Stock splits are always an exciting announcement that investors can receive. Over the last several years, the strategy has quickly gained popularity among companies.

It’s important to realize that a stock split doesn’t affect a company’s valuation, but it does lower the price tag of each share, providing ease for the stock price to multiply once again and reward investors with a multitude of gains.

Additionally, it boosts liquidity within a company’s shares. With a lower price tag on shares, overall trading volume is increased – a critical factor in share movement.

Two prominent players in the market that have had meteoric rises over the last decade – Amazon

AMZN

and Alphabet

GOOGL

– both have upcoming stock splits planned.

Both companies will be performing a 20-for-1 split. AMZN and GOOGL undoubtedly noticed the significant barrier to entry caused by steep price tags on their shares, and they hope that the splits will alleviate this issue.

The announcements are something that investors of both companies can celebrate, as stock splits generally breathe new life into shares. Amazon’s split takes place this Friday, June 3

rd

, and Google’s split takes place a little later next month on July 15

th

.

However, it does raise a valid question: which company is a better place to park your cash pre-split? Let’s take a deeper look into both companies to find a more precise answer to this mighty difficult question.

Alphabet

Alphabet

GOOGL

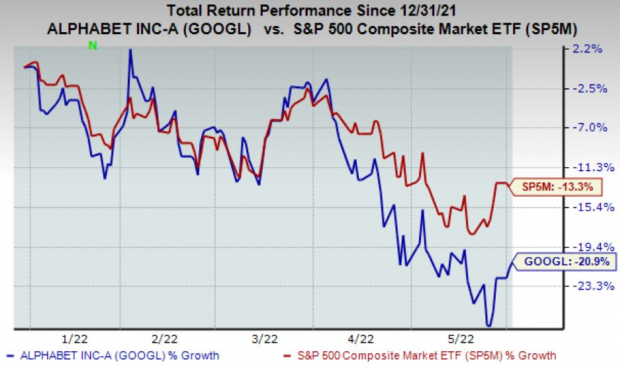

has evolved from primarily being a search engine into a company with operations in cloud computing, ad-based video and music streaming, autonomous vehicles, and more. Year-to-date, GOOGL shares have been a victim of the tech rout, declining nearly 21% and vastly underperforming the general market.

Image Source: Zacks Investment Research

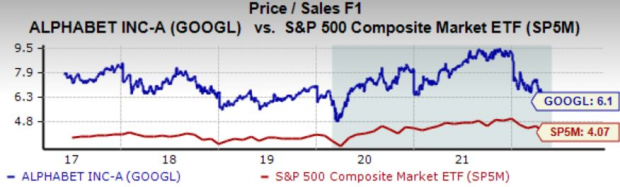

Looking at valuation levels, Alphabet’s current forward price-to-sales ratio of 6.1X represents a steep premium of 50% when compared to the S&P 500’s forward price-to-sales ratio of 4.1X. However, the value is well below its 9.5X high in 2021 and lower than its median of 7.2X over the last five years – marking a rich opportunity not seen in some time.

Image Source: Zacks Investment Research

Over the company’s last four quarters, it’s acquired an average EPS surprise in the double-digits of 17%. In its latest quarter, to the surprise of many, GOOGL reported EPS under expectations, snapping a streak of seven consecutive EPS beats.

Pivoting to forecasted bottom-line growth, the $26.66 per share estimate for the upcoming quarter reflects a slight shrinkage in the bottom-line of -2.2% from the year-ago quarter. However, the current full-year forecast shows that the $112.46 per share estimate displays a marginal expansion in the bottom line of 0.2% year-over-year.

Additionally, for FY23, the bottom line is forecasted to expand a sizable 18%.

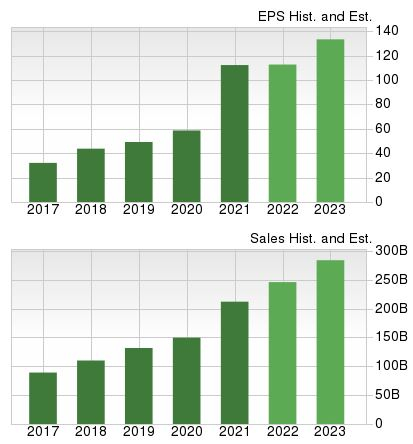

Top-line estimates display sizable year-over-year revenue growth as well. For FY22, the Zacks Consensus Sales Estimate resides at $246 billion, a 16% jump compared to FY21 sales of $212 billion. Additionally, GOOGL is forecasted to rake in $283 million in FY23, beefing up the top-line an additional 15%.

