All figures in Canadian dollars unless otherwise noted.

Highlights1:

- Net assets increase by $62.3 billion

- Net annual return of 8.0%

- 10-year net return of 9.2%

- Cumulative net income of $432.4 billion since inception in 1999

TORONTO, May 22, 2024 /CNW/ – Canada Pension Plan Investment Board (CPP Investments) ended its fiscal year on March 31, 2024, with net assets of $632.3 billion, compared to $570.0 billion at the end of fiscal 2023. The $62.3 billion increase in net assets consisted of $46.4 billion in net income and $15.9 billion in net transfers from the Canada Pension Plan (CPP).

The Fund, which includes the combination of the base CPP and additional CPP accounts, achieved a net return of 8.0% for the fiscal year. Since the CPP is designed to serve multiple generations of beneficiaries, evaluating the performance of CPP Investments over extended periods is more suitable than in single years. The Fund returned a 10-year annualized net return of 9.2%. Since its inception in 1999, CPP Investments has contributed $432.4 billion in cumulative net income to the Fund.

“The CPP Fund’s growth this year continued the trend of reaching heights several years ahead of initial actuarial projections,” said John Graham, President & CEO. “Solid performance by all of the investment departments and key corporate functions helps demonstrate how our strategy is on track.”

Annual results were positively impacted by strong public equity market performance, gains in our private equity portfolio, as well as investments in credit, infrastructure and energy. This was offset by overall weaker performance of emerging markets compared to developed markets and lower performance of real estate assets.

“Since the creation of CPP Investments 25 years ago, we have made a number of strategic decisions that have generated significant value above initial projections, with investment returns comprising more than two-thirds of total Fund assets to date,” added Graham. “As we head into our next quarter century, we are mindful of continuing geopolitical and economic uncertainties that may affect the investment environment, however, we have strong conviction that our people and our strategy will allow us to continue to deliver on our mandate for generations to come.”

Performance of the Base and Additional CPP Accounts

The base CPP account ended the fiscal year on March 31, 2024, with net assets of $593.8 billion, compared to $546.2 billion at the end of fiscal 2023. The $47.6 billion increase in net assets consisted of $44.4 billion in net income and $3.2 billion in net transfers from the CPP. The base CPP account achieved an 8.1% net return for the fiscal year and a five-year annualized net return of 7.8%.

The additional CPP account ended the fiscal year on March 31, 2024, with net assets of $38.5 billion, compared to $23.8 billion at the end of fiscal 2023. The $14.7 billion increase in net assets consisted of $2.0 billion in net income and $12.7 billion in net transfers from the CPP. The additional CPP account achieved a 5.7% net return for the fiscal year and a five-year annualized net return of 4.9%.

The additional CPP was designed with a different legislative funding target and contribution rate compared to the base CPP. Given the differences in their design, the additional CPP has had a different market risk target and investment profile since its inception in 2019. As a result of these differences, we expect the performance of the additional CPP to generally differ from that of the base CPP.

Furthermore, due to the differences in their net contribution profiles, the assets in the additional CPP account are also expected to grow at a much faster rate than those in the base CPP account.

|

CPP Investments Net Nominal Returns1 (For the year ended March 31, 2024) |

||

|

Base CPP |

Fiscal 2024 |

8.1 % |

|

Five-Year |

7.8 % |

|

|

10-Year |

9.2 % |

|

|

Additional CPP |

Fiscal 2024 |

5.7 % |

|

Five-Year |

4.9 % |

|

|

Since Inception |

5.6 % |

|

|

1After CPP Investments expenses. |

Long-Term Financial Sustainability

Every three years, the Office of the Chief Actuary of Canada, an independent federal body that provides checks and balances on the future costs of the CPP, evaluates the financial sustainability of the CPP over a long period. In the most recent triennial review published in December 2022, the Chief Actuary reaffirmed that, as at December 31, 2021, both the base and additional CPP continue to be sustainable over the long term at the legislated contribution rates.

