Nov 26 was a black Friday in reality across the global financial markets. In the United States, Black Friday is associated with massive consumer spending. However, on Nov 26, market participants were busy liquidating their long positions worldwide. This was courtesy of the resurgence of a new variant of coronavirus — B.1.1.529 — in South Africa. The World Health Organization (WHO) named it “omicron” and warned that it could be more transmissible than the previous variants.

It seems that volatility may persist in early December. At this stage, it will be prudent to invest in large-cap technology stocks with a favorable Zacks Rank. Here are five of them —

Alphabet Inc.

GOOGL

,

Cadence Design Systems Inc.

CDNS

,

Veeva Systems Inc.

VEEV

,

Mettler-Toledo International Inc.

MTD

and

ANSYS Inc.

ANSS

.

Panic Selling on Black Friday

Very few cases with the omicron variant have been detected so far and medical scientists or virologists are clueless regarding the spread of the infection or the physical destructive power of the new variant of COVID-19.

Currently, the medical science space is divided with contradictory opinions regarding omicron owing to lack of data. However, several countries including the United States have taken preventive measures like travel restrictions, wearing masks and giving more emphasis on vaccination.

However, markets always react more on sentiments, tensions and panic rather than factual reality. Consequently, on Nov 26, the Dow recorded its worst single-day drop in 2021 and the biggest Black Friday selloff since 1931. The S&P 500 and the Nasdaq Composite posted the biggest Black Friday decline in history. Bourses including European Union, the U.K., Japan, Hong Kong, South Korea and emerging markets like Australia, India and Singapore tumbled 2.5% to 4%.

As investors shifted their funds from risky-asset like equities to safe-haven government bonds, the yield on the benchmark 10-Year U.S. Treasury Note plunged 16.2 basis points to 1.482%. Fearing lack of demand, the prices of the U.S. benchmark WTI crude oil and global benchmark Brent crude oil slid 13% and 11.5%, respectively.

Near-Term Positives

Medical science is well advanced now to combat the mutating strings of coronavirus than it was a year ago. A section of medical experts has also said that omicron may not be as infectious as the Delta. The spread of omicron may create a short-term hurdle to global economic recovery but a pandemic-era lockdown is highly unlikely.

Moreover, if omicron poses a genuine threat to U.S. economic recovery, the Fed may delay its bond-buy tapering process and the benchmark interest rate hike, and may continue its ultra-dovish monetary policies. In fact, over the past two months, an expected change in Fed’s monetary stance due to skyrocketing inflation was the primary source of volatility on Wall Street.

Finally, fundamentals of the U.S. economy remain robust. Both consumer spending and business spending remain strong despite mounting inflation and supply-chain disruptions. Both manufacturing and services PMIs stayed elevated. The struggling labor market is showing a systematic recovery. The last reported weekly jobless claims data for the week ended Nov 20, came in at the lowest level since Nov 15, 1969.

Our Top Picks

At this stage, analyzing the pros and cons of the resurgence of COVID-19 and panic selling in stock markets, investment in technology stocks will be a good strategy. The technology sector has a secular uptrend potential irrespective of any pandemic-led market downturn.

We have selected five large-cap (market capital > $30 billion) technology stocks as these companies have well-established business models. These stocks have sloid growth potential for the rest of 2021 and have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

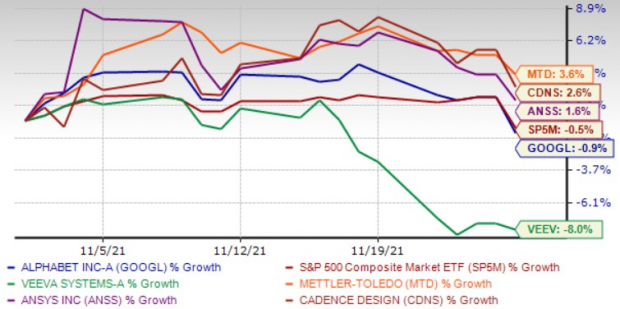

The chart below shows the price performance of our five picks in the past month.

