A recurring theme this earnings season has been supply-chain woes and shortages of essential inputs, as well as labor, with not even the mighty Apple

AAPL

and Amazon

AMZN

immune from the issues.

Of the ‘Big 5’ Tech players – Apple, Amazon, Alphabet

GOOGL

, Facebook

FB

& Microsoft

MSFT

– these challenges caused Apple and Amazon to miss estimates, while it was a non-issue for Alphabet and Microsoft. Facebook would have been in the latter camp as well, but it was dealing with some platform-specific issues in the quarter.

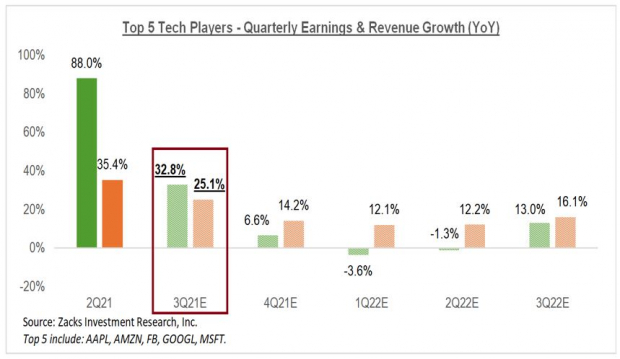

Looking at this elite group of five ‘Big Tech’ players as a whole, these companies earned $69.1 billion in earnings in the September quarter on $322.1 billion in revenues. This group’s Q3 earnings and revenues are up +32.8% and +25.1% from the year-earlier period, respectively

Take a look at the chart below that shows current consensus expectations for this group for the coming periods in the context of what they were able to achieve in 2021 Q3 and the preceding period.

Image Source: Zacks Investment Research

What we see here is that growth is decelerating in a major way, even if we account for some upward revisions estimates in the coming days.

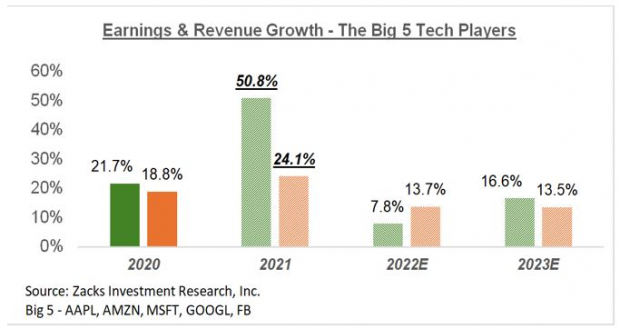

This is a very short-term view of this group as all of these companies are still capable of generating impressive growth by most conventional standards in the long run. You can see this long-term growth trajectory in the chart below that shows the group’s earnings and revenue on an annual basis.

Image Source: Zacks Investment Research

Look at the chart and note the growth trend from 2022 to 2023. In other words, whether the growth trend for these companies is decelerating or not is a function of your holding horizon. These companies are impressive growth engines in the long run.

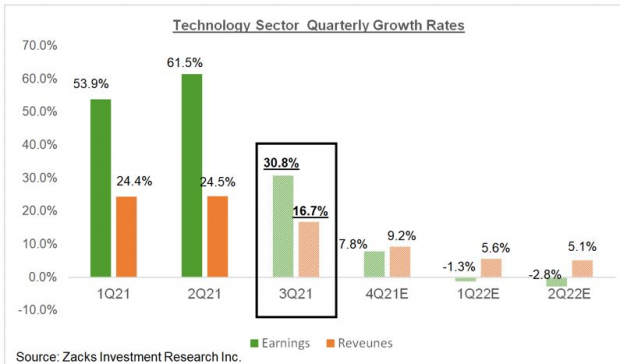

Beyond the big 5 Tech players, total Q3 earnings for the Technology sector as a whole, are expected to be up +30.8% from the same period last year on +16.1% higher revenues. The chart below shows the sector’s Q3 earnings and revenue growth expectations in the context of where growth has been in recent quarters and what is expected in the coming four periods.

Please note that the Q3 earnings and revenue growth rates are the ‘blended’ growth rates, meaning that combines the actual results that have come out already with estimates for the still-to-come companies.

Image Source: Zacks Investment Research

This big picture view of the ‘Big 5’ players, as well as the sector as whole shows a decelerating growth trend.

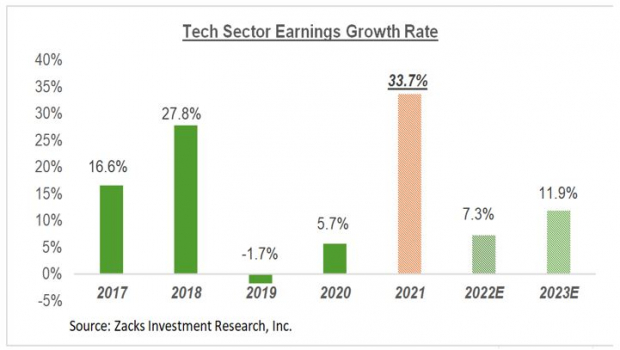

That said, unlike this ‘quarterly view’, the annual picture shows a lot more stability.

