Alternative energy is not a new or inexperienced industry anymore. It has helped to produce some of the world’s most reliable leaders who have dedicated their lives to making alternative energy a feasible energy choice. Additionally, investors have numerous stocks to choose from for alternative energy investing, and most of these stocks are showing palpable opportunities for growth.

With new advancements appearing daily, the technology linked to alternative energy is constantly changing. New developments in the sector have sent alternative energy in the right direction, however, it has also created unpredictability. Companies are being forced to adjust their business norms to the new way of creating energy as well as the new ways of energy investing. Like anything, when an environment is constantly changing, it is not hard to get lost in the process.

Here is a brief overview of the top four alternative energy companies in the world. This might be an unpredictable sector, but these four companies still offer investors that are interested in alternative energy investing some level of stability. Additionally, these world leaders profit from the increasing global demand for sustainable energy.

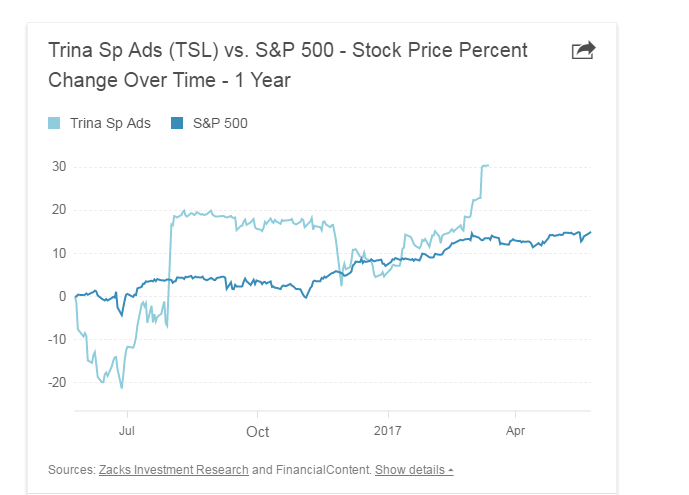

1. Trina Solar Limited ($TSL)

Despite the company operating in Europe, the Asia-Pacific area, and the United States, Trina Solar Limited is a Chinese alternative energy company. Considered to be an important leader in solar energy, Trina focuses primarily on residential and industrial solar power. Additionally, the company sells its products to power plants.

It is important to note that the stock has experienced significant drops in the past, so investors need to make sure that they choose their entry points (the price that an investor buys an investment) carefully.