The Chief Actuary’s projections are based on the assumption that, over the 75 years following 2021, the base CPP account will earn an average annual rate of return of 3.69% above the rate of Canadian consumer price inflation. The corresponding assumption is that the additional CPP account will earn an average annual real rate of return of 3.27%.

|

CPP Investments Net Real Returns1,2 (For the year ended March 31, 2024) |

||

|

Base CPP |

Fiscal 2024 |

5.1 % |

|

Five-Year |

4.3 % |

|

|

10-Year |

6.5 % |

|

|

Additional CPP |

Fiscal 2024 |

2.8 % |

|

Five-Year |

1.4 % |

|

|

Since Inception |

2.0 % |

|

|

1 After CPP Investments expenses. |

|

2 The real return is the return after the impact of inflation, defined as the Canadian Consumer Price Index, is taken into account. |

Relative Performance

The CPP is designed to serve today’s contributors and beneficiaries while looking ahead to future decades and across multiple generations. CPP Investments was created to invest and help grow the CPP Fund, maximizing returns without undue risk of loss.

CPP Investments expresses our risk targets through simple, two-asset class Reference Portfolios comprising a mix of Canadian governments’ bonds and global public equities (including Canada). The Reference Portfolios reflect the targeted level of market risk that we believe will maximize returns for each of the base CPP and additional CPP accounts, while also serving as a point of measurement when assessing the Fund’s performance over the long term. CPP Investments’ performance relative to the Reference Portfolios can be measured in percentage or dollar terms, after deducting all expenses.

On a relative basis, the aggregated Reference Portfolios’ return of 19.9% exceeded the Fund’s net return of 8.0% by 11.9%. As a result, in fiscal 2024, net value-added for the Fund was negative 11.9% or negative $64.1 billion. Over the five-year and 10-year periods, net value-added was negative 2.0% and negative 0.3%, respectively.

CPP Investments has deliberately and prudently constructed a portfolio that is significantly more diversified than the Reference Portfolios, by asset type, region and sector, and includes considerable weightings in private equity and real assets. This is designed to ensure portfolio resilience against the volatility that can impact net value-added – as experienced this year – and generate more consistent returns compared with a portfolio that is mainly exposed to public equity markets. In fiscal 2024, strong performance of the U.S. public equity market, led by technology stocks, was reflected in the performance of the Reference Portfolios.

For information on which of our decisions we believe are adding the most value, please refer to page 37 of the CPP Investments Fiscal 2024 Annual Report.

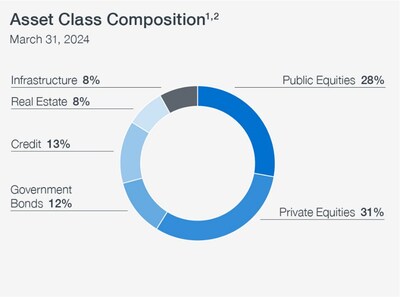

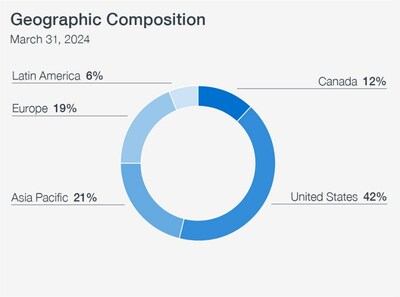

Asset Class and Geography Composition

CPP Investments, inclusive of both the base CPP and additional CPP Investment Portfolios, is diversified across asset classes and geographies.

|

1 Refer to page 69 of the Annual Report for a breakdown of the composition of each asset class. |

|

2 Credit consists of public and private credit investments, of which $59.8 billion forms part of the Active Portfolio and $19.5 billion forms part of the Balancing Portfolio as at March 31, 2024, both managed by the Credit Investments department. |

Performance by Asset Class and Geography

Five-year Fund returns by asset class and geography are reported in the tables below. In fiscal 2024, both emerging and developed markets contributed positively to our annual and five-year returns. A more detailed breakdown of performance by investment department is included on page 47 of the Fiscal 2024 Annual Report.

