Ford Motor

F

recently unveiled a slew of products that include a new generation of seven all-electric, fully-connected passenger vehicles to move toward an all-electric future in Europe. Additionally, the auto giant has multiple investments lined up to support its electrification drive and help it climb the leadership ladder.

Ford’s extended range of electric passenger and commercial vehicle models is anticipated to increase its annual sales of electric vehicles (EVs) in Europe by more than 600,000 units by 2026. It also intends to deliver a 6% EBIT margin in the continent in 2023. The expedition of efforts in Europe is in sync with its goal to sell more than 2 million EVs globally by 2026 and deliver an adjusted EBIT margin of 10%.

The announcement comes in the heels of the development of the company’s new global business unit – Ford Model e. It is focused on the design, production and distribution of electric and connected vehicles. Along with Ford’s commercial vehicle business, Ford Pro, the units have the potential to steer the company’s footprint in Europe.

All-New EV Line-Up & Cologne Investment

Riding on the successful launch of the all-electric Mach-E in 2021 and Mach-E GT this year, and the upcoming launch of the E-Transit in the next quarter, the three new passenger vehicles and four new commercial vehicles are set to join the Ford family.

Starting in 2023, Ford will begin producing an all-new electric passenger crossover vehicle built in Cologne, with a second electric vehicle to be added to the production line-up in 2024. An electric version of Ford’s top-selling passenger vehicle in Europe, the Ford Puma, made in Craiova, Romania, will be produced in 2024.

Notably, Ford targets to invest up to $2 billion in the Ford Cologne Electrification Centre facility for the development of new electrified passenger vehicles. The outlay also includes the establishment of a new battery assembly plant, which is scheduled to commence operations in 2024. The EV production at the facility is expected to increase to 1.2 million vehicles over a six-year timeframe.

As for the new electric commercial launches, Ford’s iconic commercial vehicle brand—Transit range— will include four new electric models – the all-new Transit Custom one-ton van and Tourneo Custom multi-purpose vehicle in 2023, and the smaller, next-generation Transit Courier van and Tourneo Courier multi-purpose vehicle in 2024.

The zero-emission vehicles promise to transform Ford’s brand value across Europe.

Joint Venture to Enhance Battery Production in Europe

Ford, SK On Co., Ltd. and Koç Holding have signed a non-binding memorandum of understanding for a new, industry-leading joint venture business in Turkey to aid Ford’s impressive electrification goals and create one of the largest EV battery facilities in the pan-European region.

Based near Ankara, the joint venture will manufacture high Nickel NMC cells used for battery array modules. Production is scheduled to begin as early as mid-decade and the annual capacity will be in the range of 30 to 45 Gigawatt hours.

Support from Turkey’s government and the joint efforts by the three companies will directly benefit large and small commercial vehicle operators across Europe, reducing energy and running costs and reducing carbon footprint.

Production Ramp Up at Craiova Plant

To boost electric and commercial vehicle capacity at the Craiova plant, Ford has announced that Ford Otosan, a joint venture between Ford and Koç Holding, will assume ownership of the plant and manufacturing business. Ford’s manufacturing plant in Craiova will play a significant role in the company’s electric and commercial vehicle growth plans in Europe.

From 2024 onward, European customers will get to purchase the all-electric version of the Ford Puma once it goes into production in Craiova. The production of the new Transit Courier and Tourneo Courier will start in Craiova from 2023, with all electric versions rolling out in 2024.

Last Words

These combined efforts will support F’s plans to reduce carbon emissions as it targets zero emissions for all vehicle sales in Europe and carbon neutrality across its European footprint of facilities, logistics and suppliers by 2035.

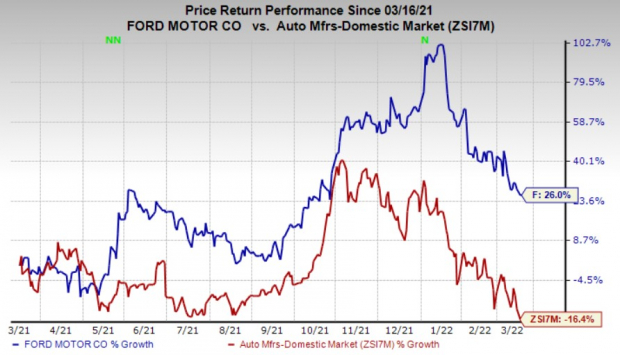

Ford’s shares have rallied 26% over the past year against the

industry

’s 16.4% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, F has a Zacks Rank #3 (Hold).

Better-ranked players in the auto space include

Harley-Davidson

HOG

,

LCI Industries

LCII

, both sporting a Zacks Rank #1 (Strong Buy), and

Tesla

TSLA

, carrying a Zacks Rank #2 (Buy), currently. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Harley-Davidson has an expected earnings growth rate of 1.9% for the current year. The Zacks Consensus Estimate for its current-year earnings has been revised around 21.7% upward in the past 60 days.

Harley-Davison’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. HOG pulled off a trailing four-quarter earnings surprise of 77.59%, on average. The stock has rallied 3.3% over the past year.

LCI Industries has an expected earnings growth rate of 27.8% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised around 16% upward in the past 60 days.

LCI Industries’ earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed the same in the other one. LCII pulled off a trailing four-quarter earnings surprise of 12.86%, on average. The stock has declined 20.4% over the past year.

Tesla has an expected earnings growth rate of 40.7% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised around 14.3% upward in the past 60 days.

Tesla’s earnings beat the Zacks Consensus Estimate in all of the trailing four quarters. TSLA pulled off a trailing four-quarter earnings surprise of 33.26%, on average. The stock has rallied 13.2% over the past year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report