General Motors

GM

is set to raise its stake in its autonomous vehicle (AV) arm Cruise. The auto giant recently announced plans of acquiring SoftBank Vision Fund 1’s equity ownership stake in Cruise for $2.1 billion. It will additionally invest $1.35 billion in Cruise, replacing a previous commitment made by the fund in 2018. GM had acquired a majority ownership stake in Cruise in 2016. Since then, its AV arm has made its reputation in self-driving cars and commercial autonomous ridesharing and delivery.

By leveraging its strong balance sheet, GM is capitalizing on the scope to increase its equity investment in Cruise. Moelis & Company LLC acted as financial advisor to GM.

The announcement follows the launch of Cruise’s limited driverless robot-taxi service to the public in San Francisco six weeks earlier. In turn, Softbank unlocked its previously committed $1.35 billion investment.

Last month Cruise became the first-ever company to offer fully driverless rides to the public in a major U.S. city, inching close to a more sustainable and accessible transportation future.

Meanwhile, in an attempt at retaining talent, Cruise has launched its Recurring Liquidity Opportunity Program, which aims to give employees the potential for long-term share price upside and flexibility around share liquidity without taking a step toward an IPO.

Under the program, current and former employees can sell any amount of their vested equity in each quarter which will be purchased by GM or others. The value is determined by a third-party financial firm that will gauge company performance, financial projections, market conditions, relevant transactions and fundraising events and market comps. It will help Cruise remain competitive in the talent market against both public and private companies as it sets out for its commercialization phase.

The Cruise Origin is a zero-emission, shared AV designed to operate without a human driver and harps on the need for sustainable driving.

It helps reduce dependency on oil and expand mobility options for seniors, the visually impaired and anybody challenged with access to transportation. GM is manufacturing the Origin in Michigan at Factory ZERO. This is also adding to the U.S. workforce.

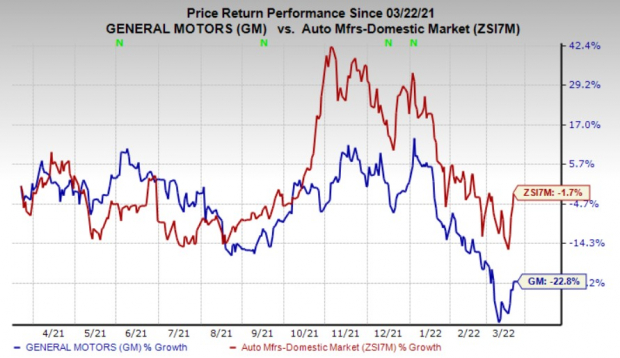

GM’s shares have lost 22.8% over the past year, underperforming the

industry

’s 1.7% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, GM has a Zacks Rank #3 (Hold).

Better-ranked players in the auto space include

Harley-Davidson

HOG

,

LCI Industries

LCII

and

Tesla

TSLA

, each sporting a Zacks Rank #1 (Strong Buy), currently. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Harley-Davidson has an expected earnings growth rate of 1.9% for the current year. The Zacks Consensus Estimate for its current-year earnings has been revised around 21.7% upward in the past 60 days.

Harley-Davison’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. HOG pulled off a trailing four-quarter earnings surprise of 77.59%, on average. The stock has rallied 14.4% over the past year.

LCI Industries has an expected earnings growth rate of 27.8% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised around 16% upward in the past 60 days.

LCI Industries’ earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed the same in the other one. LCII pulled off a trailing four-quarter earnings surprise of 12.86%, on average. The stock has declined 8.5% over the past year.

Tesla has an expected earnings growth rate of 40.7% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised around 14.3% upward in the past 60 days.

Tesla’s earnings beat the Zacks Consensus Estimate in all of the trailing four quarters. TSLA pulled off a trailing four-quarter earnings surprise of 33.26%, on average. The stock has rallied 35.1% over the past year.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $2.4 trillion by 2028 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Recommendations from previous editions of this report have produced gains of +205%, +258% and +477%. The stocks in this report could perform even better.

See these 7 breakthrough stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report