- Upfront consideration of $25.53 million and contingent consideration of $16.31 million – SolarBank’s existing share ownership of SFF excluded

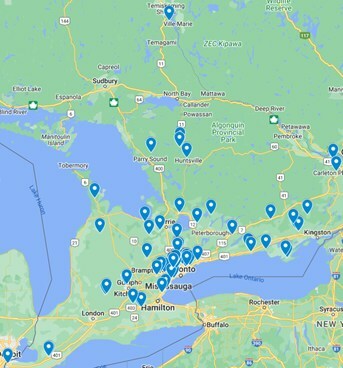

- Solar Flow-Through (“SFF”) owns a total of 70 operating solar sites located in Ontario with a combined capacity of 28.8 megawatts (“MW”) operating under long term contracts with the Ontario IESO

- SFF also owns and is constructing three battery energy storage system projects in Ontario with an aggregate discharge capacity of 14.97 MW and are expected to operate under long term guaranteed capacity contracts from the Ontario IESO

- SFF and SolarBank will have a combined capacity of approximately 47 MW, including SolarBank’s independent power producer (“IPP”) assets

- Addition of recurring revenue from existing IPP assets: $9.2 million for SFF calendar year 2023; $9.4 million for SFF calendar year 2022.

- Voting support agreements received from SFF directors, officers and shareholders holding an aggregate of 71% of SFF’s issued and outstanding common shares

TORONTO, March 20, 2024 /CNW/ – SolarBank Corporation (Cboe CA: SUNN) (OTC:SUUNF) (FSE: GY2) (“SolarBank” or the “Company”) is pleased to announce today that it has entered into a definitive agreement (the “Agreement“) with Solar Flow-Through Funds Ltd. (“SFF” or “Solar Flow-Through“) to acquire all of the issued and outstanding common shares of SFF through a plan of arrangement for an aggregate consideration of up to $41.8 million in an all stock deal (the “Transaction“). The Transaction values SFF at up to $45 million but the consideration payable excludes the common shares of SFF currently held by SolarBank.

Under the terms of the Transaction, SolarBank has agreed to issue up to 5,859,567 common shares of SolarBank (“SolarBank Shares“) for an aggregate purchase price of up to $41.8 million, representing $4.50 per SFF common share acquired. The number of SolarBank Shares was determined using a 90 trading day volume weighted average trading price as of the date of the Agreement which is equal to $7.14 (the “Agreement Date VWAP“). The Transaction represents a 7% premium to a valuation report prepared by Evans & Evans, Inc. on SFF and its assets. Through the Transaction, SolarBank will acquire SFF’s 70 operating solar power sites, along with its pipeline of battery energy storage projects (“BESS“) and electric vehicle charging stations.

The consideration for the Transaction consists of an upfront payment of approximately 3,575,638 SolarBank Shares (Cdn$25.53 million) and a contingent payment representing up to an additional 2,283,929 SolarBank Shares (Cdn$16.31 million) that will be issued in the form of contingent value rights (“CVRs“). The SolarBank Shares underlying the CVRs will be issued once the final contract pricing terms have been determined between SFF, the Ontario Independent Electricity System Operator (“IESO“) and the major suppliers for the SFF BESS portfolio and the binding terms of the debt financing for the BESS portfolio have been agreed (the “CVR Conditions“). On satisfaction of the CVR Conditions, Evans & Evans, Inc. shall revalue the BESS portfolio and SolarBank shall then issue SolarBank Shares having an aggregate value that is equal to the lesser of (i) Cdn$16.31 million and (ii) the final valuation of the BESS portfolio determined by Evans & Evans, Inc. plus the sale proceeds of any portion of the BESS portfolio that may be sold, in either case divided by the Agreement Date VWAP. The maximum number of additional shares issued for the CVRs will be 2,283,929 SolarBank Shares.

- Continues SolarBank’s strategy of creating value for all stakeholders by growing its portfolio of cash generating independent power producer assets.

