Apple

AAPL

shares jumped 4.86% in the last trading session, part of the big rally that followed Fed Chair Powell’s signal that interest rates were going to rise at a slower clip, probably starting this month, and probably resulting in the soft landing that we are all hoping for.

Rates are at 3.75-4% right now, and now they could end up at 5% or higher. And then, they’re going to hold there for as long as it takes to get inflation down. That’s a bitter pill, but easier to swallow because it’s old news.

Of course, moderation is good for the stock market, which has also been absorbing the drop in job openings, which is seen as a signal that Fed actions are getting us somewhere. Inflation numbers will be out later today, so there’s no doubt that there will be some reaction to that, as well.

Inflation should hurt Apple, which sells this ultra-premium device, and some analysts have said that it could temper sales next year. You don’t have to change your phone after all when you’re seeing your savings melt away. Unless you have to.

But it would be a mistake to read Apple quarter to quarter. The company has a fairly captive user base that has so much stuff on its cloud, music and other apps that it’s really hard to switch even if you think that they’re being a bully [Tesla

TSLA

, Spotify

SPOT

, Meta

META

are certainly asserting this last issue]. And its devices are pretty much the best available, so there just isn’t much of an incentive to switch.

Therefore, even if people don’t buy or upgrade with Apple in the near term, they will likely eventually get around to it. The robust services business will continue to generate significant revenues and the cash hoard can always come in handy.

What should have weighed on the shares, however, is the unrest within China because that’s where its devices are put together. If its Chinese factories are not functional, and that’s how things appear to be right now, Apple simply won’t have enough product on the shelves. So Apple may give us a warning soon and estimates may have to be reset. Estimates have been coming down over the past quarter, and further downward revisions may be in the cards.

Unfortunately, the Fed is not giving us the pullback that would make Apple shares worth buying. Despite the deteriorating earnings scenario, Apple shares trade at a 23.3X P/E multiple, a 28% premium to the S&P 500 and a 7% premium to the technology sector. They are also trading at a 6% premium to their median level over the past five years. Therefore, the shares are not cheap.

Zacks has a #3 (Hold) rating on the shares and it seems like a good idea to wait for a better entry point.

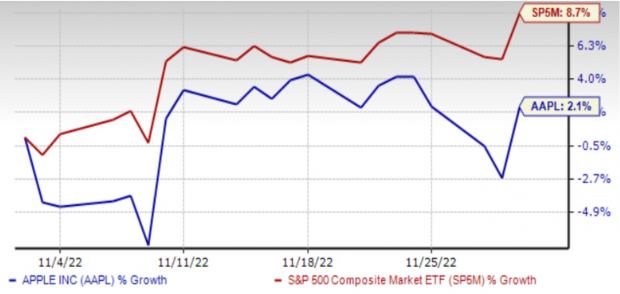

One-Month Price Performance

Image Source: Zacks Investment Research

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report