Note: The following is an excerpt from this week’s

Earnings Trends

report. You can access the full report that contains detailed historical actual and estimates for the current and following periods,

please click here>>>

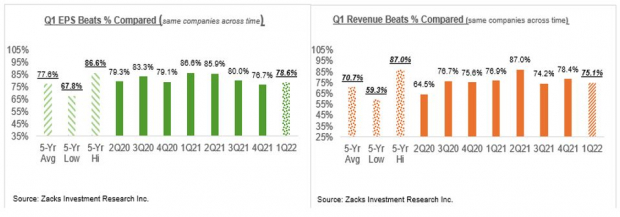

While the Q1 earnings season has been fairly good and reassuring in most respects, we have nevertheless been struck by major companies’ inability to beat consensus estimates.

This issue was particularly notable for the Finance sector, where most of the major players missed estimates, though beats became more widespread as the Q1 reporting cycle matured.

You can see this in the EPS and revenue beats percentages for the 454 S&P 500 members that have reported Q1 results already.

Image Source: Zacks Investment Research

Rising costs and logistical bottlenecks have been weighing on margins, with Q1 net margins for the 454 index members that have reported down 58 basis points from the year-earlier period. Q1 net margins are below the year-earlier level for half of the 16 Zacks sectors, including the Technology sector.

For the Big 5 Technology players – Apple

AAPL

, Microsoft

MSFT

, Amazon

AMZN

, Meta

FB

and Alphabet

GOOGL

– Q1 earnings declined -8.4% on +11.4% higher revenues. This implies 421 basis-point net margin compression for these Tech giants, with the biggest declines at Alphabet and Meta, followed by Amazon.

Looking at Q1 as a whole, total S&P 500 earnings are expected to be up +9.3% on +13.4% higher revenues. This is a significant deceleration from what we have been seeing in the preceding quarters, as you can see in the chart below that provides a big-picture view of earnings on a quarterly basis.

Image Source: Zacks Investment Research

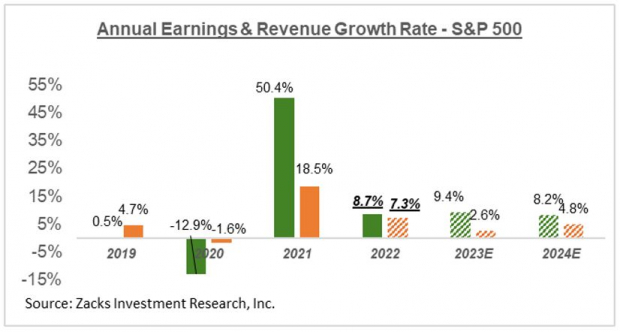

The chart below shows the overall earnings picture on an annual basis, with the growth momentum expected to continue.

Image Source: Zacks Investment Research

There is a rising degree of uncertainty about the outlook, being driven by a lack of macroeconomic visibility in a backdrop of Fed monetary policy tightening.

The Ukraine situation is exacerbating pre-existing supply-chain issues, which combined with its impact on oil prices, is weighing on the inflation situation in hard-to-predict ways. The evolving earnings revisions trend will reflect this macro backdrop.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report