American Axle & Manufacturing Holdings, Inc.

AXL

recently entered into a definitive agreement to acquire Tekfor Group for an enterprise value of €125 million. The deal is expected to close in the second quarter of 2022 after standard approvals.

The buyout promises significant synergies for AXL and has the potential to diversify its geographic and customer sales mix and bolster its electrification portfolio. The purchase will also broaden its metal forming technologies to serve a wide range of customers globally.

Hausach, Germany-based Tekfor Group is renowned in automotive fasteners and metal-formed components for driveline, powertrain and E-mobility applications. Tekfor generated sales of approximately €285 million in 2021.

American Axle is making considerable progress across the electric drive space. Collaboration with Inovance and REE Automotive is set to fuel electrification revenues. Key electrification launches like its high-performance eDrive unit for a premium European OEM and multiple electric powertrain component launches, including one for electric pickup trucks and one for a commercial truck, also offer ample growth visibility.

In February, AXL pledged a $15 million investment in Autotech Ventures, an early-stage Silicon Valley venture capital firm targeting tech start-ups in the global ground transportation industry, to develop and produce efficient and powerful electric drivelines for the industry.

American Axle’s efforts of diversifying its business, products and customer base are generating impressive results. Optimization of its portfolio via buyouts and divestitures is enhancing American Axle’s portfolio. The acquisition of Metaldyne Performance Group has widened American Axle’s operating scale, customer base and end markets. Divestment of its U.S iron casting operations has improved its margin profile.

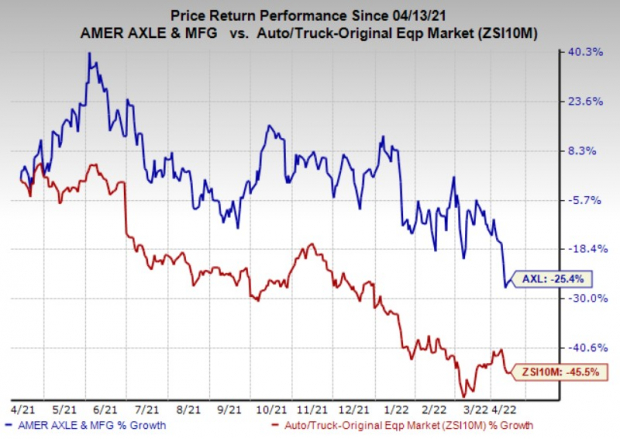

Shares of AXL have lost 25.4% over the past year compared with its

industry

’s 45.5% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

AXL currently carries a Zacks Rank #4 (Sell).

Better-ranked players in the auto space include

Tesla, Inc.

TSLA

and

Visteon Corporation

VC

, each carrying a Zacks Rank #2 (Buy), currently. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Tesla has an expected earnings growth rate of 44% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised around 4.4% upward in the past 60 days.

Tesla’s earnings beat the Zacks Consensus Estimate in all of the trailing four quarters. TSLA pulled off a trailing four-quarter earnings surprise of 33.3%, on average. The stock has risen 28% over the past year.

Visteon has an expected earnings growth rate of 104.3% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised around 9.4% upward in the past 60 days.

Visteon’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters and missed in the remaining. VC pulled off a trailing four-quarter earnings surprise of 209.9%, on average. The stock has declined 18.3% over the past year.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report