Note: The following is an excerpt from this week’s

Earnings Trends

report. You can access the full report that contains detailed historical actual and estimates for the current and following periods,

please click here>>>

The picture emerging from the Q4 earnings season is one of continued strength and momentum. Despite the well-known headwinds of cost pressures and logistical bottlenecks, an above-average proportion of companies have been able to beat estimates.

In fact, the proportion of companies beating consensus revenue estimates is actually tracking above what we had seen in the preceding earnings season from this same group of companies, with the earnings beats nearly the same.

On the guidance front, while a few notable operators stand out for providing a weak outlook, most companies have been able to offer reassuring, if not altogether positive, guidance. This is helping stabilize the revisions trend that had started going modestly negative in 2021 Q4. We are seeing this favorable development with estimates for the current period (2022 Q1) as well as full-year 2022.

The stock market setup appears to have been particularly favorable for the 2021 Q4 earnings season. We feel that market participants will be pleasantly surprised to see impressive results after watching those stocks experience significant weakness in recent days on Fed-related worries. We have seen this favorable setup in play with the strong Microsoft

MSFT

, Apple

AAPL

and Alphabet

GOOGL

results helping those mega-cap stocks show impressive rebounds.

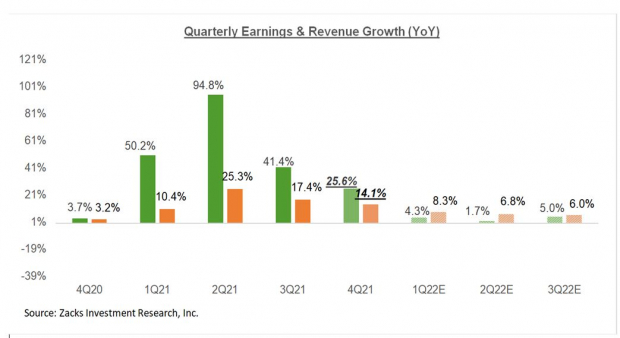

Looking at Q4 as a whole, total earnings for the quarter are expected to be up +25.6% from the same period last year on +14.1% higher revenues. The growth pace decelerates significantly in the following periods, as you can see in the chart below that provides a big-picture view of earnings on a quarterly basis.

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture on an annual basis, with the growth momentum expected to continue.

Image Source: Zacks Investment Research

We remain positive in our earnings outlook, as we see the overall growth picture steadily improving, as Omicron’s effects start easing and the near-term logistical issues get addressed.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +25.3% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report