The cannabis market has taught investors a thing or two in the last two months. Taking it as an example, let’s look at some lessons to be learned when checking out cheap stocks.

Cheap Stocks: Lesson 1—Be Wary of Hype

This lesson may sound obvious, but you’d be surprised how hype can seep in unnoticed to a sector and sway sentiment. The dictionary defines hype as to “promote or publicize (a product or idea) intensively, often exaggerating its benefits.”

I think ‘exaggerating’ is the important word here. Be aware of companies or markets that are deemed “the next big thing.” Often a company exaggerates success or a product in a ‘fake it til you make it’ kind of way. It’s happened many times before, and investors have lost out.

Success doesn’t happen without falling many times first, so beware of the hype and be careful of those falls.

Cheap Stocks: Lesson 2—Don’t Expect New Markets to Get it Right

When Canada legalized cannabis on October 17th, many stocks went into the red the next day. One of the reasons was an unprecedented demand arriving for this legalized product that had been promoted for so long. It highlighted an immature market, not yet fully equipped to deal with the demand.

Entire provinces ran out of marijuana by day two.

So, if you are willing to invest in a relatively new market, then being aware that they take time to fully mature is imperative. If a new market is floundering when you expected it to not, don’t be a fleeing shareholder.

You wouldn’t expect a child to run before they’ve learned to walk, would you?

Cheap Stocks: Lesson 3—Green Doesn’t Always Mean Go

When you are perusing through cheap stocks eyeing potentials for your portfolio, remember that a company in the green doesn’t always mean an investment opportunity. Especially when they are cheap stocks. To really see returns, a company should show its future credentials with periods of steady upward trajectory. Sudden highs and lows can spell disaster, and the cannabis sector of late is a perfect example of this.

>> Cannabis Penny Stocks: See-Sawing Back into the Green

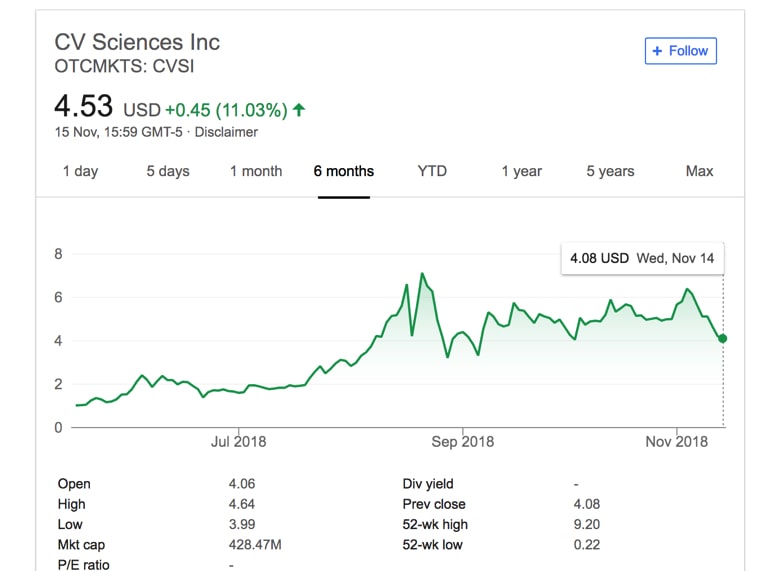

Take for example CV Sciences’ (OTCQB:CVSI) stock movement over the last six months:

There have been as many ups as there have been downs in its trends. Such movement means it’s hard to know if you will gain or lose on this stock, which leads us to our final lesson…

Cheap Stocks: Lesson 4—Hold on for Dear Life

Cheap stocks are cheap usually because they are relatively new companies. New companies are the riskiest for a variety of reasons, but common risks include no prior proof of being able to turn an actual profit. Therefore, it’s advisable to hold your cheap stocks. If you want to see serious gains, then you need to give it time. After all, it took Amazon (NASDAQ:AMZN) nearly twenty years to grow from a $5 stock to a $2,000+ stock.

Featured Image: Depositphotos/© AllaSerebrina