MoviePass Shares Down: It was always too good to be true.

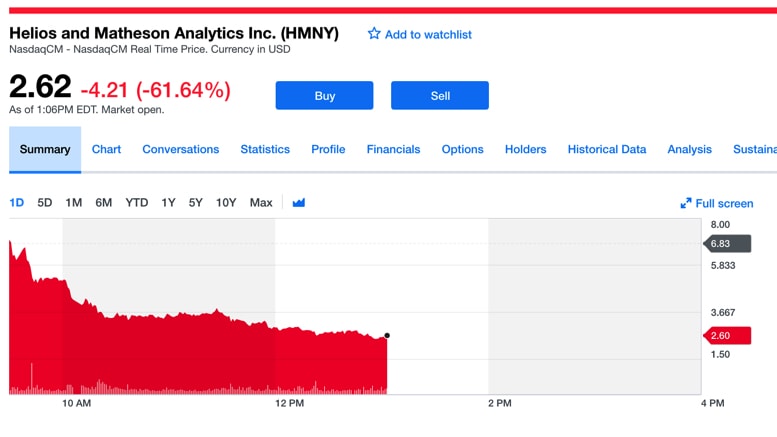

MoviePass parent Helios and Matheson Analytics Inc. (NASDAQ:HMNY) is currently dealing with a MASSIVE -60.95% stock drop.

A “service interruption” occurred yesterday due to the companies inability to make its required payments to its vendors.

Now, the company is now trying to raise $6.2 million capital to pay its debts.

MoviePass Shares Down, What Happened?

Earlier this week, the company’s stock began tumbling as it implemented a 1-to-250 reverse stock split, but the stock has fallen dramatically since then, falling from over $20 to $3.50 a share.

But MoviePass has been struggling for months; accused of burning through its cash holdings, it disclosed in an April filing with the SEC that there was “substantial doubt” expressed by an auditor on its ability to continue. The company’s average cash deficit was $21.7 million a month from September 2017 to April 2018.

On Top of the World

Only last October, Helios and Matheson Analytics Inc. saw it’s share price shoot up from $2.50 to $32.90 in less than a month. The reason? The company had acquired a large stake in the MoviePass service which at the time was considered the next big thing in film viewing.

It made the decision to slash the MoviePass monthly fee from $50 a month to only $9.95, and its subscriber base ballooned as a result, jumping from a paltry 20,000 members to over 3 million come June.

MoviePass Shares Down, A Business Model Too Good to be True

But $9.95 was a price far too good to be true and as the company soon discovered, letting people see a lot of movies for a little money did not come cheap.

As a MoviePass subscriber, a flat fee of $9.95 would allow you to see a movie-a-day for that month. Helios and Matheson would pick up the tab for every ticket ordered under that subscription. The result was that it was impossible for MoviePass to make a profit from the subscription service itself; the more subscribers go to the movies, the more money the company has to pay out for cinema tickets.

It has since tried to increase the price for this subscription service whilst simultaneously reducing the perks of it which as only infuriated its customers.

>>Bridgepoint Education Soars 50% After Q2 Earnings—Why?

It now claims it is actually banking on user data to bring in the profits and NOT the subscription service. The company hopes that its massive subscriber base will provide user-data that can be used to sell advertisements and help drive box-office revenue, allowing the company to strike revenue-sharing and bulk-ticket deals with studios and cinemas.

But as it stands, it is not working, analysts say.

“They’re giving away dollars for quarters,” said Michael Pachter, managing director of equity research at Wedbush Securities.

“That’s just a terrible business model”.

Featured Image: Deposit Photos/skab3txina