Last week, the European Automobile Manufacturers Association (“ACEA”) released data for passenger car registrations for March 2022. The European Union (EU) passenger vehicle market contracted 20.5% in March to 844,187 units amid chip woes aggravated by the Russia-Ukraine war. Most of the countries in the EU witnessed a double-digit drop in registrations, including four key markets. Registrations in Italy, Germany, Spain and France witnessed a yearly decline of 29.7%, 17.5%, 30.2% and 19.5%, respectively. During the first quarter of 2022, new car registrations contracted 12.3% from the prior-year period to 2,245,976 units. All four major EU markets saw double-digit declines: Italy (-24.4%), France (-17.3%), Spain (-11.6%) and Germany (-4.6%).

Meanwhile, first-quarter 2022 earnings for the auto sector kicked off last week and so far, results have been pretty good despite industry challenges. Electric vehicle behemoth

Tesla

TSLA

delivered yet another blockbuster show, with Q1 earnings and revenues not just topping estimates but increasing year over year. Auto retailers

Lithia Motors

LAD

and

AutoNation

AN

also delivered earnings and revenue beat for the quarter in discussion. Auto replacement parts stock

Genuine Parts Company

GPC

also topped Q1 earnings and sales mark. The company also raised its full-year guidance. Meanwhile, used car e-retailer

Carvana

CVNA

incurred a wider-than-expected loss for the quarter under review. Also, it withdrew full-year 2022 forecasts in the light of higher used-vehicle prices, volatility in interest rates and exorbitant fuel prices.

Inside the Headlines

1.

Tesla

reported first-quarter 2022 earnings of $3.22 a share, growing significantly from the year-ago figure of 93 cents and surpassing the Zacks Consensus Estimate of $2.15. This marked the

fifth straight earnings beat

for the company. Higher-than-expected deliveries and automotive gross profit resulted in this outperformance. Total first-quarter 2022 deliveries of 310,048 units topped the Zacks Consensus Estimate of 298,495. Automotive gross profit came in at $5,539 million, which outpaced the consensus mark of $4,113 million.

Total revenues came in at $18,756 million, beating the consensus mark of $17,276 million. The top line also witnessed year-over-year growth of 80.5%. Importantly, TSLA reported an automotive gross margin of 32.9% and overall gross margin of 29.1% for the quarter. Further, operating margin came in at 19.2%. Tesla generated free cash flow of $2,228 million during the quarter, up a whopping 660% year on year. Long-term debt and finance leases — net of current portion on Dec 31, 2021 — totaled $3,153 million, down from $5,245 million as of the same date.

2.

Genuine Parts

reported first-quarter 2022 adjusted earnings of $1.86 per share, up 24% year over year. The bottom line also surpassed the Zacks Consensus Estimate of $1.70 per share. Higher-than-expected sales and operating profits across both its segments resulted in this

outperformance

. The company reported net sales of $5,294.6 million, surpassing the Zacks Consensus Estimate of $5,131 million. The top line is also higher than the year-ago quarter’s $4,465 million. The upside resulted from 12.3% growth in comparable sales and 8.1% benefit from acquisitions, partly offset by an unfavorable impact of foreign currency translation.

Genuine Parts had cash and cash equivalents worth $610.7 million as of Mar 31, 2022. Long-term debt increased to $3,387.8 million from $2,458 million recorded as of Mar 31, 2021. The company generated a free cash flow of $320.7 million in 2021. GPC projects revenues from automotive and industrial sales to witness a year-over-year uptick of 5-7% and 21-23%, respectively. Full-year adjusted earnings per share are envisioned in the band of $7.70-$7.85, higher than the previous forecast of $7.45-$7.60.

3.

Lithia r

eported first-quarter 2022 adjusted earnings of $11.96 per share, marking a whopping 103% increase from the prior-year quarter’s $5.89. The bottom line also beat the Zacks Consensus Estimate of $9.63 per share. Higher-than-expected revenues from new vehicle, used-vehicle (retail and wholesale) and fleet and others segments led to the upside. Total revenues jumped 54% year over year to $6,705.3 million. The top line also exceeded the Zacks Consensus Estimate of $6,031.8 million.

The company approved a dividend of 42 cents per share for first-quarter 2022, which

marks an increase from the previous payout

of 35 cents. Year to date, LAD has repurchased 515,130 shares at a weighted average price of $292.80. Nearly $572 million is remaining under its authorization. Lithia had cash and cash equivalents of $161.4 million as of Mar 31, 2022, down from $174.8 million on Dec 31, 2021. Long-term debt was $3,395.2 million, marking an increase from $3,185.7 million as of Dec 31, 2021.

4.

AutoNation

reported first-quarter 2022 adjusted earnings of $5.78 per share, which skyrocketed 103% year over year and topped the Zacks Consensus Estimate of $5.39. This outperformance can be primarily attributed to

higher-than-expected used vehicle sales

. For the reported quarter, revenues amounted to $6,752.8 million, up 14.4% year over year. The top line also outpaced the Zacks Consensus Estimate of $6,628.1 million.

AutoNation’s cash and cash equivalents were $608.1 million as of Mar 31, 2022, reflecting a sharp rise from $350 million in the year-ago period. The company’s liquidity was $2.4 billion, including $608 million in cash and nearly $1.8 billion availability under the revolving credit facility. The firm’s inventory was valued at $1,698.3 million. At first quarter-end, non-vehicle debt was $3,548.3 million. Capital expenditure for the quarter amounted to $50.8 million. During the reported quarter, AutoNation repurchased 3.5 million shares of common stock for an aggregate purchase price of $381 million. On Apr 19, it had around $376 million remaining for share buyback under the current authorization.

5.

Carvana

incurred a

loss of $2.89 per share

for first-quarter 2022, wider than the Zacks Consensus Estimate of a loss of $1.72 and the year-ago loss of 46 cents. First-quarter revenues of $3,497 million outpaced the Zacks Consensus Estimate of $3,400.3 million and surged 56% year over year. During the reported quarter, the number of used vehicles sold to retail customers grew 14% from the prior-year period to 105,185. Total gross profit amounted to $298 million, decreasing 12% year over year. SG&A expenses were $727 million, flaring up 45.4% from the prior-year quarter.

Carvana had cash and cash equivalents of $247 million as of Mar 31, 2022 compared with $403 million on Dec 31, 2021. Long-term debt amounted to $3,286 million as of Mar 31, 2022, up from $3,208 million recorded on Dec 31, 2021. Carvana currently carries a Zacks Rank #5 (Strong Sell).

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Price Performance

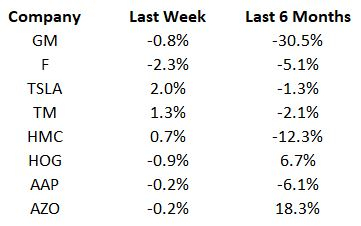

The following table shows the price movement of some of the major auto players over the past week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

Industry watchers will keep a tab on March 2022 commercial vehicle registrations to be released by the ACEA this week. Investors are also awaiting the quarterly releases of a host of auto biggies that are slated to report this week. Meanwhile, stay tuned for any update on how automakers will tackle the semiconductor shortage and make changes in business operations.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +25.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report