|

Annualized Net Returns by Asset Class |

|

|

Five years ended March 31, 2024 |

|

|

Public Equities |

8.4 % |

|

Private Equities |

13.9 % |

|

Government Bonds |

(0.3) % |

|

Credit |

3.8 % |

|

Real Estate |

0.7 % |

|

Infrastructure |

5.9 % |

|

Total Fund1 |

7.7 % |

|

Annualized Net Returns by Geography |

|

|

Five years ended March 31, 2024 |

|

|

Canada |

4.2 % |

|

United States |

8.9 % |

|

Europe |

4.0 % |

|

Asia Pacific |

4.6 % |

|

Latin America |

7.7 % |

|

Total Fund1 |

7.7 % |

|

1 The performance of certain investment activities is only reported in the total Fund return and not attributed to an asset class and/or geography return. Activities reported only within total Fund net returns include those from currency management activities, cash equivalents and money market securities investments, and absolute return strategies. For the geography-based presentation, total Fund net returns also include securities, such as swaps, forwards, options and pooled funds, that are without country of exposure classification. |

Managing CPP Investments Costs

Discipline in cost management is a main thrust of our public accountability as we continue to build an internationally competitive enterprise that seeks to create enduring value for multiple generations of beneficiaries of the CPP.

To generate $46.4 billion of net income, CPP Investments directly and indirectly incurred $1,617 million of operating expenses, $1,449 million in investment management fees and $2,067 million in performance fees paid to external managers, as well as $427 million of transaction-related expenses.

Operating expenses increased by $77 million due to inflationary pressure impacting salaries, employee benefits, and our technology infrastructure. Our operating expense ratio was 27.5 basis points (bps), which is below the five-year average of 28.3 bps and below the 28.6 bps in fiscal 2023.

Management fees decreased by $10 million, remaining broadly in line with the prior year. Performance fees increased by $302 million driven by more realization events in the private equity portfolio compared to the prior year.

Transaction-related expenses, which increased by $11 million, vary from year to year according to the number, size and complexity of our investing activities. Other categories affecting our total cost profile include taxes and expenses associated with various forms of leverage.

Page 26 of the Fiscal 2024 Annual Report provides a discussion of how we manage our costs. For a complete overview of CPP Investments combined expenses, including year-over-year comparisons, refer to page 45.

Operational Highlights for the Year

Corporate developments

- Ranked one of the world’s top-performing public pension funds by Global SWF when measuring annualized returns between fiscal years 2014 and 2023 (Global SWF Data Platform, May 2024).

- Issued a joint statement with Canada’s leading pension plan investment managers that calls on companies to embrace the new International Sustainability Standards Board disclosure framework. The new framework will help to improve trust and confidence in company disclosures about sustainability to inform investment decisions.

Board appointments

- Welcomed the designation of Dean Connor as Chairperson of the Board of Directors, effective October 27, 2023. Mr. Connor succeeded Dr. Heather Munroe-Blum, CPP Investments’ Chairperson since 2014, whose final term as Chairperson and Director expired in October. Mr. Connor has served on the Board since August 2021.

- Welcomed the appointment of Nadir Mohamed to the Board of Directors and the reappointments of Ashleigh Everett, John Montalbano, Mary Phibbs and Boon Sim as Directors of the Board for three-year terms effective October 2023.

Executive announcements

- Separated the roles of Chief Investment Officer (CIO) and Head of Total Fund Management to allow for more dynamic management of our portfolio, as well as balance sheet management and tactical positioning. CIO Edwin Cass now oversees all investment departments and Manroop Jhooty was appointed Senior Managing Director & Head of Total Fund Management, where he leads the balancing and financing portfolio, which is invested in global public securities, as well as balance sheet management, tactical positioning, trading and portfolio design.

Transaction Highlights for the Year

Active Equities

- Completed an investment in Inspira, one of Brazil’s leading private K-12 education providers, serving over 57,000 students across more than 100 schools, in a R$1 billion (C$270 million) investment round led by Advent International.

