Ford Motor Co.

F

recently signed a five-year deal with online payment processor, Stripe, to bolster its e-commerce strategy.

Per the agreement, Stripe will look after the transactions for consumer vehicle orders and reservations, as well as bundled financing options for Ford’s commercial customers. Ford also has plans to use Stripe to route a customer’s payment from its website to the correct local Ford or Lincoln dealer.

The companies have notified in a joint statement that the auto giant’s financial services arm, Ford Motor Credit Company, will utilize Stripe’s technology to process digital payments in markets across North America and Europe.

Ford expects to start rolling out Stripe’s technology in the second half of 2022, starting with North America. Later it intends to launch it in Europe.

Markedly, Stripe is the most valuable start-up in Silicon Valley, with a $95 billion valuation. The company sells software that facilitates digital payments. The firm earns its revenues by charging a small amount on each transaction it processes. Stripe has some major customers like Deliveroo, Shopify and Salesforce, but it faces intense competition from rival fintechs such as Adyen and Checkout.com. In that light, the deal with Ford undoubtedly counts for one of the biggest client wins for the digital wallet provider.

The collaboration with Stripe is part of Ford+ restructuring plan, which is an electrification and growth strategy where the company intends to invest $30 billion by 2025. The strategic decision is also in sync with the larger auto industry’s focus toward investing in technology that offers a high return on investment, benefiting the pandemic-affected industry, especially in the short run. As Ford and Lincoln are set to add a number of subscription services, the most recent one being Amazon’s Fire TV, it is a strategic move for the automaker to establish a robust digital payment platform.

Ford noted that the pandemic saw a boom in digital payment as more and more people opted for online transactions. So it focuses on carrying the momentum ahead by introducing digitalized payments offerings to its customers.

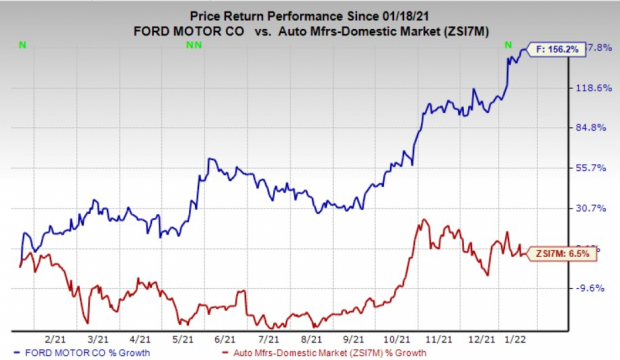

Ford was the best-performing auto stock in 2021. Last week, its market capitalization topped a whopping $100 billion for the first time. The company’s shares have soared 156.2% over the past year compared with the

industry

’s 6.5% rise. F’s estimated earnings growth rate for the current year is pegged at 4%.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Currently, Ford sports a Zacks Rank #1 (Strong Buy).

Other top-ranked players in the auto space include

Tesla

TSLA

, flaunting a Zacks Rank #1, and

Genuine Parts

GPC

,

Fox Factory Holdings

FOXF

, carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Tesla has an expected earnings growth rate of 32.7% for the current year. The Zacks Consensus Estimate for the current-year earnings has been revised around 5% upward over the past 60 days.

Tesla’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters. TSLA pulled off a trailing four-quarter earnings surprise of 25.38%, on average. The stock has also rallied 27% over a year.

Genuine Parts has an expected earnings growth rate of 11% for the current year. The Zacks Consensus Estimate for earnings for the current year has been revised around 2.2% upward over the past 60 days.

Genuine Parts’ earnings beat the Zacks Consensus Estimate in all the trailing four quarters. GPC pulled off a trailing four-quarter earnings surprise of 16%, on average. Its shares have gained 35.2% over a year.

Fox Factory has an expected earnings growth rate of 14% for the current year. The Zacks Consensus Estimate for the current year has been revised around 0.2% upward over the past 60 days.

Fox Factory’s bottom line beat the Zacks Consensus Estimate in all the trailing four quarters. FOXF delivered a trailing four-quarter earnings surprise of roughly 16%, on average. The stock has rallied 19.9% over a year.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report