I’ve got a bullish 6-month option spread on a stock that I am really excited about as we enter the 4th Industrial Revolution. Splunk

SPLK

, the Data-to-Everything ™ platform, ingests unlimited machine data and provides actionable solutions in real-time across business functionalities.

I’m looking at a 3-legged bullish option spread with a mid-May expiration that will position you to take full advantage of this unique opportunity in a stock that is poised to explode as we enter this digital renaissance that will propel economic growth into high gear.

The Catalyst

Splunk

SPLK

is in the midst of transforming from an on-premises cybersecurity software to an innovative cloud-based real-time data analytics platform. Unfortunately, the byproduct of a cloud transformation is a temporarily painful period of margin compression. Fortunately for us, it provides us with a great entry point for a medium-term trade.

This structural business shift is one that legacy tech giants like Microsoft

MSFT

and Adobe

ADBE

have pioneered in the past decade. The transition tends to briefly scare away investors, at least until these models demonstrate the desired outcomes. Once these subscription-based revenues begin driving accelerating profitable growth, these enterprises experience skyrocketing share prices on justified valuation multiple expansion (due to the incredible topline visibility that its cloud services provided).

Splunk just unveiled a tidal wave of innovative cloud-focused products in its mid-October virtual .conf21 event. The company is expanding its best-in-class real-time data management offerings amid its pivotal transformation towards subscription-based cloud revenue drivers.

The focus of this innovation-driven event was data-to-everything on the cloud, from the launch of an improved cybersecurity platform to significant enhancements in its enterprise observability platforms, equipping companies with unique real-time operational visibility.

.con21 was a critical informational event for SPLK stakeholders who have been waiting for a clear and definitive plan for Splunk’s cloud transformation. I am more bullish than ever on this stock and am looking at a $200+ short-term price target as its newly unveiled cloud-based product line-up begins gaining the expected traction in the coming quarters.

The Trade

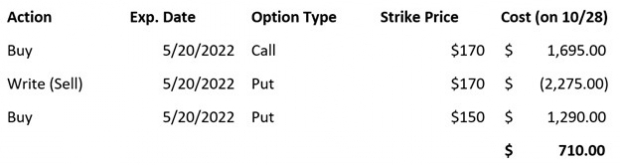

The SPLK option spread I am assessing involves 3 May 2022 options (1 Call & 2 Puts) for an abbreviated upfront cost to produce a leveraged upside position in this equity built for the future. I am choosing May 2022 (more specifically, May 20th, 2022) as our expiration because it will allow us to capture 2 more earnings reports, which should provide this equity with robust upside catalysts as its cloud segments develop and conservative outlooks improve.

The Spread:

Image Source: Zacks Investment Research

The initial cost is only $710 for a medium-term bullish position that would have cost over $2,000 for the same level of upside on a naked call option(s) if it wasn’t for the addition of the put spread. The spread provides you with the same type of upside as a naked call. However, it enhances your total return opportunity, sizably reducing your breakeven (from 187 to 177) while still limiting your downside potential ($2,710).

SPLK is currently trading just south of $165 a share, and virtually every covering analyst is giving this thing a $200 a share or higher 12 to 18-month price target. Following Splunk’s flood of product releases and enhancements this year, I find it hard to believe that SPLK would be trading under $200 a share in 6 months as management is clearly taking the right steps to execute a successful cloud transformation.

Happy Trading!

Dan Laboe

Equity Strategist & Editor of The

Headline Trader

portfolio at Zacks Investment Research

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report