Image Source: Zacks Investment Research

Q3 Earnings Season Scorecard

Including all the results that came out through Friday, October 29

th

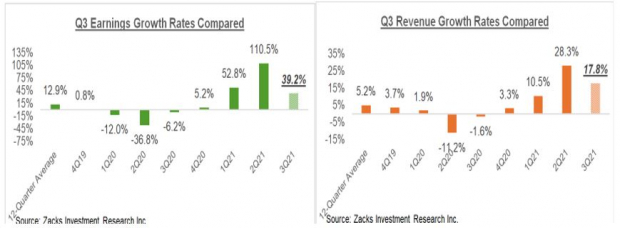

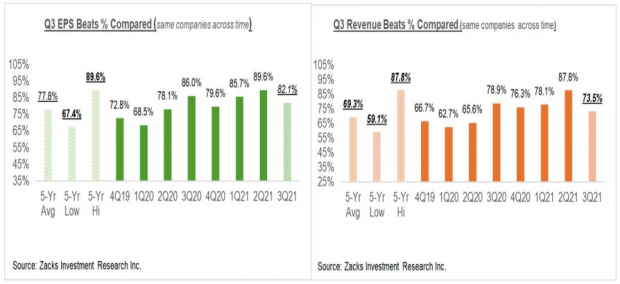

, we now have Q3 results from 279 S&P 500 members or 55.9% of the index’s total membership. Total earnings (or aggregate net income) for these 279 companies are up +39.2% from the same period last year on +17.8% lower revenues, with 82.1% beating EPS estimates and 73.5% beating revenue estimates.

The two sets of comparison charts below put the Q3 results from these 279 index members in a historical context, which should give us a sense of how the Q3 earnings season is tracking at this stage relative to other recent periods.

The first set of comparison charts compare the earnings and revenue growth rates for these index members.

Image Source: Zacks Investment Research

The second set of charts compare the proportion of these 279 index members beating EPS and revenue estimates.

Image Source: Zacks Investment Research

As you can see from the above comparison charts, the Q3 numbers not only represent a growth deceleration from the first half’s blistering pace, but also in terms of the beats percentages.

For the

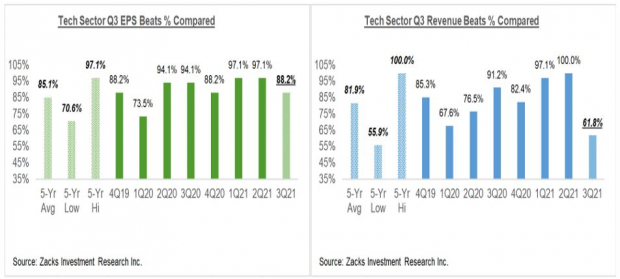

Technology sector

, we now have Q3 results from 76.3% of the sector’s market capitalization in the S&P 500 index. Total Q3 earnings for these Tech companies are up +37% from the same period last year on +18.6% higher revenues, with 88.2% beating EPS estimates and 61.8% beating revenue estimates.

The comparison charts below put the sector’s Q3 EPS and revenue beats percentages in a historical context.

Image Source: Zacks Investment Research

The revenue beats percentages show that Apple and Amazon are hardly the only companies that struggled to beat estimates.

Expectations for Q3 & Beyond

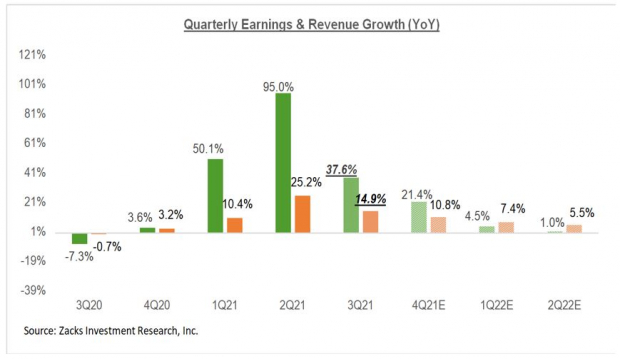

Looking at the quarter as a whole, combining the actual results that have come out with estimates for the still-to-come companies, total Q3 earnings for the S&P 500 index are expected to be up +37.6% from the same period last year on +14.9% higher revenues. The growth rate has started going up as companies come out with better-than-expected results.

The chart below presents the earnings and revenue growth picture on a quarterly basis, with expectations for 2021 Q3 contrasted with the actual growth achieved over the preceding four quarters and estimates for the following three.

Image Source: Zacks Investment Research

The chart below shows the revisions trend for the current period (2021 Q4).

Image Source: Zacks Investment Research

The chart below shows the comparable picture on an annual basis.

Image Source: Zacks Investment Research

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>>

A Very Strong & Improving Earnings Picture

Tech IPOs With Massive Profit Potential:

Last years top IPOs surged as much as 299% within the first two months. With record amounts of cash flooding into IPOs and a record-setting stock market, this year could be even more lucrative.

See Zacks’ Hottest Tech IPOs Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report