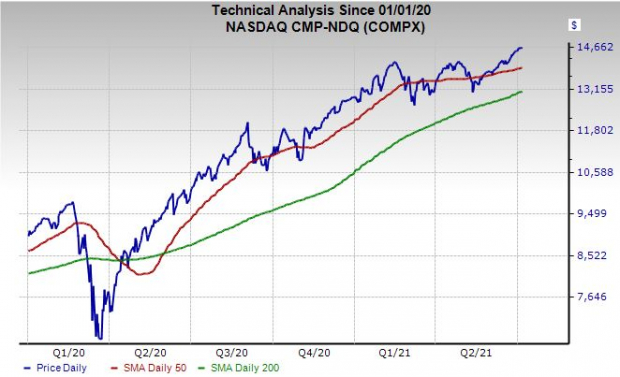

All three major U.S. indexes hit records before the long July Fourth weekend, as bullish investors continue to push stocks higher despite inflation worries. The S&P 500 is now up around 16% in 2021, while the Nasdaq has jumped 14%.

Wall Street has driven the tech-heavy index back to new heights because investors take seemingly every chance they get to buy beaten-down stocks at discounts. For instance, the Nasdaq has climbed nearly 13% since May 12, shortly after its fell below its 50-day moving average and many names neared oversold RSI levels.

The strength in tech shows the market is always looking ahead because even as the U.S. economy booms and people return to bars, concerts, hotels and more, technology dominates nearly every aspect of our lives. And the ability to look beyond rising prices underscores Wall Street’s understanding that TINA investing won’t end anytime soon because interest rates are poised to remain historically low even when the Fed starts to raise its core rate (also read:

Durable Earnings Growth Expected

).

The strong June jobs report also created what some on Wall Street are calling a Goldilocks scenario for the Fed, since unemployment edged slightly higher, up to 5.9% last month from 5.8%, as more people look for work. And the market appears to have pulled back on overheating fears, with the yield on the 10-year U.S. Treasury down from 1.75% in late March to 1.32% on Wednesday…

Image Source: Zacks Investment Research

Netflix

NFLX

Netflix disappointed Wall Street last quarter when it fell short of Q1 subscriber projections and offered disappointing guidance. The lackluster period followed a blockbuster, pandemic-driven 2020 where it added a record 37 million users to blow away its 23 million average during the past five years. NFLX experienced a pull-forward that’s hurting its ability to expand its user base in 2021—a number that’s historically driven its stock.

Despite the near-term slowdown, Netflix is still the largest streaming TV firm boasting 208 million subscribers, and streaming is the future of entertainment, with plenty of gas left in the growth tank. Some on Wall Street are worried the rise of Disney

DIS

, and Amazon

AMZN

and Apple’s

AAPL

ability to spend billions on content will hurt the streaming TV pioneer.

Luckily, the streaming wars are far from a winner take all, as many consumers pay for multiple services given their vastly different content libraries. And more people are cutting the cable cord every day.

Netflix continues to roll out a diverse array of shows, movies, reality TV, and more, in the U.S. and around the globe. The firm has landed deals with Hollywood giants in front of and behind the camera, including striking a multiyear deal with iconic director Steven Spielberg in late June. These deals highlight the slow death of movie theaters, especially outside of the massive blockbusters.

Image Source: Zacks Investment Research

NFLX posted 24% growth last year, marking a slowdown from some recent periods. But Netflix was one of the star stocks of the 2010s, while averaging 28% sales growth during the past decade—inflated by a 48% jump in 2011.

Zacks estimates call for its FY21 revenue to climb 19% from $25 billion to $29.7 billion, with it set to jump another 15%, or $4.4 billion in fiscal 2022. Meanwhile, its adjusted earnings are projected to climb by 73% and 22%, respectively.

Netflix projected it will post break-even free-cash-flow in 2021. This marked a big improvement from its previous projection that called for burning as much as $1 billion. The fact executives think they no longer need to “raise external financing for our day-to-day operations” is a big win, after it had taken on billions in debt to ramp up content over the last several years. Wall Street also remains largely high on NFLX, with 23 of the 31 brokerage recommendations Zacks has at “Strong Buys” or “Buys.”

NFLX’s earnings estimates have trended upward, including some strong positive moves higher recently to help it land a Zacks Rank #2 (Buy) right now. The stock also rocks an “A” grade for Growth in our Style Scores system and is part of a space that sits in the top 31% of over 250 Zacks industries.