- Invested C$534 million in KPN, bringing our ownership stake to 2.9%. KPN is a leading telecommunications company in the Netherlands.

- Invested C$400 million in SK Hynix, a South Korean supplier of dynamic and flash memory chips, increasing our ownership stake to 0.4%.

- Invested an additional C$258 million in LY Corp., a Japanese holding company that owns and manages a portfolio of businesses including Yahoo! Japan, increasing our ownership stake to 3%.

- Invested C$435 million for a stake of approximately 1% in Evolution AB, a Sweden-based company that develops, produces, markets and licenses online casino solutions to gaming operators.

Credit Investments

- Committed US$325 million to TPG AG Essential Housing Fund III, which provides financing to U.S. single-family homebuilders for production-ready, fully entitled land.

- Formed a US$750 million strategic capital partnership with Redwood Trust, Inc., a publicly listed U.S. mortgage real estate investment trust. The partnership consists of a newly formed US$500 million Asset Joint Venture and a US$250 million corporate secured financing facility to Redwood Trust.

- Committed US$300 million to an India-based asset manager that focuses on structured and private credit opportunities in the country.

- Committed to provide up to US$138 million in financing to VoltaGrid LLC through a term loan. Based in the U.S., VoltaGrid is an energy management and generation company, which provides power, alternate fuels and emissions reduction solutions.

- Committed US$500 million to Quantum Capital Solutions Fund II, which will invest primarily in asset-level joint ventures and hybrid credit investments within the conventional energy sector in the U.S.

- Invested US$100 million in financing to support EQT’s acquisition of Zeus, a leading contract manufacturer in the medical devices industry based in the U.S.

- Invested £93 million in a debt facility to Vårgrønn, owner of a 20% stake in Dogger Bank Wind Farm, which is an offshore wind farm currently under construction, located off the coast of the U.K.

- Entered into a newly formed venture with Blackstone Real Estate Debt Strategies, Blackstone Real Estate Income Trust, Inc., and funds affiliated with Rialto Capital and acquired a 20% equity stake for US$1.2 billion in a venture that holds a US$16.8 billion senior commercial mortgage loan portfolio, primarily located in the New York metropolitan area.

- Invested A$300 million (C$268 million) in a first-lien term loan to TEG, a leading integrated live entertainment and ticketing service provider in Australia.

- Committed to invest C$197 million in financing to support CapVest Partners in its acquisition of Recochem. Headquartered in Canada, Recochem is a global manufacturer and distributor of aftermarket transportation and household fluids.

Private Equity

- Committed US$50 million to Sands Capital Life Sciences Pulse III. Based in the Washington D.C. area, Sands Capital Life Sciences Pulse III invests in growth-stage life sciences tools, diagnostics, and therapeutics companies primarily in the U.S.

- Invested US$30 million in Sogo Medical Group, a leading dispensing pharmacy chain and hospital services provider in Japan, alongside CVC Capital.

- Invested C$84 million for a minority stake in Plusgrade, alongside General Atlantic. Headquartered in Montreal, Canada, Plusgrade is a leading provider of ancillary revenue optimization solutions for the travel industry.

- Committed €100 million to Montagu VII SCSp, which focuses on Northern European mid-market buyouts in healthcare, critical data, financial services, digital infrastructure and education.

- Invested US$50 million in Zeus, alongside EQT. Based in the U.S., Zeus is a leading contract manufacturer in the medical devices industry.

- Invested US$27 million in HRBrain, a leading human resources software provider in Japan, alongside BPEA EQT Middle Market Growth Fund.

- Closed two commitments with Northleaf Capital Partners, a Toronto-headquartered global private markets investment firm: C$200 million to an evergreen separately managed account that provides access to the Canadian private equity market through mid-market buyout and growth funds, secondary investments and direct investments; and C$50 million to Northleaf Venture Catalyst Fund III, a Canada-focused venture capital fund that invests in Canadian venture capital and growth funds, secondary investments and direct investments.

