Are These The Best Growth Stocks To Buy In The Stock Market Today?

The

U.S. stock market

can be quite a difficult place to navigate these days. The volatility driven by worries about inflation and the persistence of COVID-19 have kept investors at the edge of their seats. After a turbulent September, investors are also concerned about the Fed’s tapering in the coming months, which could put

growth stocks

under pressure. Not to mention, matters relating to the debt ceiling and government shutdown have likely contributed to the pullback.

Amidst all this chaos though, lies opportunities. It may appear that Wall Street has turned away from seemingly risky investments in favor of more stable value plays. But some investors simply take the opportunity to look for the best growth stocks to buy on dips. And many of the notable growth names in the

stock market today

are stemming from the tech industry.

Now, we are not just going to talk about any tech stocks with potentially good prospects. Instead, we are looking for

best growth stocks to buy

that have reported blowout quarterly results, have a strong balance sheet and strong forward guidance. The share prices of these fundamentally strong companies have recently taken a dive amid the market downturn. Having said that, could investors position themselves for significant returns by picking up these growth stocks at a discount now?

Best Growth Stocks To Watch Right Now

-

Teladoc Health, Inc.

(

NYSE: TDOC

) -

Lucid Group, Inc.

(

NASDAQ: LCID

) -

Semrush Holdings, Inc.

(

NYSE: SEMR

) -

Futu Holdings Limited

(

NASDAQ: FUTU

)

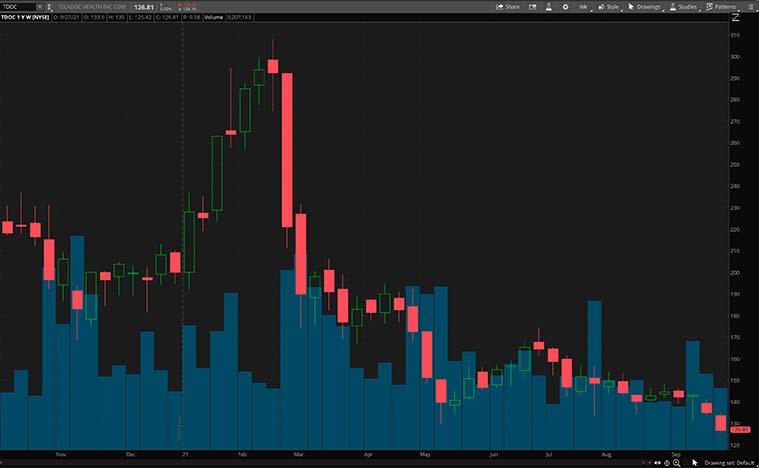

Teladoc Health

Teladoc

is a company primarily specializing in providing telehealth services. Besides, the company also offers healthcare-related services revolving around medical opinions, artificial intelligence and analytics, and telehealth devices. Thanks to all of this, Teladoc is now a leading name in the virtual care industry. With the broader market continuing to slide, TDOC stock eked out a slight gain on Thursday. That’s after the company announced that it has ranked no.1 among direct-to-consumer (DTC) companies in the J.D. Power 2021 U.S. Telehealth Satisfaction Study.

Overall, the current case for Teladoc would be the relevance of its general public offerings amidst the pandemics. Accordingly, its contactless telehealth solutions would be favorable during such times. Despite all of this, some investors could be considering the long-term potential of TDOC stock post-pandemic. To remedy this, Teladoc appears to be hard at work expanding its partnerships in the medical world.

Last month, Teladoc started working with Proximie, a health tech platform operator focusing on digitizing operating rooms. Through this collaboration, Teladoc users can conduct virtual surgical mentoring and proctoring while providing technical support. All in all, would you consider TDOC stock a top buy now?

