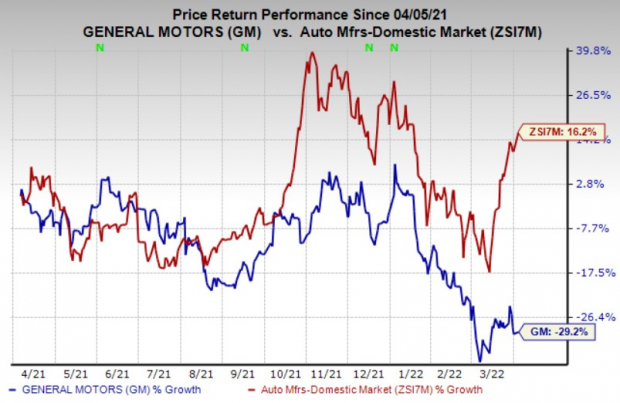

GM’s shares have lost 29.2% over the past year against the

industry

’s 16.2% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

GM currently has a Zacks Rank #3 (Hold).

Better-ranked players in the auto space include

Harley-Davidson

HOG

,

LCI Industries

LCII

and

Tesla

TSLA

, each sporting a Zacks Rank #1 (Strong Buy), currently. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Harley-Davidson has an expected earnings growth rate of 2.2% for the current year. The Zacks Consensus Estimate for its current-year earnings has been revised around 28.1% upward in the past 60 days.

Harley-Davison’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. HOG pulled off a trailing four-quarter earnings surprise of 77.6%, on average. The stock has declined 4.8% over the past year.

LCI Industries has an expected earnings growth rate of 26.7% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised around 15% upward in the past 60 days.

LCI Industries’ earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed the same in one. LCII pulled off a trailing four-quarter earnings surprise of 12.9%, on average. The stock has declined 21.7% over the past year.

Tesla has an expected earnings growth rate of 44% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised around 4.4% upward in the past 60 days.

Tesla’s earnings beat the Zacks Consensus Estimate in all of the trailing four quarters. TSLA pulled off a trailing four-quarter earnings surprise of 33.3%, on average. The stock has risen 65.7% over the past year.

Just Released: The Biggest Tech IPOs of 2022

For a limited time, Zacks is revealing the most anticipated tech IPOs expected to launch this year. Concerns about Federal interest rates and inflation caused many private companies to stay on the bench- leading to companies with better brand recognition and higher growth rates getting into the game. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity. See the complete list today.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report