- Committed €500 million to CVC Capital Partners IX, L.P., which focuses on control and shared-control buyouts across industries primarily in Europe and the Americas.

- Invested NZ$105 million (C$88 million) to acquire a 9.4% stake in Pushpay Holdings Ltd., a New Zealand-headquartered payments software provider for churches, alongside BGH Capital.

- Agreed to the partial realization of our investment in Visma, a leading provider of mission-critical cloud software in Europe, retaining an approximate 2% stake in the company. Net proceeds from the sale are expected to be approximately C$700 million. Our original investment was made in 2019.

- Completed the sale of Inmarsat, a European satellite service provider, to Viasat Inc., a U.S.-based global communications company, in which we now own an approximate 9% stake. Net cash proceeds from the sale were US$206 million.

Real Assets

- Established a new real estate investment and operating platform focused on purpose-built student accommodation (PBSA) in continental Europe through the acquisition of our joint venture partner’s minority stake in Round Hill European Student Accommodation Partnership and the full acquisition of Nido Living, a leading European PBSA operator and manager. Through these combined transactions, we are investing up to C$40 million in the platform.

- Invested INR 18.2 billion (C$297 million) in the units of National Highways Infra Trust (NHIT), an infrastructure investment trust sponsored by the National Highways Authority of India. We have invested INR 36.8 billion (C$614 million) in NHIT since 2021 and hold 25% of the units.

- Funded £380 million in total follow-on investments to Octopus Energy through the fiscal year to support the company’s continued global growth. Octopus Energy is a global clean energy technology pioneer based in the U.K. Our partnership was established in 2021 and we currently have a 12% ownership stake.

- Committed to acquire a 17.5% interest in Netco for up to €2.0 billion as part of the Optics BidCo investor group. Netco is an extensive telecommunications network in Italy. The transaction is expected to close in the summer of 2024.

- Increased our commitment to Boldyn Networks, a leading shared network infrastructure provider in the U.S. and globally, alongside partners AIMCo and Manulife, to support the company’s ongoing growth strategy, including the agreed acquisition of Apogee Telecom. We have committed approximately C$3.5 billion towards Boldyn Networks since 2009 and hold an 86% ownership stake.

- Invested an additional C$540 million in Interise Trust (formerly known as IndInfravit Trust), our Indian toll roads portfolio company, in which we now own a 60.8% stake, to help fund the acquisition of four operating road concessions. In fiscal Q4, we acquired a 50% stake in the Investment Manager of Interise Trust for C$8 million, alongside our partners, OMERS and ACP, who acquired 25% each.

- Signed a definitive agreement in support of the proposed merger between Aera Energy, one of California’s major energy producers, and California Resources Corporation, an independent energy and carbon management company in the U.S. Through this transaction, we will receive newly issued shares of common stock upon close of the transaction, expected to represent approximately 11.2% of the combined company.

- Announced a new partnership with Amsterdam-based Power2X, in which we plan to invest an initial €130 million to accelerate its growth as a development platform and fund green molecule projects. Power2X is a leading European green molecule developer and advisor focused on the decarbonization of industrial value chains.

- Invested C$1,438 million to acquire a 24.99% stake in FCC Servicios Medio Ambiente Holding, SAU, the environmental services division of Spanish conglomerate Fomento de Construcciones y Contratas, S.A. FCC Servicios Medio Ambiente is a leading waste management operator in Iberia, the U.K. and Central Europe, with a growing presence in the U.S.

- Sold our 45% stake in 1455 Market Street, an office building in San Francisco, California. Net proceeds from the sale were approximately US$44 million. Our original investment was made in 2015.

- Signed an agreement to sell our 45% stake in 10 East 53rd Street, an office building in Manhattan, New York. Net proceeds from the sale are expected to be approximately US$7 million. Our original investment was made in 2012.

- Sold three office properties in Houston, Texas, including the Phoenix Tower. Net proceeds from the sales were approximately US$62 million. Our original investments were made in 2017.

