Microchip stocks have been unstoppable over the last few years, providing investors with a multitude of gains and rolling over any doubters along the way. With the rapid expansion of the digital world, we now rely heavily on this technology for everyday tasks, and it’s no secret that this is one of the hottest topics in the market. This week, the microchip space got even more interesting.

After making a splash with its acquisition of Xilinx, Advanced Micro Devices

AMD

is back on the offensive. Monday, it announced its plans to acquire Pensando, a developer of new edge services and programmable processors for enterprise and cloud computing to expand its Data Center Solution capabilities.

AMD saw high value within the acquisition, and that’s what we’re here to look at today. Let’s take a magnified view of Pensando, acquisition benefits, and analyze a few key financial metrics of AMD.

Pensando

CEO Prem Jain and the Pensando team will unite forces with AMD as part of the Data Center Solutions Group. Pensando has a stellar team of disruptive world-class expertise and a proven track record of innovation at the chip, software, and platform levels.

Pensando’s distributed services platform includes a high-performance, fully programmable packet processor and comprehensive software stack that accelerate networking, security, storage, and other services for cloud, enterprise, and edge applications.

Pensando’s products have already been deployed at scale across cloud and enterprise customers; a stacked list that includes Goldman Sachs

GS

, IBM Cloud

IBM

, Microsoft Azure

MSFT

, and Oracle Cloud

ORCL

.

By partnering with Pensando, Microsoft Azure VP Girish Bablani says, “We have seen a 40x improvement in overall cloud-based connection related performance. Pensando delivered this in less than 12 months. This partnership has enabled a transformational “limitless networking” shift that will ensure our customers have access to the highest performing products and services they expect from Microsoft Azure.”

Benefits

It’s crucial to have the ability to operate data centers at a massive scale efficiently, a primary reason why AMD took the acquisition head-on. Pensando claims that its robust programmable packet processor provides between 8x and 13x better performance than its rivals’ similar products. The processor controls how workloads move through hardware infrastructure, bouncing tasks off the CPU whenever able, considerably increasing efficiency. Obtaining this high level of efficiency is expected to propel AMD.

The acquisition comes at a time when Intel

INTC

and Nvidia

NVDA

have both expanded their portfolios; Intel has its infrastructure processing unit (IPU) and SmartNICs (network interface cards), and Nvidia has Bluefield DPUs (data processing units) and DPU-based SmartNics. However, these companies don’t have the cutting-edge system software Pensando provides, giving AMD an edge on two of its largest competitors.

Dr. Lisa Su, the highly distinguished CEO and chair of AMD re-iterated in a press release the importance of building a leading-edge data center with the best performance, security, flexibility, and lowest total cost of ownership. She says, “Today, with our acquisition of Pensando, we add a leading distributed services platform to our high-performance CPU, GPU, FGPA, and adaptive SoC portfolio.”

AMD

After peering into Pensando a little deeper and laying out a few of the acquisition perks, let’s take a deeper look into AMD’s financial performance by analyzing a few key metrics and summarizing the performance of the company’s latest earnings reports.

The company’s shares have been weathering the brutal sell-off within high-growth stocks, declining 28% year-to-date. However, it’s worth noting that the adverse price action has caused the company’s forward earnings multiple to slide down to 26.7X, a fraction of its 2021 November high of 67.8X and much lower than 2022’s January high of 63.1X. To me, the steep decline in valuation provides a rare opportunity to buy one of the best growth stories in the market at a deep discount.

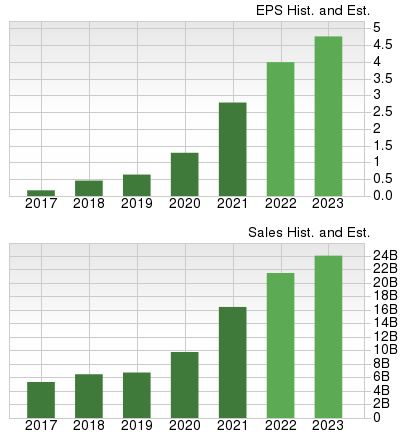

Image Source: Zacks Investment Research

Quarterly reports for AMD have been stellar, beating earnings estimates each time in its last four quarters by at least double-digit percentages and acquiring a four-quarter trailing average EPS surprise of a notable 17%. The company beat the $0.75 per share estimate by nearly 23% in its latest quarter, officially reporting EPS of $0.92. Additionally, AMD’s bottom line is forecasted to expand by a considerable 30% over the next three to five years.

Fueled by a surge in demand for its robust technology, AMD’s top line skyrocketed nearly 69% from 2020 to 2021. The company has crushed quarterly sales estimates, chaining together nine consecutive quarters of revenue beats dating back to October 2019. Furthermore, something that caught my eye is that the Zacks Consensus Sales Estimate for the current year reflects year-over-year top-line growth of nearly 31%. The company is clearly expected to grow, further displayed by its Growth Style Score of an A. AMD is a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

NVDA

Before concluding, let’s look at Nvidia

NVDA

, one of AMD’s biggest rivals. Nvidia sports a Zacks Rank #2 (Buy) with an overall VGM Score of a C.

Over the last 60 days, NVDA has seen its current full-year earnings estimate increase 7.5% to $5.55 per share, and the consensus estimate trend for next year has climbed 8%, reflecting full-year EPS of $6.37 per share.

NVDA has a four-quarter trailing average EPS surprise of 7%, and in its latest quarter, Nvidia beat earnings estimates by almost 9%, reporting EPS of $1.32 per share.

Final Thoughts

The acquisition bodes well for the company’s future direction and displays a commitment to consistently advancing and staying ahead of the curve. Additionally, it’s very healthy for the microchip space to remain competitive, as it is one of the most crucial industries moving forward on a global scale.

After a brutal start to 2022, shares have declined to an attractive buying level. Investors should be wary of the high-risk nature growth stocks carry during market weakness, but I still believe that AMD is an excellent investment that will continue to climb as the world further embraces the digital shift.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report