Chase Corporation (NYSE:CCF): Chase Corp shares are range-bound since the start of this year, after generating share price gains of more than 250% between fiscal 2015 to the beginning of 2018.

The range-bound movement in Chase Corp shares over the last six months was mainly due to lofty valuations and increasing costs. Although the company has generated high double-digit revenue growth in the third quarter this year, its margins plunged sharply from the previous year. Chase Corporation blames rising input costs for its lower margins.

Declining Margins Impact Earnings Growth Potential

Its third-quarter revenue jumped 22% year-over-year to $78 million, supported by growth from both industrial and construction segments.

>> Adesto Technologies Corp: The Little-Known Stock with Strong Momentum

Combined with organic growth, the company has also been supporting its revenue base through acquisitions. Its newly-acquired superabsorbent polymers business Zappa Stewart contributed significantly to its industrial material segment revenues.

The company, however, didn’t convert robust revenue growth into big profits. Chase Corp generated year-over-year earnings per share growth of only 13% in the third quarter on revenue growth of 22%. Slower earnings growth compared to robust revenue expansion indicates that the company is experiencing pressure on its margins. Its margins for both business segments declined sharply from past periods, primarily due to increasing costs.

Adam P. Chase, President and Chief Executive Officer commented, “We are seeing rising raw material prices and their continued pressure on margins in specific areas. We also continued to experience a comparatively less favorable product mix in the period, further curtailing results.”

Lofty Valuations Hinders Chase Corp Shares Momentum

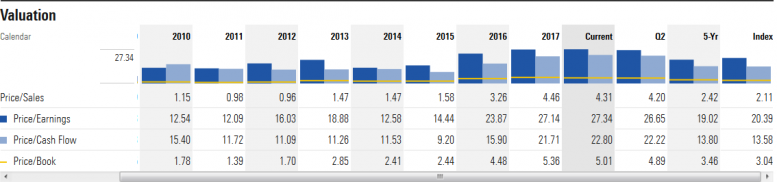

Analysts and market specialists always give significant importance to valuations; they believe valuations indicate how much the stock is overvalued or undervalued. In the case of Chase Corporation, its stock valuations are trading well above the industry averages. Chase Corp shares are trading around 4 times to sales and 27 times to earnings, whereas the industry average is hovering around 2.42 and 19 times, respectively. Although its valuations are slightly higher than the industry average, the stock looks quite fairly valued at present.

Featured Image: alexeynovikov