- 28.8 MW of long life assets that have favorable feed in tariff rates into the 2030s.

- Expansion into ownership of battery energy storage projects (14.97 MW) and electric vehicle charging stations – both key components of the net zero energy transition.

- All stock transaction preserves cash for continued funding of the Company’s development pipeline.

Dr. Richard Lu, President & CEO of SolarBank commented: “This acquisition advances our strategy of creating stakeholder value through growing our portfolio of high-quality cash-generating independent power producer assets. SolarBank was actively involved in the construction of many of Solar Flow-Through’s projects and knows the assets well. They all have long term government power purchase agreements at favorable rates that continue into the next decade.”

Matthew Wayrynen, CEO of Solar Flow-Through commented: “Solar Flow-Through has been working closely with SolarBank for over a decade now. We look forward to aligning our efforts toward a shared mission of expanding and diversifying the SolarBank portfolio, increasing long-term shareholder value and contributing to a sustainable future. We would like to thank the investors of Solar Flow-Through for their support throughout this process and entrusting Solar Flow-Through and SolarBank’s management and board to guide the growth of the portfolio moving forward.”

The Transaction will be carried out by way of a court-approved plan of arrangement under the Business Corporations Act (British Columbia) and will require approval at a special meeting expected to be held in April, 2024 (the “SFF Meeting“) by: (i) 66 2/3% of the votes cast by SFF common shareholders and 66 2/3% of votes cast by holders of SFF tracking shares (the “SFF Tracking Shares“) present in person or represented by proxy, voting together as a single class; (ii) 66 2/3% of the votes cast by SFF common shareholders present in person or represented by proxy, voting together as a separate class; and (iii) 66 2/3% of the votes cast by holders of SFF Tracking Shares present in person or represented by proxy, voting together as one separate class.

There are three classes of SFF Tracking Shares. Each class of SFF Tracking Shares is linked to a separate lawsuit where SFF is plaintiff seeking to recover damages for the termination of certain solar power project development contracts. If the lawsuit that is linked to a class of SFF Tracking Shares is successful, the shareholder of such SFF Tracking Shares will have the option to receive its pro-rata share of the net settlement award or to convert such amount into common shares of SFF, which assuming the closing of the Transaction, would instead convert into SolarBank Shares.

Under the terms of the Transaction, SFF shareholders will receive consideration of (i) $25.53 million, representing approximately $2.75 per SFF common share or 0.3845938 of a SolarBank Share for every SFF common share; and (ii) up to $16.31 million in CVRs that may, on satisfaction of the CVR Conditions, be exchanged for SolarBank Shares representing up to approximately $1.75 per SFF common share or up to 0.2456582 of a SolarBank Share for every SFF common share.

Prior to the SFF Meeting, the Company will convert $4.7 million of a receivable that is due from SFF to the Company into 663,403 SFF common shares for the purpose of voting such shares in favor of the Transaction at the SFF Meeting. If the Agreement is terminated, then the Company shall have the option exercisable to return the SFF common shares to SFF for cancellation and thereafter the receivable shall again be due and owing by SFF to the Company. After conversion of the receivable SolarBank will hold 1,366,223 SFF common shares of a total of 10,663,403 SFF common shares.

All SolarBank Shares issued in the Transaction, including SolarBank Shares issued on conversion of the CVRs or SFF Tracking Shares, if any, will be subject to transfer restrictions pursuant to a release schedule as set forth in the table below:

|

Release Date |

Percentage |

|

Closing |

0 % |

|

6 Months from Closing |

5 % |

|

12 Months from Closing |

5 % |

|

18 Months from Closing |

5 % |

|

24 Months from Closing |

5 % |

|

27 Months from Closing |

20 % |

|

30 Months from Closing |

20 % |

|

33 Months from Closing |

20 % |

|

36 Months from Closing |

20 % |

The Board of Directors of SolarBank have unanimously approved the Transaction. The Board of Directors of SFF have unanimously approved the Transaction, with SFF directors recommending that SFF shareholders vote in favour of the Transaction.