- Average Volume amounts to 1,596,778

- Market Capitalization is $1.08 billion

- Price-to-earnings ratio is 8.68

- Earnings per share is 1.33

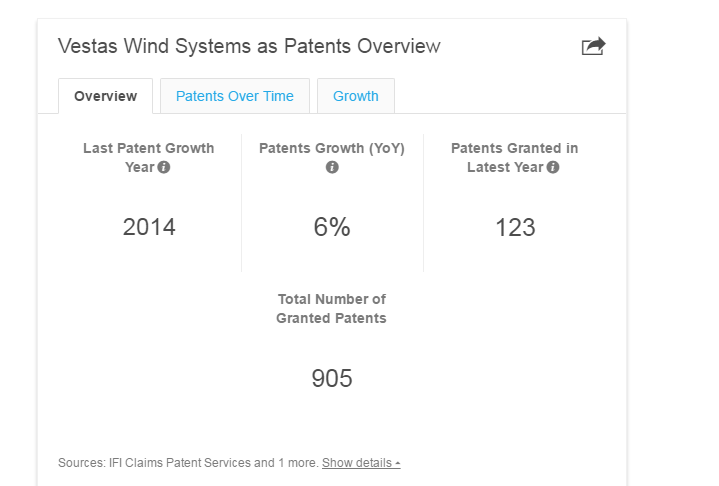

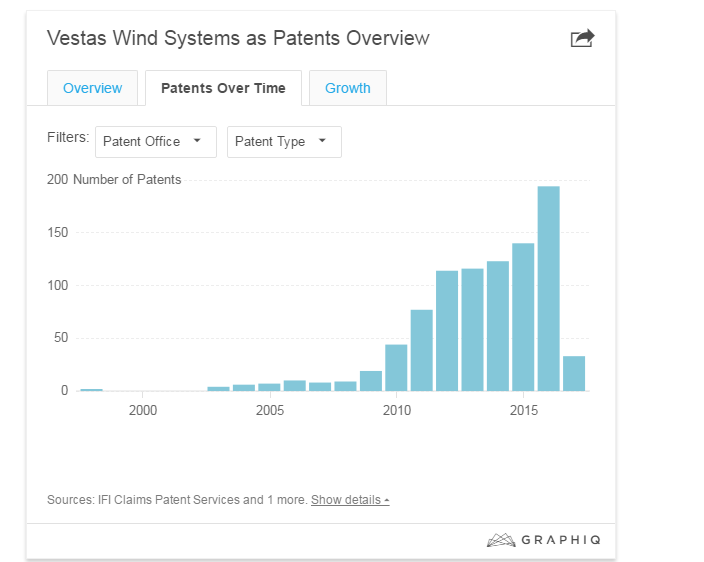

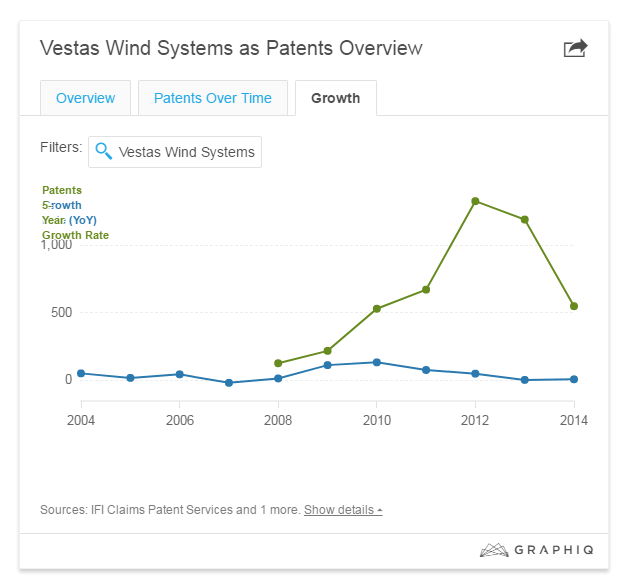

2. Vestas Wind Systems A/S (CPH:$VWS)

Holding the largest market share of turbines in the world, Vestas makes it living selling wind turbines across the globe. In addition, the company also sells power plants, individual wind turbines, and it services its products.

Headquartered in Denmark and dating back to 1898, Vestas also operates in countries such as Germany, India, China, the United States, Romania, the United Kingdom, Australia, and Norway, with the number of employees surpassing 21,000.

- Average Volume is 4,034

- Market Capitalization is $17.51 billion

- Price-to-earnings ratio is 18.91

- Earnings per share is 4.39

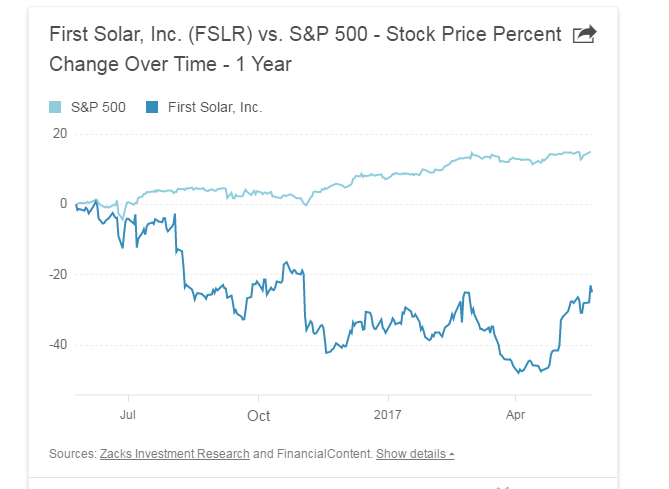

3. First Solar, Inc. (NASDAQ:$FSLR)

Known for creating low-cost solar converters which help to make electricity more efficient to produce, First Solar is an international alternative energy investing company. The firm’s main focus is to develop solar projects for utilities, power companies, and commercial entities. Additionally, First Solar creates solar modules for the solar sector and provides construction, engineering, and service for their solar systems.

