General Motors

GM

has announced that it will be putting the shutters down for its pickup truck factory in Ft Wayne, IND, for two weeks next month as the company is facing a severe shortage of computer chips.

The Wayne plant will remain closed between Apr 4 and Apr 11. At present, it is running on three shifts per day, manufacturing Chevrolet Silverados and GMC Sierra light-duty pickups. Since the plant employs more than 4,000 blue-collar workers, it is a matter of concern.

General Motors reported that all of its North American assembly plants have at least one shift running since Nov 1, 2021. Throughout this global crisis, GM has routed most of its semiconductor purchases to pickup trucks and large SUV factories as they qualify for GM’s most profitable vehicles.

Despite the grim situation, the automaker is optimistic that it can tide over the chip crisis. The scenario was expected to improve, but probable shortages of rare earth metals caused by the Russia-Ukraine war is an added worry. Uncertainty and unpredictability loom large in the semiconductor supply base, but GM is actively working to come up with measures.

The computer chip shortage that has been irking the auto and other industries for a long time has its roots in the pandemic in early 2020. As U.S. auto manufacturers had to halt production and close their factories to check the spread of the virus, and some parts companies had to cancel orders for semiconductors, the chip deficiency crept in and now threatens production even for major auto giants like GM.

With the pandemic forcing people to stay indoors, there was a demand surge for gaming consoles and gadgets with a high dependency on computer chips. Since electronic goods demand skyrocketed, the chip makers shifted their production base to these goods, thus creating a shortage of weather-resistant automotive-grade chips once auto production resumed.

The severe onslaught of the second wave of the pandemic that hit Asian countries like Malaysia further worsened the problem as chips are finished in these countries.

Analysts expect the chip shortage to tone down in the second half of this year, but not return to near-normal levels until 2023.

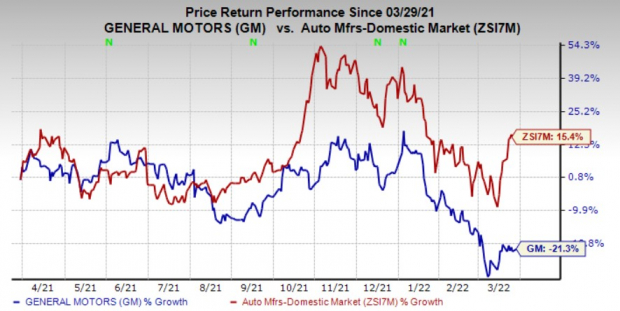

GM’s shares have lost 21.3% over the past year, against the

industry

’s 15.4% rise.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

GM currently has a Zacks Rank #3 (Hold).

Better-ranked players in the auto space include

Harley-Davidson

HOG

and

LCI Industries

LCII

, each sporting a Zacks Rank #1 (Strong Buy), and

Tesla

TSLA

, carrying a Zacks Rank #2 (Buy) currently. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Harley-Davidson has an expected earnings growth rate of 2.2% for the current year. The Zacks Consensus Estimate for its current-year earnings has been revised around 28.1% upward in the past 60 days.

Harley-Davison’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. HOG pulled off a trailing four-quarter earnings surprise of 77.6%, on average. The stock has gained 6.1% over the past year.

LCI Industries has an expected earnings growth rate of 27.8% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised around 16% upward in the past 60 days.

LCI Industries’ earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed the same in the other one. LCII pulled off a trailing four-quarter earnings surprise of 12.9%, on average. The stock has declined 18.6% over the past year.

Tesla has an expected earnings growth rate of 42% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised around 11.3% upward in the past 60 days.

Tesla’s earnings beat the Zacks Consensus Estimate in all of the trailing four quarters. TSLA pulled off a trailing four-quarter earnings surprise of 33.3%, on average. The stock has risen 74.6% over the past year.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report