Image Source: Zacks Investment Research

Alphabet ranks as a Zacks Rank #3 (Hold).

Amazon

Amazon

AMZN

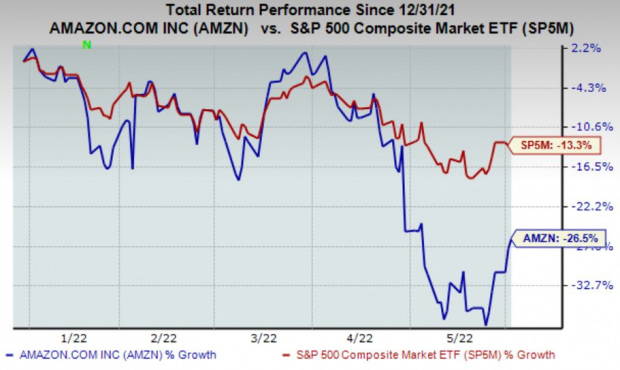

has evolved into an e-commerce titan with global operations. The company also enjoys a very dominant position within cloud computing with its Amazon Web Services (AWS) operations. AMZN shares have plummeted year-to-date, falling nearly 27% in value and vastly underperforming the general market.

Image Source: Zacks Investment Research

The e-commerce titan’s forward price-to-sales ratio has crept all the way down to 2.3X, representing a deep 41% discount relative to the S&P 500’s value. Additionally, the value is nowhere near 2020 highs of 4.8X and is nicely below the median of 3.3X over the last five years.

Image Source: Zacks Investment Research

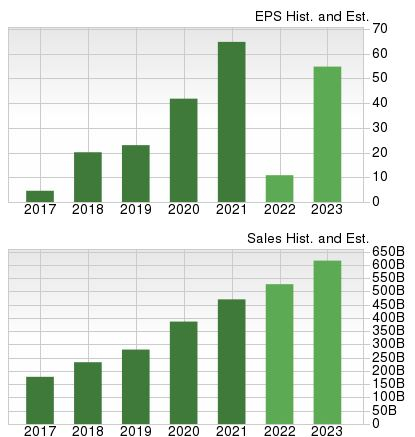

Quarterly reports for AMZN have provided mixed bottom-line results over the last four quarters, but the company has acquired an average EPS surprise of a sizable 140%. It’s worth noting that AMZN missed EPS estimates by a very concerning 51% in its latest quarter and shook the entire market.

Looking at bottom-line growth, the $4.63 per share earnings estimate for the upcoming quarter reflects a concerning 70% decline in the bottom-line from the year-ago quarter. The FY22 EPS estimate isn’t looking too hot either – the $10.85 per share estimate represents a massive 83% decline in earnings year-over-year.

However, for FY23, earnings are forecasted to skyrocket a jaw-dropping 405%.

Revenue estimates show top-line strength. For FY22, Amazon is pegged to rake in $526 billion in revenue, increasing 12% compared to FY21 sales of $469 billion. Additionally, the Zacks Consensus Sales estimate for FY23 resides at $614 billion, marking a 16% increase compared to FY22’s revenue estimate.

Image Source: Zacks Investment Research

Amazon ranks as a Zacks Rank #5 (Strong Sell).

Bottom Line

Both companies are absolute powerhouses within the market. Providing investors with serious market-beating gains over the years has been just one of the reasons that investors have loved these stocks so much.

However, there’s always a winner – and this one is excruciatingly hard to pick.

First, I believe that both companies will continue to be long-term winners in the future for some foreseeable time – this is hardly a debate.

Amazon has become the top dog in cloud computing, one of the fastest-growing industries, and has a chokehold on the e-commerce market. Then there’s Alphabet, which has become so intertwined within the internet that it’s difficult to imagine the world without it.

This time around, I believe that Alphabet delivers the final punch.

Here’s why – GOOGL is positioned better than AMZN currently is, top and bottom-line estimates show sizable growth across multiple timeframes, it has more diverse business operations, and quarterly results have been more consistent.

Additionally, and most importantly, GOOGL currently has a much more attractive Zacks Rank than AMZN does.

How to Profit from the Hot Electric Vehicle Industry

Global electric car sales in 2021 more than doubled their 2020 numbers. And today, the electric vehicle (EV) technology and very nature of the business is changing quickly. The next push for future technologies is happening now and investors who get in early could see exceptional profits.

See Zacks’ Top Stocks to Profit from the EV Revolution >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report