Image Source: Zacks Investment Research

Alphabet Inc.

has been strongly emphasizing AI techniques and the home automation space, which should aid business growth over the long term. Solid momentum across search, advertising, cloud and YouTube businesses aided the results of Alphabet. Further, the growing proliferation of consumers’ online activities and rising advertiser spending remained as tailwinds.

Alphabet’s robust cloud division continues to be the key catalyst. Expanding data centers will continue to bolster its presence in the cloud space. Further, major updates in its search segment are enhancing the search results. Moreover, GOOGL’s mobile search is constantly gaining traction.

Zacks Rank #1 Alphabet has an expected earnings growth rate of 84.8% for the current year. The Zacks Consensus Estimate for current-year earnings improved 0.4% over the last 7 days.

Cadence Design Systems Inc.

offers products and tools that help customers to design electronic products. Through the System Design Enablement strategy, CDNS offers software, hardware, services and reusable IC design blocks to electronic systems and semiconductor customers.

Cadence’s performance is being driven by strength across segments like digital & signoff solutions and functional verification suite. CDNS is also gaining from higher investments in emerging trends like IoT and autonomous vehicle sub-systems along with strength in the semiconductor end-market. Frequent product launches are expected to help the company sustain top-line growth.

Zacks Rank #2 Cadence Design Systems has an expected earnings growth rate of 16.1% for the current year. The Zacks Consensus Estimate for current-year earnings improved 2.5% over the last 30 days.

Mettler-Toledo International Inc.

is the world’s largest manufacturer and marketer of weighing instruments for use in laboratory, industrial and food retailing applications. MTD focuses on the high value-added segments of the weighing instruments market by providing solutions for specific applications.

Mettler-Toledo is also a leading provider of analytical instruments for use in life science, reaction engineering and real-time analytic systems used in drug and chemical compound development, and process analytics instruments used for in-line measurement in production processes. MTD’s portfolio strength, cost-cutting efforts, robust sales, marketing strategies, and margin and productivity initiatives are expected to continue aiding its performance.

Zacks Rank #2 Mettler-Toledo has an expected earnings growth rate of 29.9% for the current year. The Zacks Consensus Estimate for current-year earnings improved 1.7% over the last 30 days.

Veeva Systems Inc.

offers cloud-based software applications and data solutions for the life sciences industry. Strength in Veeva Systems’ data business and Veeva OpenData raise optimism. The steady adoption of Veeva Systems’ products is also encouraging. Revenue uptick in Veeva Commercial Cloud with 21 new Veeva CRM customer wins and good traction with Veeva CRM add-ons look impressive.

The expansion of both margins bodes well for VEEV. Veeva System’s focus on cloud-based software and a strong product suite buoy optimism. A strong liquidity position is an added plus for VEEV.

Zacks Rank #2 Veeva System has an expected earnings growth rate of 21.4% for the current year (ending January 2022). The Zacks Consensus Estimate for current-year earnings improved 0.3% over the last 60 days.

ANSYS Inc.

develops and globally markets engineering simulation software and services widely used by engineers, designers, researchers and students across a broad spectrum of industries and academia. ANSYS is also gaining from the robust adoption of its engineering simulation software in 3D printing and additive manufacturing applications.

Solid recurring revenue growth and improving business conditions at small- and medium-sized customers acted as a tailwind. The sound acquisition strategy of ANSS bodes well for the long haul.

Zacks Rank #2 ANSS has an expected earnings growth rate of 7.6% for the current year. The Zacks Consensus Estimate for current-year earnings improved 2.4% over the last 30 days.

Investor Alert: Legal Marijuana Looking for big gains?

Now is the time to get in on a young industry primed to skyrocket from $13.5 billion in 2021 to an expected $70.6 billion by 2028.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could kick start an even greater bonanza for investors. Zacks Investment Research has recently closed pot stocks that have shot up as high as +147.0%

You’re invited to immediately check out Zacks’

Marijuana Moneymakers: An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report