Square

SQ

started over a decade ago by selling technology to help tiny businesses process credit card transactions from their smart devices. Today the company is at the forefront of the ever-growing financial tech or fintech industry and its sights are set on becoming an all-encompassing app and ecosystem for sellers and consumers.

SQ shares soared for roughly 12 months straight off the coronavirus lows and its recent underperformance presents a relatively enticing buying opportunity, especially with a big acquisition set to close in early 2022.

Growing Fintech Portfolio

Square is light-years beyond the firm that mostly sold small smartphone and tablet-connected credit card readers geared toward small businesses and the self-employed. Its expanding portfolio includes a range of point-of-sale offerings, broader payment software and infrastructure, business loans, peer-to-peer payments, bitcoin transactions, and beyond.

SQ aims to be comprehensive financial services firm for both sellers and consumers. This includes its relatively new Square Banking offerings for U.S. sellers that includes savings and checking accounts, loans, and more. The company also offers a variety of POS systems for in-store transactions and various back-end and online payment technology.

Square’s business-focused fintech is catching on with larger sellers amid the continued e-commerce revolution as businesses, entrepreneurs, artists, and everyone in between turn to SQ and the likes of Shopify

SHOP

and Etsy

ETSY

to succeed.

Last quarter, SQ processed $43 billion in gross payment volume, up 88% from the year-ago period, with 65% coming from larger sellers (over $125K in annualized GPV). These bigger sellers accounted for 57% of GPV in Q2 FY20.

Wall Street also loves its ability to attract more consumers to its P2P platform the Cash App, as it competes against PayPal

PYPL

and JPMorgan Chase

JPM

. The app reached 40 million monthly transacting active customers in June and millions of customers are now directly depositing checks to digitally pay friends and family and do much more.

Image Source: Zacks Investment Research

Plus, the Cash App allows users to buy and sell bitcoin, as well as stocks and ETFs. Square’s ability to attract a younger generation of investors and compete against the likes of Robinhood

HOOD

offers huge upside potential. The firm said roughly 4.5 million customers held a stock or ETF in Q2 up more than “3x from a year ago.”

Square is clearly well on its way to becoming a holistic financial services firm where both consumers and businesses keep, spend, and invest their money. The company in early August announced its entry into the fast-growing “buy now, pay later” area of digital commerce with its planned acquisition of Afterpay. The all-stock deal valued at $29 billion is expected to close in the first quarter of calendar year 2022,

Afterpay is one of the leaders in short installment payment options for e-commerce shoppers and the purchase is part of a broader plan to integrate Square’s seller business and its Cash App. Afterpay boasts around 16 million consumers and nearly 100,000 merchants globally. The BNPL space is booming and various fintech firms offer buyers the ability to make smaller payments everywhere from Nike to Home Depot.

Square hopes its integration will help “even the smallest of merchants to offer BNPL at checkout, give Afterpay consumers the ability to manage their installment payments directly in Cash App, and give Cash App customers the ability to discover merchants and BNPL offers directly within the app.”

SQ then at the end of September announced a partnership with social media standout and Instagram

FB

competitor TikTok that “enables sellers to send fans directly from TikTok videos, ads, and shopping tabs on their profiles to products available in their existing Square Online store.”

Image Source: Zacks Investment Research

Recent Growth and Outlook

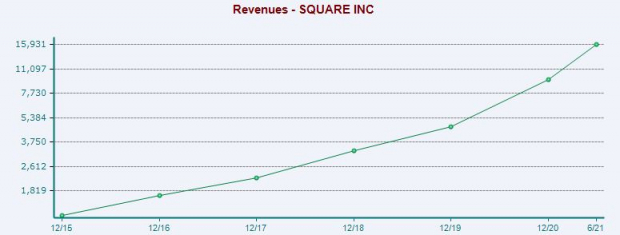

Square steadily expanded its revenue since its late 2015 IPO and 2020, driven by the nearly overnight need for digital payments and e-commerce, was its best showing as sales skyrocketed 102% to $9.50 billion.

More recently, its Q2 revenue soared 143%, and 87% excluding bitcoin revenue. Its transaction-based revenue climbed 80% and subscription and services sales came in 98% higher. And its adjusted earnings surged from $0.18 to $0.66 a share to blow away our Zacks estimate

SQ’s adjusted Q3 EPS are projected to climb 15% on 51% higher revenue, based on Zacks consensus estimates. Peeking further ahead, the company’s FY21 sales are set to soar another 99% to reach a whopping $18.89 billion—up from $4.7 billion in FY19. Meanwhile, its adjusted earnings are projected to climb nearly 120% to $1.84 a share.

The company is then set to follow up back-to-back years of 100% growth with another 12% higher revenue in FY22, pulling in $2.3 billion more, or what amounts to its total FY17 revenue. And its adjusted 2022 earnings are projected to climb another 23% higher.

Square’s positive earnings revisions help it land a Zacks Rank #1 (Strong Buy) right now, alongside its “A” grade for Momentum in our Style Scores system. The fintech firm has also crushed our bottom-line estimates by an average of 111% in the trailing four periods.

Image Source: Zacks Investment Research

Bottom Line

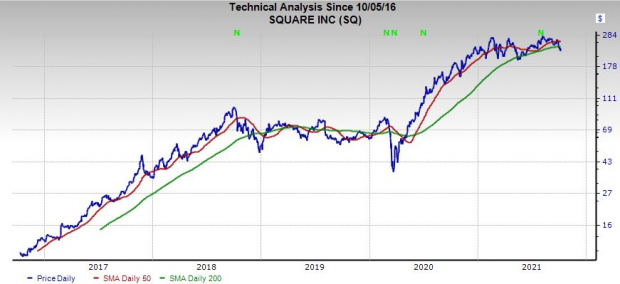

SQ shares are up 1,900% in the past five years and 275% in the last two years to outpace its industry’s 70% average. Luckily, it’s cooled off in 2021, up around 8% to lag its industry and the S&P 500. At roughly $235 a share, Square trades around 18% below its records, which could be a nice entry point.

Some recent selling pushed it below its 50-day and 200-day moving averages. This is a place it’s rarely stayed for too long. SQ popped during regular hours Tuesday after it came close to falling below oversold RSI levels (30 or under), with it now at 38.

The recent downturn has improved its valuation picture, with it trading near its year-long lows at 5.0X forward 12-month sales. It’s worth pointing out that it still trades at sky-high forward earnings multiples. But investors have been willing to pay up for the futuristic financial services firm.

Wall Street remains largely high on Square, with 16 of the 29 brokerage recommendations Zacks has at “Strong Buys,” three “Buys,” and only one below a “Hold.” Therefore, investors with longer-term horizons might want to consider buying Square even if the market experiences more selling pressure and volatility in the fourth quarter.

SQ is set to release its Q3 financial results in early November.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report