Could These Top EV Stocks Pose A New Threat To Tesla?

Electric Vehicle (EV) stocks

are gaining much popularity recently as traditional automakers are preparing their transition to EV. The initiative is necessary not only due to pressure and incentives from governments but also due to climate change and the growing scarcity of non-renewable resources.

Now, these

EV stocks

have pulled back sharply from their recent highs. But it is important to note that their fundamentals have not changed in any way. Instead, investors might want to grab the opportunity to buy these companies on dips. That’s because the EV market continues to have a long growth runway ahead. EV stocks could climb by up to 50% this year, according to Wedbush analyst Daniel Ives. He thinks there’s enough room in the market for more than just Tesla (

NASDAQ: TSLA

).

The rally in TSLA stock over the past year has fueled investors’ demand for a wave of

top EV stocks

. Amongst them, Churchill Capital Corporation IV (

NYSE: CCIV

) and Fisker (

NYSE: FSR

) are the two names that are making their presence felt loud and clear. But could they replicate the success of Tesla? Before we find out, let’s get into the details on how these two EV stocks stack up against each other.

[Read More]

Best Tech Stocks To Buy Now? 4 Names To Watch

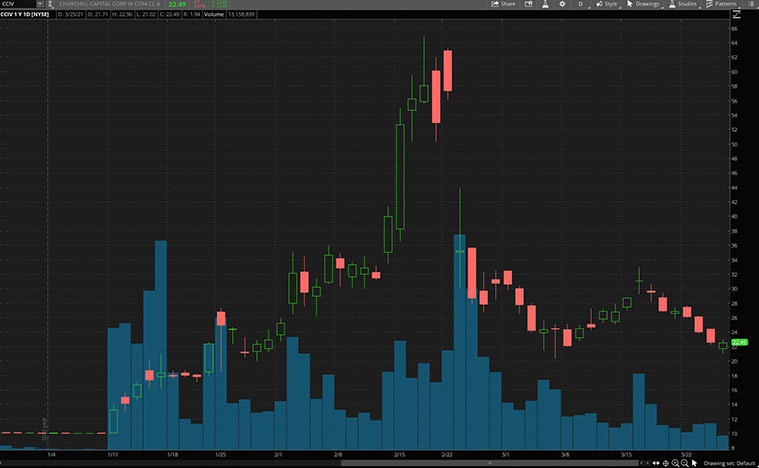

Churchill Capital Corporation IV (CCIV)

Churchill Capital Corp. IV is a special purpose acquisition company (SPAC) that is merging with Lucid Motors. For those uninitiated, Lucid is a brainchild of former chief engineer for Tesla, Peter Rawlinson.

Since the confirmation of the merger news, it has garnered a lot of attention from investors. The company’s mission is to inspire the adoption of sustainable transportation by creating the most captivating luxury electric vehicles centered around the human experience.

Lucid Motor recently announced that the 500 limited units of Lucid Air Dream Edition priced at $169,000 have been fully reserved. The Dream Edition alone can generate potential revenue of around $84.5 million. The news is certainly an encouraging one for the company, as it highlights the demand from prospective customers. It’s also worth mentioning that these reservations are fully refundable. And don’t be surprised if some customers who made reservations decided to change their minds.

Potential From Energy Storage Play

Apart from having cars with some pretty sleek designs ready for sale sometime during the second half of the year, Lucid is also making a play into energy storage. This shows that the EV maker has a few tricks up its sleeve. The company is looking at innovative ways to create additional value in its product chain. Perhaps, it wouldn’t end up being a very profitable endeavor. However, should Lucid execute successfully in this initiative, it could end up becoming a bigger player in the energy storage space than many would have thought.

Despite shedding more than 60% of its value, there are some investors who believe that CCIV stock is still overvalued. Hence, the company’s stock continues to be under pressure as of late. With all this in mind, I have to say Lucid is no doubt an interesting EV play. Its management team has deep expertise in electric vehicles. There may be some volatility with CCIV stock, but its potential remains intact.

[Read More]

Top Reopening Stocks Worth Investing In Now? 4 Names To Watch

Fisker Inc. (FSR)

For the die-hard automotive fans out there, the name Henrik Fisker certainly rings some bells. An automotive icon and tech visionary, Henrik has created some of the most iconic vehicles ever on four wheels. These include James Bond’s famed BMW Z8. And Henrik’s latest disruption? The revolutionary Fisker Ocean.

The California-based company is a designer and manufacturer of electric vehicles and advanced mobility solutions. Fisker aims to revolutionize the automotive industry by developing the most emotionally attractive and eco-friendly electric vehicles.

Given his track record of producing many of the luxury automobile world’s most iconic vehicles, when Henrik designs a car, the world pays attention. The company recently came into the limelight after it announced a partnership with Foxconn, Apple’s (

NASDAQ: AAPL

) to produce over 250,000 EV units annually.

Ocean SUV & Project PEAR Potential

Earlier in March, Fisker announced that the Ocean SUV reservations had surpassed the 14,000 mark. That is roughly over additional 1,000 units since the end of February. This includes commercial-fleet orders for 300 Oceans from Viggo, the technology-driven Danish ride-hailing service. This is certainly encouraging to investors as commercial sectors start to take transitional steps towards EV fleets.

The collaboration with Foxconn, dubbed “Project PEAR” (Personal Electric Automotive Revolution) is expected to close in the second quarter of this year. The EVs are expected to sell under the Fisker brand. However, a more formal agreement is still in the works. The Foxconn deal will be Fisker’s second major deal in recent months. The company already has a deal with Magna (

NYSE: MGA

) to produce the Fisker Ocean, its first expected vehicle.

Combined with its Magna facility, we could be looking at 500,000 units of production capacity by the end of 2025. On 30

th

March, Henrik Fisker will be participating in the upcoming Bank of America 2021 Virtual Global Automotive Summit to talk about the Ocean SUV and Project PEAR vehicle programs.

[Read More]

Best Industrial Stocks To Buy? 4 Names To Watch Before April 2021

Bottom Line: CCIV Stock Vs FSR Stock

Both EV makers have yet to actually sell any vehicles but they certainly do have exciting developments on their own. With Lucid planning to deliver its first batch of Lucid Air in the 2

nd

half of 2021, we would be able to see some revenue this year. That may be sufficient to allay fears of valuation with CCIV stock. With an annual capacity of 30,000 units at its current Arizona facility, Lucid appears to be in a good position to meet the demand for its EVs. What’s more, Lucid’s dabbling in energy storage could be a sign of bigger things to come.

On the other hand, the pedigree that Fisker carries suggests that it is not a brand to underestimate. Of course, Lucid and Fisker are not direct competitors at this stage. Unlike Lucid, Fisker’s first model is an SUV. Production is scheduled to only begin by Q4 2022. Fisker is planning ahead, with 500,000 annual unit capacity from Foxconn and Magna. The question is, will Henrik Fisker’s second attempt at building an EV company be a fruitful one?