Evans & Evans, Inc. has provided a fairness opinion to the Board of Directors of SFF stating that, as of the date of such opinion, and based upon and subject to the assumptions, limitations and qualifications stated in such opinion, the consideration to be received by SFF shareholders under the Transaction is fair, from a financial point of view, to SFF shareholders.

Each of the directors and senior officers of SFF, and certain shareholders of SFF, representing in aggregate approximately 71% of the issued and outstanding SFF common shares, have entered into voting support agreements with SolarBank and have agreed to vote in favour of the Transaction at the SFF Meeting.

In addition to SFF shareholder approval, the Transaction is subject to normal course regulatory approvals and the satisfaction of customary closing conditions. Subject to the satisfaction of these conditions, SolarBank expects that the Transaction will be completed during the second calendar quarter of 2024.

SolarBank and SFF have provided representations and warranties customary for a transaction of this nature and SFF has provided customary interim period covenants regarding the operation of its business in the ordinary course. The Agreement also provides for customary deal-protection measures, including non-solicitation covenants on the part of SFF and a right to match in favour of SolarBank. SFF may, under certain circumstances, terminate the Agreement in favour of an unsolicited superior proposal, subject to a termination payment by SFF to SolarBank.

On closing of the Transaction, Mr. Matthew Wayrynen, the current CEO of SFF, will join the Board of Directors of the Company and Mr. Olen Aasen will step down as board member but remain as General Counsel to the Company.

The Company will pay an advisory fee in connection with the closing of the Transaction.

Further information regarding the Transaction will be contained in an information circular that SFF will prepare and mail in due course to its shareholders in connection with the SFF Meeting.

Details regarding these and other terms of the Transaction are set out in the Agreement, which will be available on SEDAR+ at www.sedarplus.com.

None of the securities to be issued pursuant to the Agreement have been or will be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws, and any securities issued in connection with the Transaction are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Sections 3(a)(9) and 3(a)(10) of the U.S. Securities Act, as applicable, and applicable exemptions under state securities laws. This news release does not constitute an offer to sell or the solicitation of an offer to buy any securities.

SolarBank Corporation is an independent renewable and clean energy project developer and owner focusing on distributed and community solar projects in Canada and the USA. The Company develops solar projects that sell electricity to utilities, commercial, industrial, municipal and residential off-takers. The Company maximizes returns via a diverse portfolio of projects across multiple leading solar markets including projects with utilities, host off-takers, community solar, and virtual net metering projects. The Company has a potential development pipeline of over one gigawatt and has developed renewable and clean energy projects with a combined capacity of over 70 megawatts built. To learn more about SolarBank, please visit www.solarbankcorp.com.

This news release contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation (collectively, “forward-looking statements“) that relate to the Company’s current expectations and views of future events. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as “will likely result”, “are expected to”, “expects”, “will continue”, “is anticipated”, “anticipates”, “believes”, “estimated”, “intends”, “plans”, “forecast”, ”projection”, “strategy”, “objective” and “outlook”) are not historical facts and may be forward-looking statements and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in such forward-looking statements. In particular and without limitation, this news release contains forward-looking statements pertaining to: the parties completing the Transaction in accordance with, and on the timeline contemplated by, the terms and conditions of the relevant agreements, on a basis consistent with our expectations; the settlement of terms of the debt financing for the BESS portfolio, and such financing proceeding; the conversion of the receivable owed by SFF to SolarBank into SFF common shares and the effect and intended benefit of such conversion; expected changes in the composition of the Board of Directors of SolarBank post-Closing; the holding of the SFF shareholder meeting on the timeline contemplated in this press release, if at all, and the meeting materials to be sent to SFF shareholders in connection with such meeting; the availability and expected reliance on certain exemptions from U.S. securities laws in connection with the Transaction; the accuracy of management’s assessment of the effects and benefits of the successful completion of the proposed Transaction, including the value creation for the Company’s stakeholders; the continuation of favorable feed in tariff rates into the 2030s and government power purchase agreements at favourable rates into the next decade, if at all; the Company’s expectations regarding its industry trends and overall market growth; the Company’s growth strategies; the expected energy production from the projects mentioned in this press release; and the development pipeline, including the Company’s continued funding thereof. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon. These statements speak only as of the date of this news release.