For those interested in alternative energy investing, keep in mind that this stock can be quite unpredictable at times, therefore, it is for investors who believe that solar can challenge traditional institutions that produce energy.

- Average Volume is 1,072,733

- Market Capitalization is $3.89 billion

- Price-to-earnings ratio is -10.72

- Earnings per share is -3.48

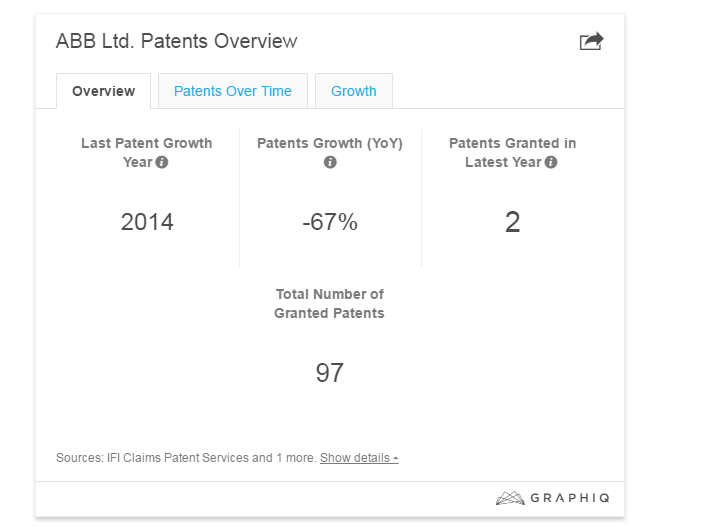

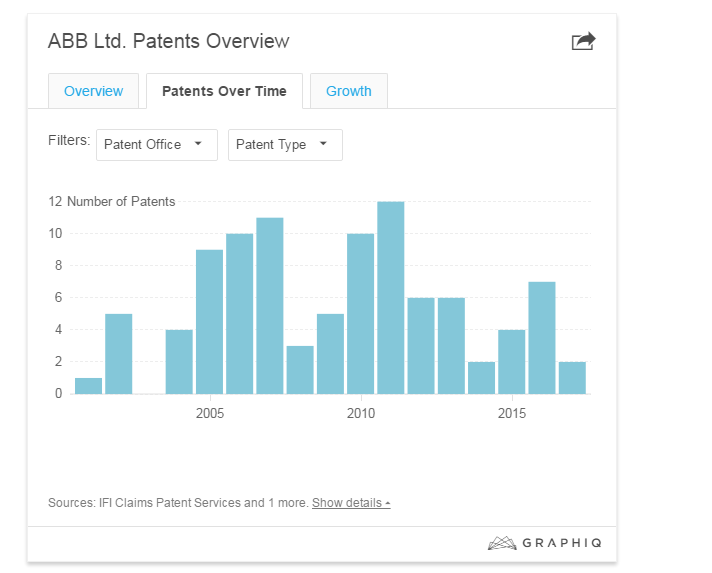

4. ABB Ltd (NYSE:$ABB)

Working alongside railroads, utilities, transportation companies and industrial plants, this company administers wind conversion, solar conversion, and electric vehicle quick-charge systems. In addition, ABB provides motors, robotics, and generators.

For those wanting a foundation in both alternative energy and traditional electrical services, ABB might be an attractive route for you. Known as one of the top electrical engineering firms in the world, ABB operates in 100 countries. One specialization of ABB is to connect alternative energy to the electrical grid.

- Average Volume is 2,189,911

- Market Capitalization is $53.86 billion

- Price-to-earnings ratio is 25.12

- Earnings per share is 0.99

What You Should Take Away

Despite there being an increased amount of unpredictability in this industry, it is important for investors to recognize that alternative energy investing has tremendous potential to produce strong returns. The alternative energy companies on this list are companies with solid track records, therefore, if you are interested in alternative energy, you might want to think about investing in one of the four mentioned.

Featured Image: depositphotos/3dmentat