Brief Summary

- Lithium prices saw a rise in the month of May, 2017

- Australian junior mining company Orocobre (TSX:$ORL) predicts that lithium supply will remain in deficit this year

- Pilbara Minerals (ASX:$PLS) settled a 20-year offtake agreement

- Altura Mining (ASX:$AJM) has a project that is close to getting full funding

- Bacanora Minerals (CVE:$BCN) makes an offtake equity deal with Japanese trading company Hanwa Co., LTD (TYO:$8078)

In Detail – Spot Prices and Contract Prices

As of May, lithium carbonate spot prices in China rose a total of 2.92%. However, lithium cobalt oxide spot prices fell 1.67% in China.

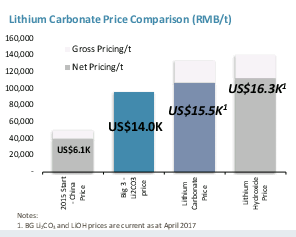

In April 2017, lithium carbonate contract prices were between US$14,500 to US$15,500 per tonne, while lithium hydroxide contract prices was at US$16,300 per tonne.

In Detail – Supply/Demand

In terms of demand, Tobias Tretter, a Swiss lithium fund manager, revealed in an interview that he predicts lithium demand to get as high as one million tonnes by 2025 — five times the demand in 2016.

Financial company UBS (NYSE:$UBS) believes that electric vehicles will cause quite a commotion in the commodity markets, reported The Financial Times on May19. According to UBS, the rising popularity of electric vehicles will result in quite a rise for battery materials like lithium, cobalt, and rare earths. In a futuristic world where electric vehicles occupy most of the automobile market, lithium demand can increase by 2,898%, cobalt demand can increase by 1,928%, and rare earth metals demand increase by 655%, UBS said.

Featured Image: twitter