Transocean Ltd.

RIG

formed a joint venture with Intellilift to commercialize products and services based upon a digital well construction solution, which the companies are currently developing.

The joint venture, which will be known as Inteliwell, is intended to incorporate digital systems for well construction, drilling control, and real-time data monitoring. Intellilift, a subsidiary of Norway-based industrial technology group Nekkar, will own a 33% ownership interest in the partnership.

The digital well construction solution will connect with the drilling rig’s control system to implement tasks independently per the well plan, which is designed to accelerate the well construction process. Beside this, an integrated real-time monitoring platform will measure downhole progress and evaluate the well conditions to provide important and precision-enhancing feedback to the drilling control system.

Intellilift has digitized and advanced increased automation and remote-controlled operations in offshore vessels and drilling rigs. The company will provide development resources, licenses for existing software and other services into the joint venture, which has been created as a separate entity. Intellilift did not reveal any capital contributions to the joint venture.

With the formation of the joint venture, Intellilift is likely to benefit from Transocean’s global footprint and well construction skills. The partnership aims to provide software solutions to enable operators to continue improving the consistency of operations, while reducing drilling expenses through more reliable and faster drilling operations.

Company Profile & Price Performance

Switzerland-based Transocean is one of the world’s largest offshore drilling contractors and leading providers of drilling management services.

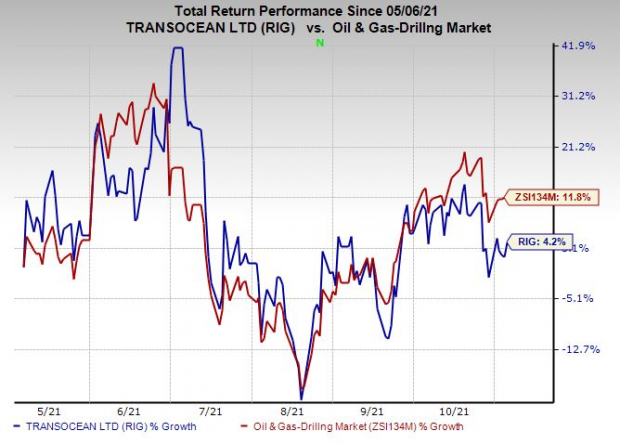

Shares of the company have underperformed the

industry

in the past six months. The stock has gained 4.2% compared with the industry’s 11.8% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Transocean currently has a Zacks Rank #3 (Hold).

Some better-ranked players in the energy space are

Diamondback Energy

FANG

,

Chesapeake Energy

CHK

and

Range Resources Corporation

RRC

, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Diamondback’s bottom line for 2021 is expected to surge 60.9% year over year.

Chesapeake’s bottom line for 2021 is expected to increase 12.3% year over year.

Range Resources’ bottom line for 2021 is expected to surge 73.2% year over year.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report