Stocks touched fresh records to start what is arguably the most important week of second quarter earnings season, with reports due out from many of the biggest names in technology. Wall Street could use the last week of July as a chance to take more winnings off the table, after the market’s quick rebound.

But not all tech names sit at new highs ahead of earnings.

Pinterest, Inc.

PINS

stock trades about 15% below its records heading into its Q2 FY21 financial release on Thursday, July 29. And investors, especially ones with long-term horizons, might want to consider buying the unique social media-style tech company at a discount.

Pinterest’s Pitch

Pinterest operates a visual discovery platform that enables users to find and search for products, inspirations, services, and more. Users can find inspiration for everything from date-night outfits and home-cooked meals to planning trips and learning how to remodel a room.

PINS relatively unique offerings in a social media landscape dominated by Facebook

FB

and its other platforms, has helped it become a hit with advertisers, small businesses, entrepreneurs, and do-it-yourself enthusiasts. The firm that launched roughly a decade ago has thrived in the e-commerce and digital media age and its revenue has soared as more dollars go to digital.

Digital advertising could account for 65% of the roughly $240 billion-a-year industry in the U.S. by 2023, up from just one-third of ad spending only a few years ago. Investors should note that paid content and ads fit seamlessly into Pinterest. This is vital because people pay to avoid ads on Netflix

NFLX

and largely ignore more traditional banner ads.

The company has also found success using artificial intelligence to boost its user and ad-revenue numbers and is working to bolsters its video capabilities. Pinterest’s appeal helped it add 100 million new users in 2020 to close the year with 459 million.

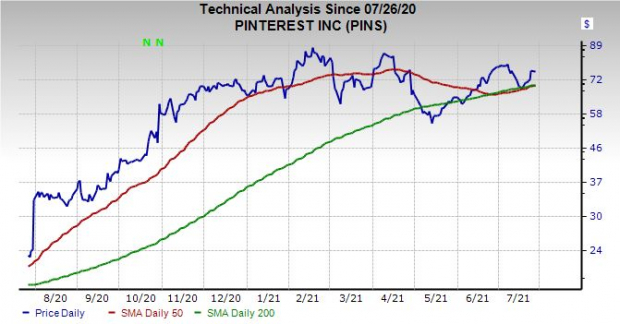

Image Source: Zacks Investment Research

Other Fundamentals

Pinterest’s revenue surged 48% in 2020 to reach $1.69 billion, nearly matching the 51% growth it did during its first year as a public company in 2019. The last two years of almost identical top-line expansion showcase PINS is far from a one-hit-covid-wonder.

The firm topped our Q1 estimates, with global MAUs up 30% to roughly 480 million. Zacks estimates call for Pinterest’s FY21 revenue to climb another 55% from $1.69 billion to $2.61 billion. PINS 2022 revenue is then expected to climb 37% (adding another $1 billion) to come in at $3.57 billion.

At the bottom-end of the income statement, PINS adjusted earnings are projected to skyrocket 131% this year to post $0.97 a share. Peeking ahead, Pinterest’s fiscal 2022 EPS are expected to jump by an additional 33% to hit $1.30 a share.

Despite some recent EPS revisions stagnation and a slight consensus pullback, its FY21 and FY22 estimates are up 37% and 22%, respectively from where they were prior to its Q1 release. Pinterest has destroyed our earnings estimates in the trailing four quarters and the stock grabs a Zacks Rank #3 (Hold) at the moment, alongside an “A” grade for Growth in our Style Scores system.

Wall Street also remains high on PINS, with 12 of the 19 brokerage recommendations Zacks has at “Strong Buys” and none below a “Hold.” The company also boasts a strong balance sheet, with about $2 billion in cash and zero long-term debt.

Image Source: Zacks Investment Research

Bottom Line

PINS shares are up about 215% since their public debut, including over a 200% jump in the past year. Luckily for investors who missed out on this run, the stock has cooled down in 2021, up 15% to lag the Zacks Tech Sector and the S&P 500.

The stock is also in the midst of a relatively up and down ride in 2021, and it closed regular hours Monday around 15% below its records at $76.49 a share. PINS sits below overbought RSI (70) levels at 59 and trades at a discount to its year-long median at 15.5X forward 12-month sales. And Pinterest stock popped above some key technical levels last week.

Despite the positivity, some investors may want to hold off until PINS reports. Plus, it could be prudent to see how Wall Street reacts to results from Apple

AAPL

, Amazon

AMZN

, Microsoft

MSFT

, and other market-movers, as more profit-taking could be in the cards.

That said, some investors might consider Pinterest as a long-term play for its ability to thrive in the digital-ad age through its growing user base. And people continue to disconnect and unsubscribe from legacy media such as linear TV and magazines in droves.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%.

You’re invited to check out

Zacks’ Marijuana Moneymakers

:

An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report