The big banks got us off to a flying start in this Q3 earnings season, but we will get a true sense of how good or otherwise the corporate profitability picture is after seeing the coming week’s reporting docket. It goes beyond the Finance sector and includes reports ranging from

Netflix

NFLX

,

Tesla

TSLA

and

Snap

SNAP

to

Johnson & Johnson

JNJ

,

Procter & Gamble

PG

and

Intel

INTC

. In total, this week will bring results from more than 200 companies, including 73 S&P 500 members.

This week’s lineup of results will give us fresh insights on the most important issue weighing on the earnings picture at present, namely inflationary trends and developments on the logistics/supply-chain front. The banks aren’t as directly exposed to these issues as P&G and Tesla are. That said, some of the bank leaders see these issues as transitory, and expect them to be worked out over time.

With respect to bank earnings, not only have the reported numbers turned out to be stronger than expected, but managements have provided reassuring comments about trends in core banking activities that have been muted in recent quarters. The group’s investment banking businesses were on fire, offsetting tough comparisons on the trading front.

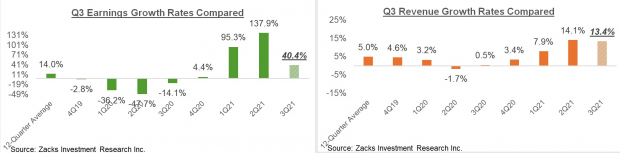

Including all the results that came out through Friday, October 15th, we now have Q3 results from 41 S&P 500 members, or 8.2% of the index’s total membership. Total earnings (or aggregate net income) for these 41 companies are up +40.4% from the same period last year on +13.4% lower revenues, with 85.4% beating EPS estimates and 70.7% beating revenue estimates.

The two sets of comparison charts below put the Q3 results from these 41 index members in a historical context, which should give us a sense how the Q3 earnings season is tracking at this stage relative to recent periods.

The first set of comparison charts compare the earnings and revenue growth rates for these 41 index members:

Image Source: Zacks Investment Research

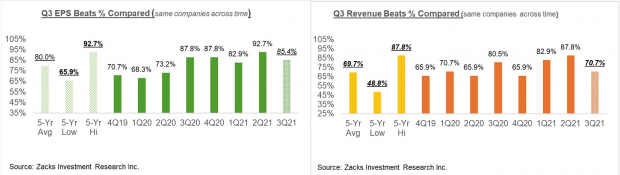

The Finance sector is heavily represented in the results at this stage. For the Finance sector, we now have Q3 earnings from 40.6% of the sector’s market cap in the S&P 500 index. Total earnings for these Finance sector companies are up +42.2% on +9.9% higher revenues, with 92.9% beating EPS estimates and 78.6% beating revenue estimates.

Reported Q3 earnings growth drops to +36.9% on an ex-Finance basis.

The second set of charts compare the proportion of these 41 index members beating EPS and revenue estimates:

Image Source: Zacks Investment Research

I had started getting worried about the revenue numbers at the start of Q3 earnings season, but the picture has notably improved since then, as you can see above.

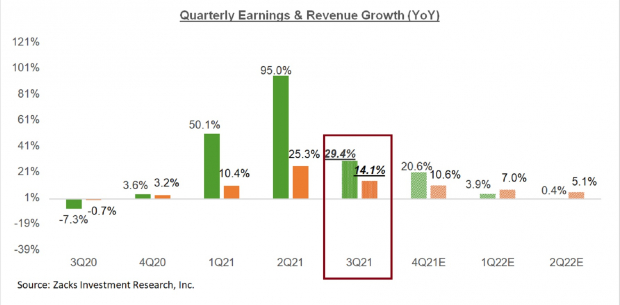

Expectations for Q3 & Beyond

Total Q3 earnings for the S&P 500 index are expected to be up +29.4% from the same period last year on +14.1% higher revenues. The growth rate has started going up as more companies come out with better-than-expected results.

The chart below presents the earnings and revenue growth picture on a quarterly basis, with expectations for 2021 Q3 contrasted with the actual growth achieved over the preceding four quarters, and estimates for the following three:

Image Source: Zacks Investment Research

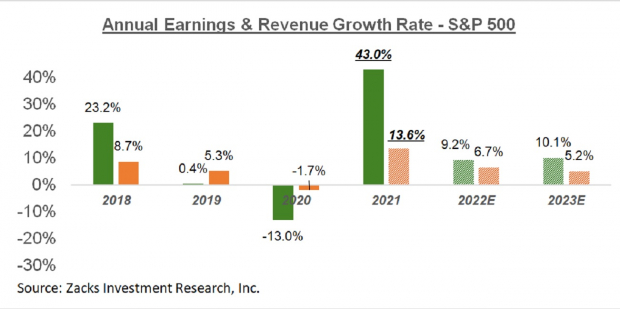

The chart below shows the comparable picture on an annual basis:

Image Source: Zacks Investment Research

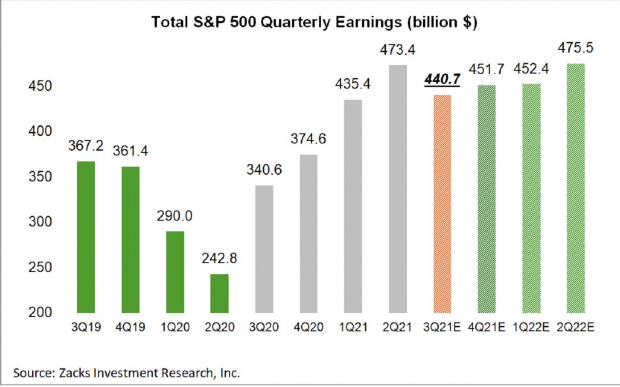

We mentioned earlier how the aggregate 2021 Q2 earnings tally represented a new all-time quarterly record:

Image Source: Zacks Investment Research

We all know that large segments of the economy — particularly in the broader leisure, travel and hospitality spaces — are held down by the pandemic, with companies in these areas still earning significantly less than they did in the pre-Covid period. In fact, many of these companies aren’t expected to get back to pre-Covid profitability levels for almost another full year.

The impressive feature of the record earnings in each of the last two quarters is that they were achieved without help from these key parts of the economy.

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>

Solid Start to Q3 Earnings Season

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report