- Agreed to a restructure and sale of a 21% partial interest in the Kendall Square Development Venture (KDV I) in South Korea. Net proceeds from the sale will be approximately US$245 million. KDV I is a joint venture set up in 2015 alongside APG and ESR to develop modern logistics real estate assets in prime locations within major strategic logistics hubs in South Korea.

Transaction Highlights Following the Year-End

- Signed an agreement to sell Amitra Capital Limited, which specializes in managing European non-performing loans and real estate investments, to Arrow Global Group Limited. Established in 2019, we retain our current direct economic interest in all of the portfolios managed by Amitra Capital.

- Entered into a definitive agreement to jointly acquire ALLETE, Inc. alongside Global Infrastructure Partners for US$6.2 billion, including the assumption of debt. Headquartered in Duluth, Minnesota, ALLETE is focused on addressing the clean-energy transition by expanding renewables, reducing carbon, enhancing grid resiliency, and driving innovation.

- Committed US$450 million to Ontic, a provider of specialized parts and repair services for established aerospace technologies, headquartered in the U.K.

- Realized a partial interest of our stake in Viking Holdings for expected net proceeds of C$714 million through the company’s initial public offering. Viking Holdings is a global cruise operator and travel company. Our initial investment in the company was made in 2016 and we maintain a 15% stake.

- Committed US$100 million to Kedaara Capital Fund IV, which will focus on mid-market buyout and minority growth investments in India.

- Agreed to sell our ownership stake in Dorna Sports, an international sports management, media and marketing company, which holds the global rights to organize the MotoGP and WSBK Championships. Net proceeds from the transaction are expected to be approximately C$1.9 billion, of which approximately 75% is in cash and 25% in Series C Liberty Formula One tracking stock. Our original investment was made in 2013.

About CPP Investments

Canada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that manages the Fund in the best interest of the more than 22 million contributors and beneficiaries of the Canada Pension Plan. In order to build diversified portfolios of assets, investments are made around the world in public equities, private equities, real estate, infrastructure and fixed income. Headquartered in Toronto, with offices in Hong Kong, London, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At March 31, 2024, the Fund totalled $632.3 billion. For more information, please visit www.cppinvestments.com or follow us on LinkedIn, Instagram or on X @CPPInvestments.

Disclaimer

Certain statements included in this press release constitute “forward-looking information” within the meaning of Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and other applicable United States safe harbors. All such forward-looking statements are made and disclosed in reliance upon the safe harbor provisions of applicable United States securities laws. Forward-looking information and statements include all information and statements regarding CPP Investments’ intentions, plans, expectations, beliefs, objectives, future performance, and strategy, as well as any other information or statements that relate to future events or circumstances and which do not directly and exclusively relate to historical facts. Forward-looking information and statements often but not always use words such as “trend,” “potential,” “opportunity,” “believe,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may” and similar expressions. The forward-looking information and statements are not historical facts but reflect CPP Investments’ current expectations regarding future results or events. The forward-looking information and statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations, including available investment income, intended acquisitions, regulatory and other approvals and general investment conditions. Although CPP Investments believes that the assumptions inherent in the forward-looking information and statements are reasonable, such statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. CPP Investments does not undertake to publicly update such statements to reflect new information, future events, and changes in circumstances or for any other reason. The information contained on CPP Investments’ website, LinkedIn, Facebook and Twitter are not a part of this press release. CPP INVESTMENTS, INVESTISSEMENTS RPC, Canada Pension Plan Investment Board, L’OFFICE D’INVESTISSEMENT DU RPC, CPPIB and other names, phrases, logos, icons, graphics, images, designs or other content used throughout the press release may be trade names, registered trademarks, unregistered trademarks, or other intellectual property of Canada Pension Plan Investment Board, and are used by Canada Pension Plan Investment Board and/or its affiliates under license. All rights reserved.

|

______________________________ |

|

1 Certain figures may not add up due to rounding |

SOURCE Canada Pension Plan Investment Board

Featured image: Megapixl © Lovelyday12