[Read More]

Top Stocks To Buy Now? 4 Renewable Energy Stocks For Your Watchlist

k

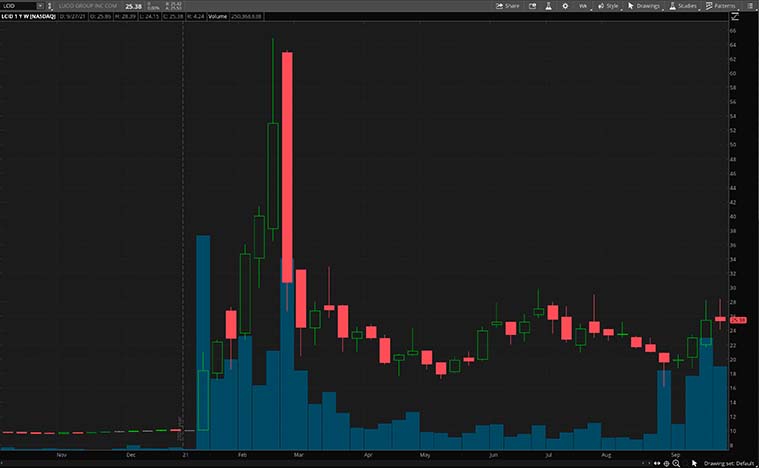

Lucid Group

Lucid Group

is coming out as one of the hottest growth stocks in what is otherwise a turbulent September. If you missed out on

Tesla

(

NASDAQ: TSLA

), many are viewing Lucid as Tesla 2.0. Lucid may have bold dreams. But with its strong team and underlying technology, it’s not surprising to me why some choose to hold on to their beliefs on LCID stock.

Just this week, Lucid hosted its highly anticipated production preview week in Arizona, for the first time. EV enthusiasts had the chance to tour the factory and see Lucid’s technology first-hand. What’s more, some of them were also able to test-drive its much-awaited luxury sedan, the Lucid Air. While a lot of the attention is on luxury electric vehicles itself, that’s only the tip of the iceberg. Here’s why.

If you have been paying attention during the investor presentation, you would also pick up that Lucid doesn’t just want to make electric vehicles. Instead, they aim to leverage their market-leading battery technology to sell energy storage systems. Or simply supply some of the components to other futuristic industries such as flying cars. With the EV space constantly dominated by Tesla, will the Lucid Air give Elon Musk a run for his money?

[Read More]

Best Lithium Battery Stocks To Buy Now? 4 To Know

Semrush Holdings

Coming up next,

Semrush

is a company that creates tools for digital marketing. The company started in 2008 as a single-point solution for search engine marketing. It has since expanded into a wide array of marketing services. If you’re running a new business, the services from Semrush could offer you a better relationship with your prospective customers. After all, in order to succeed in today’s digital world, you will need to master these online marketing tools to get your products and services out there.

Also, the company recently announced an integration with

monday.com

(

NASDAQ: MNDY

), a leading cloud-based work operating system. Through this integration, customers can have real-time keyword insights powered by Semrush, without leaving the monday.com interface. For monday.com, this integration will allow their customers to achieve even more with their platform and help diversify their customization capabilities.

From its most recent quarter, Semrush’s revenue came in 58% higher year-over-year to $45 million. And the company expects the momentum to continue even in the current quarter. Earlier this week, Semrush announced that Canadian businesses now have access to its Listing Management tool. With the tool, businesses are able to use a single resource to manage their online presence and optimize online visibility. With its recent pullback along with the broader market, would now be a good time to scoop up SEMR stock at a discount?

[Read More]

3 Top Pot Stocks To Watch After The SAFE Banking Act Update

Futu Holdings

To sum up the list, we will be taking a look at

Futu

. The Hong Kong-based fintech company offers digitized brokerage and wealth management services. Through its advanced fintech offerings, Futu brings seamless investing experiences to users. This is evident as Futu facilitates stock trading and clearing, margin financing, and market data analysis among other wealth management solutions.

As more new investors are climbing on board booming stock market trends like meme stocks, it would put Futu and

Up Fintech

(

NASDAQ: TIGR

) in a strong position to benefit. With the current weakness of these Chinese growth stocks, it appears to me that they have reached the oversold territory. Sure, the government crackdown on various industries and the debt crisis at China Evergrande may have sent investors fleeting. But nothing is specifically pointing toward these online brokerages, yet.

Considering Futu’s strong fundamentals, it’s certainly tempting for investors to take a closer look at its stock. In its latest quarter, revenue came 129.3% higher year-over-year to $203.1 million. And that represented the sixth straight quarter the company has posted triple-digit sales growth. And the company is not resting on its laurels just yet. Futu and

Sea Limited

’s (

NYSE: SE

) e-commerce platform Shopee have recently launched a promotion campaign in Singapore. In detail, Shopee users there can stand a chance to win free stocks and get introduced to Futu’s platform. With all these developments, would FUTU stock make your list of best growth stocks to buy right now?