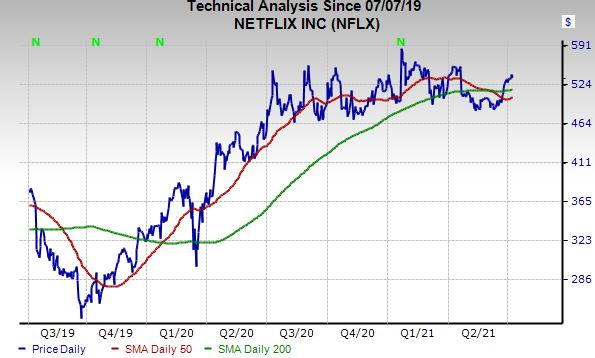

The stock has lagged the market and its industry in the last year, up just 7%, which includes a 1% dip in 2021. Luckily, NFLX has popped 9% in the past month and it broke above its 50-day and 200-day moving averages in late June. Netflix still sits about 10% below its January records even as the likes of Microsoft

MSFT

, Facebook

FB

, and others push the Nasdaq to fresh highs.

Image Source: Zacks Investment Research

Netflix is trading at a 35% discount to its own year-long highs in terms of forward earnings and nearly 20% below its median. All of this provides NFLX with runway potential in the second half of 2021.

Let’s remember that its subscription model provides stability and it could always pull in more users if it were to ever introduce a free ad-supported tier that would surely be a hit as marketers clamor to reach consumers as they disconnect from legacy media. Some might want to wait for NFLX to report its Q2 results and offer up guidance on July 20.

Pinterest

PINS

Pinterest is a largely unique social media company in an area dominated by Facebook and its various platforms. PINS is essentially a visual discovery platform that enables users to find and search for products, services, and more, from planning trips and coordinating an outfit to making home-cooked meals, learnings how to remodel or decorate a room, and beyond.

Advertisers, small businesses, entrepreneurs, and do-it-yourself enthusiasts have all come to love Pinterest. The company has thrived in the e-commerce and digital media age as fewer people flip through magazines or catalogs for purchasing inspiration.

Plus, paid content and ads fit seamlessly into Pinterest, which is vital in our digital-heavy ad world where people pay to avoid ads on Netflix and largely ignore more traditional banner ads. The company has also found success using artificial intelligence to boost its user and ad-revenue numbers and is working to bolster its video capabilities.

Image Source: Zacks Investment Research

The company’s FY20 revenue surge 48% to $1.69 billion to nearly match FY19’s 51% sales growth. PINS also added over 100 million new users last year to close 2020 with 459 million. It then topped our Q1 estimates at the end of April, with global MAUs up 30% to roughly 480 million. PINS executives also provided strong guidance.

Zacks estimates call for Pinterest’s FY21 revenue to climb another 55% from $1.69 billion to $2.61 billion, with FY22 expected to surge higher 37% (adding another $1 billion) to reach $3.57 billion. Alongside its impressive top-line growth outlook, PINS adjusted EPS figures are projected to skyrocket 131% this year and 33% in FY22.

Pinterest has destroyed our earnings estimates in the trailing four quarters and the stock grabs a Zacks Rank #3 (Hold) at the moment. Despite some recent EPS revisions stagnation and a slight consensus pullback, its FY21 and FY22 estimates are up 37% and 22%, respectively from where they were prior to its Q1 release. Plus, 13 of the 19 brokerage recommendations Zacks has are “Strong Buys” or “Buys,” with none below a “Hold.”

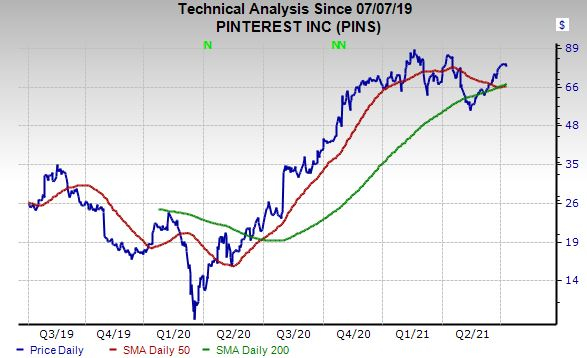

PINS has skyrocketed over 200% in the last year. But it has cooled off in 2021, while experiencing some large swings. Its shares are currently up about 18% this year to lag behind the Zacks Tech Sector. This run includes a 40% surge since May 13, when it fell into oversold RSI territory of under 30. Even though PINS has stormed back and jumped above its 50-day and 200-day moving averages, it still trades roughly 12% below its February records at around $78 a share.

On the valuation front, PINs trades in line with its year-long median at 16.5X forward sales and over 20% below its highs and fellow social media-style firm Snap’s

SNAP

21.5X. Like with NFLX, some investors may want to hold off until the firm reports earnings. But long-term investors might consider Pinterest as a long-term play for its ability to remain a hit with advertisers and users as people disconnect from traditional media.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report