Forward-looking statements are based on certain assumptions and analyses made by the Company in light of the experience and perception of historical trends, current conditions and expected future developments and other factors it believes are appropriate, and are subject to risks and uncertainties. In making the forward looking statements included in this news release, the Company has made various material assumptions, including but not limited to: assumptions regarding the combined company following completion of the Transaction; completion of the Transaction, including receipt of required shareholder, regulatory and court approvals; obtaining the necessary regulatory approvals for the Company’s other projects; that regulatory requirements will be maintained; general business and economic conditions; the Company’s ability to successfully execute its plans and intentions; the availability of financing on reasonable terms; the Company’s ability to attract and retain skilled staff; market competition; the products and services offered by the Company’s competitors; that the Company’s current good relationships with its service providers and other third parties will be maintained; and government subsidies and funding for renewable energy will continue as currently contemplated. Although the Company believes that the assumptions underlying these statements are reasonable, they may prove to be incorrect, and the Company cannot assure that actual results will be consistent with these forward-looking statements. Given these risks, uncertainties and assumptions, investors should not place undue reliance on these forward-looking statements.

Whether actual results, performance or achievements will conform to the Company’s expectations and predictions is subject to a number of known and unknown risks, uncertainties, assumptions and other factors, including those listed under “Forward-Looking Statements” and “Risk Factors” in the Company’s Annual Information Form for the most recently completed financial year, and other public filings of the Company, which include: the failure to obtain shareholder, regulatory or court approvals in connection with the Transaction; risks related to the successful integration of acquisitions; the Company may be adversely affected by volatile solar power market and industry conditions; the execution of the Company’s growth strategy depends upon the continued availability of third-party financing arrangements; the Company’s future success depends partly on its ability to expand the pipeline of its energy business in several key markets; governments may revise, reduce or eliminate incentives and policy support schemes for solar and battery storage power; general global economic conditions may have an adverse impact on our operating performance and results of operations; the Company’s project development and construction activities may not be successful; developing and operating solar projects exposes the Company to various risks; the Company faces a number of risks involving Power Purchase Agreements and project-level financing arrangements; any changes to the laws, regulations and policies that the Company is subject to may present technical, regulatory and economic barriers to the purchase and use of solar power; the markets in which the Company competes are highly competitive and evolving quickly; an anti-circumvention investigation could adversely affect the Company by potentially raising the prices of key supplies for the construction of solar power projects; foreign exchange rate fluctuations; a change in the Company’s effective tax rate can have a significant adverse impact on its business; seasonal variations in demand linked to construction cycles and weather conditions may influence the Company’s results of operations; the Company may be unable to generate sufficient cash flows or have access to external financing; the Company may incur substantial additional indebtedness in the future; the Company is subject to risks from supply chain issues; risks related to inflation; unexpected warranty expenses that may not be adequately covered by the Company’s insurance policies; if the Company is unable to attract and retain key personnel, it may not be able to compete effectively in the renewable energy market; there are a limited number of purchasers of utility-scale quantities of electricity; compliance with environmental laws and regulations can be expensive; corporate responsibility may adversely impose additional costs; the future impact of COVID-19 on the Company is unknown at this time; the Company has limited insurance coverage; the Company will be reliant on information technology systems and may be subject to damaging cyberattacks; the Company may become subject to litigation; there is no guarantee on how the Company will use its available funds; the Company will continue to sell securities for cash to fund operations, capital expansion, mergers and acquisitions that will dilute the current shareholders; and future dilution as a result of financings.

The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for the Company to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements contained in this news release are expressly qualified in their entirety by this cautionary statement.

SOURCE SolarBank Corporation

Featured image: Megapixl © wolterk