As inflation continues to bite, more and more automakers are being forced to hike the prices of their models on soaring costs of commodity parts, technology, raw materials and logistics of late. Last week, electric vehicle (EV) behemoth

Tesla

TSLA

raised prices across its lineup, with Model X up by $6,000. U.S. legacy automaker

General Motors

GM

also hiked the price of its already expensive GMC Hummer EV pickup or SUV.

China EV company,

NIO Inc.

NIO

made headlines with the launch of its much-awaited ES7 SUV. EV charging company

Blink Charging

BLNK

signed an agreement to acquire SemaConnect in a bid to boost its charging network. The buyout allows Blink to capitalize on the Biden administration’s $7.5 billion EV infrastructure bill to establish a network of 500,000 EV chargers along U.S. highways and communities. Finally,

Electric Last Mile Solutions

ELMS

filed for bankruptcy just a year after going public.

Last Week’s Top Stories

1.

Tesla

yet again raised prices for all its car models in the United States last week. The EV leader has increased the prices of its luxury EVs multiple times this year, including a significant hike twice in the same week of March. It also issued a comparatively smaller increase on certain Model 3s in April. In the face of the ongoing global supply-chain problems and escalating raw material costs, Tesla again hiked prices across its lineup. Here’s a summary of the latest price increases.

The price of Model X was increased from $114,990 to $120,990, but the Model X Plaid, priced at $138,990, has not yet been affected. Tesla Model S saw a price increase from $99,990 to $104,990. Like Model X, Plaid’s price will remain the same at $135,990. Both versions of the automaker’s most popular Model Y increased. The Long Range went from $62,990 to $65,990 and the price of Performance jumped from $67,990 to $69,990. The price of Model 3 was increased from $54,490 to $57,990.

2.

General Motors

announced a price hike for all new reservations of its already expensive GMC Hummer EV pickup or SUV placed on or after Jun 18. Prices will see an increase of $6,250 to the base manufacturer’s suggested retail price (MSRP). However, the company noted that all existing Hummer EV reservations, regardless of trim or model, placed before Jun 18 will see no price increase.

As for the new reservations placed after Jun 18, the automaker says that final pricing is determined based on selected options and packages, “as well as the price the customer and dealership agree upon at the time of vehicle ordering.” The 3X trim level has a starting MSRP of $99,995, but the base price for new reservations placed after Jun 18 will be raised to $106,245. GM, however, is of the view that given the Hummer EV’s clientele and initial high price point, the latest hike will likely not be an issue for the vehicle’s affluent customers. More and more automakers are being forced to hike prices on soaring costs of commodity parts, technology, raw materials and logistics.

3.

Blink

inked a $200 million cash-and-stock deal to acquire SemaConnect. Maryland-based SemaConnect is one of the leading providers of EV charging infrastructure solutions in North America. SemaConnect CEO Mahi Reddy is set to join Blink’s board of directors after the closure of the acquisition, subject to the fulfillment of customary closing conditions.

This transformative deal would enable Blink to gain full control over its supply chain. It would become the only EV charging firm providing 100% vertical integration, ranging from research and development, hardware design and manufacturing to EV charger ownership and operations. The buyout is expected to add close to 13,000 EV chargers, 3,800 site host locations and more than 150,000 registered EV driver members to Blink’s existing network. The acquisition of SemaConnect will also speed up Blink’s expansion into markets like California.

4.

Electric Last Mile

plans to file for bankruptcy just a year after going public. It is the first among a line of special purpose acquisition company (SPAC) electric vehicle (EV) players to run into trouble and go out of business.Electric Last Mile Solutions went public in June 2021 through a merger valued at $1.4 billion with Forum Merger III. However, it has been under the scrutiny of the U.S. Securities and Exchange Commission (“SEC”) since March. Last week, ELMS announced its intention to liquidate through a Chapter 7 bankruptcy process.

Electric Last Mile stated that it has faced a number of obstacles, and it became difficult for it to steer clear of those within a short span. The bankruptcy announcement comes three weeks after the Electric Last Mile had flagged that it was in danger of running out of cash. Some of the company’s top brass resigned in February when it came to light that they had purchased equity in the company at substantial discounts before its merger. The SEC investigation that followed thereafter sent its shares plummeting below $1. The company was forced to lay off nearly a quarter of its workforce. Last month, the firm disclosed it ran the risk of being delisted over delays in filing its 2021 annual and first-quarter 2022 financial reports.

3.

NIO

launched its much-awaited ES7 SUV, the deliveries of which are expected to commence on Aug 28. The newest SUV, available for pre-order in China on the company’s app, will be equipped with NIO’s latest EV technology. The ES7 has a range of premium features besides a 75kWh Standard Range Battery and 150 kWh Ultralong Range Battery. It will identify as NIO’s fastest SUV to date with one of the first certified passenger vehicles in China with the ability to tow a caravan or a trailer. Not only can the vehicle supply power to towed equipment but also support vehicle-to-load discharging and “Camping Mode” to power outside devices.

NIO has released the starting prices, exclusive of subsidies, for the ES7 in China. The Standard 75 kWh battery will come at a price of RMB 468,000 ($69,700). The Ultralong 100 kWh battery will cost RMB 526,000 ($78,350). The ES7 Premier Edition will be priced 548,000 ($81,600). Customers who choose battery-as-a-service (BaaS) will have to pay a pre-subsidy price, starting at RMB 398,000 ($51,800).

NIO currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price Performance

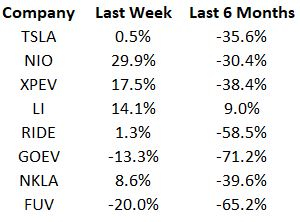

The following table shows the price movement of some of the major EV players over the last week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Space?

Stay tuned for announcements of upcoming EV models and any important updates from the red-hot industry.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report