It’s been an absolute battlefield within the market landscape throughout 2022, with high-growth and tech stocks seemingly walking around with big targets on their backs. Buyers have entirely retreated, and bears have been pushing forward all year long. It’s been exhausting, to say the least, and bears keep reloading.

While this volatile market is an absolute paradise for day-traders, the same can’t be said for investors. Long-term investors don’t benefit from the significant intraday price swings that we’ve become familiar with; they desire considerable, consistent gains on a much larger time horizon.

While day-traders and scalpers have their fun, it brings about an elegant opportunity for investors to add to their long-term positions at valuation levels not seen in quite some time. Although it’s never fun to watch one of your favorite stocks consistently give back gains, it is exciting to know that you can build up a much stronger position, allowing you to ride the wave back up.

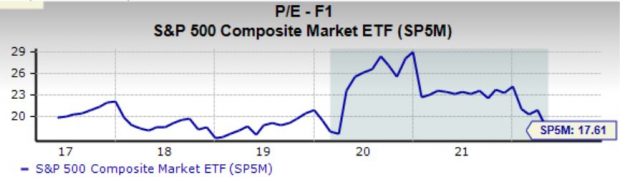

The chart below shows the five-year performance of the S&P 500. As we can see, it currently sits at levels not seen since March of 2021.

Image Source: Zacks Investment Research

Additionally, the S&P 500’s forward earnings multiple has retraced down to 17.6X, beneath its median of 19.9X over the last five years and well below its 2020 high of 28.6X. The rocky market environment has provided long-term investors with a rich buying opportunity not seen in some time.

Image Source: Zacks Investment Research

Remain Confident In Your Investment Thesis

There are many reasons why investors start a position in any stock. Whether that is robust future growth rates, rock-solid financial statements, or the stock is being considered the next big thing, there is always a reason behind that first initial buy.

If you’re a long-term investor, there is little reason to move out of a position if your original investment thesis has changed. Think about why you initially took a starter position, and if that reason hasn’t changed, then there should be no fear concerning the long-term picture; short-term noise needs to be muted.

For example, look at this chart of Tesla

TSLA

. It would’ve been a massive mistake if an early Tesla investor sold against their confidence and belief in EVs and TSLA’s overall business during the lows in 2019.

Image Source: Zacks Investment Research

Building A Bigger Position

It’s nearly impossible to time the market just right. The market saying of “buy low, sell high” is hardly beneficial; if investors could consistently and accurately forecast these levels, the market would be entirely out of balance.

Of course, there is the “buy the dip” approach as well, which is inherently risky. Many people buy at the dip, yet it keeps dipping – that’s never fun. One of the best ways to build a more prominent position for your long-term winners is the simple approach of dollar-cost averaging.

Dollar-cost averaging is a strategy in which investors split up their initial buys in periodic timeframes, reducing the impact of volatility on the overall purchase. It allows you the flexibility to “buy the dip” and add on to those winners whenever they come into uptrends. This is a great way to limit overall risk, as no investor wants to see an initial position become an unfavorable entry point due to market conditions.

Apple

We all know about Apple

AAPL

, the legendary tech giant that has taken the mobile phone marketplace to new levels with its flagship iPhone. As is with most, AAPL shares have been disappointing year-to-date compared to how highly it has performed in recent years. The year-to-date chart below illustrates that.

Image Source: Zacks Investment Research

Widening the time frame to over the past five years shows that Apple shares are trading at their lowest level since October 2021.

Image Source: Zacks Investment Research

Additionally, Apple’s current forward earnings multiple sits at 23.9X, an absolute fraction of its 2020 high of 41.5X. These levels are great spots for increasing a position relative to where the stock has climbed over the last five years.

Image Source: Zacks Investment Research

Microsoft

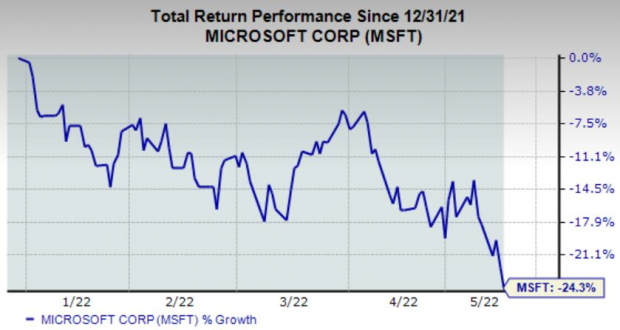

Microsoft

MSFT

has been a major winner in the market and a staple in many tech portfolios. Among the tech-rout of 2022, shares have suffered. The chart below illustrates the year-to-date performance of MSFT shares.

Image Source: Zacks Investment Research

Expanding the timeframe to encompass the last five years of price action, we see that MSFT shares are trading at levels not seen since summer 2021.

Image Source: Zacks Investment Research

Furthermore, Microsoft’s forward earnings multiple has retraced to 27.9X, below the median of 28.1X over the last five years and well below 2021 highs of 37.5X.

Image Source: Zacks Investment Research

Bottom Line

Bear markets are never a fun time for market participants. However, they do bring about rare opportunities in the market to buy some top-tier companies at a fraction of previous valuation levels and share prices.

It’s critical for investors in these companies to uphold the long-term picture alongside their original investment thesis. Once the thesis has changed or has been impacted, investors should take a closer look at their position.

Bear markets can’t last forever, although nobody truly knows where the market heads next. But, right now, bears are in control, and it’s vital for investors to gradually build up their positions in periodic increments to enjoy the ride back up and seize the current opportunities presented to them.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year’s 2021

Zacks Top 10 Stocks

portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys

Access Zacks Top 10 Stocks for 2022 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report