Bayerische Motoren Werke

BAMXF

, commonly referred to as BMW, is focused on initiatives in electric vehicles (EVs) in a bid to make its mark in the space.

The company recently announced that it has formally started production at the new Lydia plant in China, with an investment of 15 billion yuan ($2.24 billion), to accelerate EV capacity.

The Lydia plant is designed to produce battery-powered electric cars on its flexible manufacturing lines, tailor-fit for the existing market demand.The first model to roll off Lydia’s production lines is the i3, a pure electric mid-sized sports sedan.

The plant, located in the Liaoning province, is BMW’s third car assembly facility in the country. Through the new plant, the company aims to take its annual output to 830,000 vehicles from 700,000 in 2021 in China, which happens to be the world’s biggest auto market.

China has been a booming hub for EVs, with major auto players trying to capture whatever market share they can in the country.

Tesla Inc.

TSLA

has been ramping up its EV sales in the nation on war-footing. Tesla has vouched to establish its Shanghai Gigafactory as one of the largest EV sites in the world. Therefore, for BMW to reap the benefits of a sizeable chunk of sales, it is giving a big push to its ambitious EV plans in the country.

In another noteworthy development in its EV initiatives, BMW plans to spend nearly €1 billion ($1.05 billion) through 2030 to modify its factory in Steyr, Austria, so that it becomes a leading production and development site for the company’s next-generation electric powertrains.

The Austria-based facility has been operating for more than 40 years and it is a matter of pride for the site that one out of every two BMW vehicles globally has a powertrain built there. As pre-requisites for the production, BMW will build a new two-story production hall that will house two assembly lines for electric powertrains and transmissions.

A second new building will expand the logistics areas. All upgrades will expand the total production area by about 60,000 square meters and the cost will reach nearly €710 million ($747 million) by 2030. The premium electric powertrains to be produced will be an entirely on-site development, accounting for an additional €230 million ($242 million) investment.

In the long run the automaker envisions building an annual capacity of more than 600,000 electric powertrains while maintaining the production of diesel and petrol engines in parallel at the site. The factory will also obtain all of its energy requirements from renewable sources, latest by 2025, through the use of green power and heat from regional biomass.

Austria’s manufacturing industry plays a vital role in strengthening the nation as a business hub and generating employment. In that light, the contribution of BMW to the country will go a long way in fostering economic growth. Also, investment in powertrains makes it a key contributor to sustainable mobility. The company’s prospects in the country appear to add to its already thriving momentum.

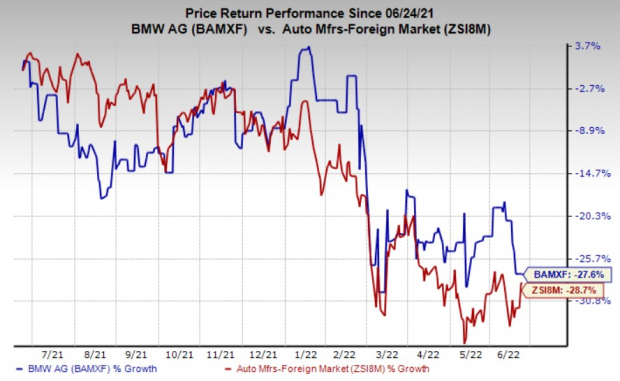

Shares of BMW have lost 27.6% over the past year compared with its

industry

’s 28.7% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

BMW carries a Zacks Rank #3 (Hold), currently.

Some better-ranked players in the auto space are

Wabash National Corporation

WNC

, sporting a Zacks Rank #1 (Strong Buy) and

Fox Factory Holdings

FOXF

, carrying a Zacks Rank #2 (Buy) currently. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Wabash National has an expected earnings growth rate of 239.3% for the current year. The Zacks Consensus Estimate for current-year earnings has remained constant in the past 30 days.

Wabash National’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed in one. WNC pulled off a trailing four-quarter earnings surprise of 51.26%, on average. The stock has declined 19.8% over the past year.

Fox Factory has an expected earnings growth rate of 14.9% for the current year. The Zacks Consensus Estimate for current-year earnings has remained constant in the past 30 days.

Fox Factory’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. FOXF pulled off a trailing four-quarter earnings surprise of 10.18%, on average. The stock has declined 47.8% over the past year.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report