Adobe

ADBE

shares have outperformed Amazon

AMZN

, Facebook

FB

, and the broader Zacks Technology sector over the last five years. But the creative and design software firm has cooled down in 2021, having moved roughly sideways since early September.

ADBE is one of the first huge names set to report its second quarter earnings, with its Q2 fiscal 2021 financial results due out on Thursday, June 17. Let’s quickly look at Adobe to see if investors might want to consider buying the tech giant.

Creative Niche

Adobe created the PDF and went public in the mid-1980s. Today it has transformed into a SaaS powerhouse, with a portfolio full of some of the most important creative and design software on the market. The firm’s subscription-based software includes Photoshop, InDesign, Premiere, and newer offerings made for the digital media age where strong visuals are paramount.

ADBE’s subscription-based model helps create stable growth and its creative cloud suite is invaluable to countless businesses, schools, artists and designers, and more. Along with its array of creative software, it has bolstered its business-focused offerings into e-signature, marketing, and more. And Adobe in December completed its purchase of Workfront, a leading work management platform for marketers.

Adobe’s diversified and relatively unique solutions help provide a solid moat in a crowded SaaS market that features a ton of similar offerings. The firm’s impressive and consistent revenue growth highlights its compelling platforms and the strength of its subscription focus.

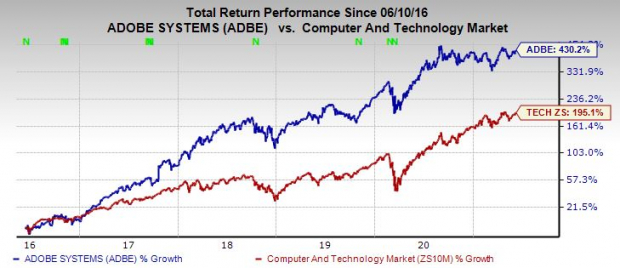

Image Source: Zacks Investment Research

Outlook & Other Fundamentals

Adobe’s revenue climbed 15% in 2020 and its first quarter sales jumped 26%. The record quarterly sales were driven by growth across creative cloud, document cloud and experience cloud. Zacks estimates currently call for its Q2 sales to jump 19% to help lift its adjusted earnings by 15%.

Peeking further down the line, ADBE’s full-year 2021 revenue is projected to surge 20.4% to $15.5 billion, with FY22 set to climb over 14% higher. These projections would extend its streak of roughly 15% or stronger sales growth to eight straight years, which is better than Microsoft

MSFT

and far more consistent than Apple

AAPL

.

At the bottom end of the income statement, Adobe’s adjusted earnings are expected to climb by 18% this year and another 15% next year. The company also boasts an impressive history of EPS beats and its executive team raised its FY21 guidance last quarter.

Adobe’s constant expansion helps investors understand why the stock has soared 430% in the last five years. But as we mentioned at the outset, it has cooled down, matching the tech space in the past two years. More recently, ADBE is up 25% in the trailing 12 months to lag the tech sector’s 45% surge and it is down around 4% from its records heading into its release.

Adobe popped 1% during regular trading Wednesday as the broader market dipped to close at $514.68 a share. And its recent momentum has pushed it back above its 50-day moving average. Luckily, it still comes in under overbought RSI (70) levels at 62 and it’s trading at a discount to its own year-long median in terms of forward earnings. All of this could provide ADBE runway if it’s able to impress with its guidance.

Bottom Line

Adobe lands a Zacks Rank #3 (Hold) right now and Wall Street is very high on the stock overall, with 14 of the 16 brokerage recommendations Zacks has at “Strong Buys.” The company also repurchased approximately 1.9 million shares last quarter. Therefore, investors with long-term horizons might want to consider ADBE heading into its Q2 release.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report