Bitcoin surpassed the psychological barrier of $50,000 on Aug 22 for the first time in the past three months. The world’s largest cryptocurrency hit a 24-hour high of $50,495.95. It is up 7.9% in the past seven days and 70.6% year to date.

Bitcoin is having a rocky 2021, hitting an all-time high of $64,829.14 on Apr 14 and then briefly dropping to $28,600 on Jun 22. It is currently trading at $49,605.02, down 1.4% on a 24-hour basis and

23.5% from the all-time high

, per coindesk.com data.

Bitcoin’s latest rally can be attributed to growing mainstream adoption of cryptocurrencies.

PayPal

’s

PYPL

announcement that is now offering its crypto service in the U.K. is expected to be a game changer for the cryptocurrency market.

PayPal introduced crypto service for its U.S. customers in October 2020. The Zacks Rank #3 (Hold) company will allow U.K. customers to buy, sell and hold bitcoin, ether, litecoin and bitcoin cash on its platform.

Apart from PayPal,

Square

SQ

is now planning to launch new financial services products based on bitcoin. This Zacks Rank #3 company is launching a business dedicated to decentralized financial services or DeFi, using bitcoin. The division is likely to include Seller, Cash App and Tidal businesses. Square also announced its

plans to build a non-custodial bitcoin

hardware wallet.

Square CEO Jack Dorsey along with

Tesla

’s

TSLA

CEO Elon Musk has been a frontrunner in endorsing bitcoin. Dorsey’s enthusiasm for bitcoin led Square to invest $50 million in October 2020, which represented 1% of the company’s total assets at that time. He along with rapper Jay Z also created a bitcoin development fund by investing 500 bitcoins.

Meanwhile, Tesla revealed its investments worth $1.5 billion into bitcoin in February. The EV giant also started accepting bitcoin as payment for its cars in March only to stop in May, citing environmental issues due to usage of fossil fuels in mining bitcoin. However, Musk in July stated that Tesla might again start accepting bitcoin for car purchases as usage of renewable energy increases in mining.

Markedly, per a CNBC report, which cited new data from Cambridge University, the United States has rapidly evolved as the

second-biggest mining destination

for miners, accounting for roughly 17% of all the world’s bitcoin miners as of Apr 21, 2021, up 151% from September 2020. The United States offers the cheapest sources of renewable energy, which is making it attractive for bitcoin miners.

Bitcoin is also benefiting from interest shown by hedge funds. Hedge fund bigwigs like Paul Tudor Jones, Daniel Loeb, Ray Dalio, Anthony Scaramucci and Alan Howard have expressed their enthusiasm over bitcoin’s ability to replace gold and become an effective hedge against inflation.

These Stocks Jump on Bitcoin Rally

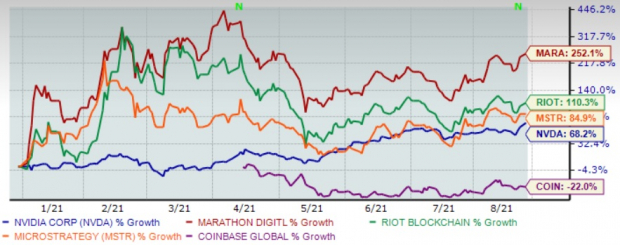

Bitcoin’s latest rally drove crypto-oriented stocks.

NVIDIA

NVDA

and

Marathon Digital

MARA

rose 5.4% and 4.3%, respectively, at close on Aug 23. While NVIDIA currently carries a Zacks Rank #2 (Buy), Marathon Digital sports a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Riot Blockchain

RIOT

, which has a Zacks Rank #3), reported impressive second-quarter 2021 results. The company’s mining revenues jumped a whopping 1,540% to a record $31.5 million. The stock was up 4.1% on close at Aug 23.

However,

MicroStrategy

MSTR

and Coinbase showed muted response to the bitcoin rally. While MicroStrategy inched up 0.3%, Coinbase declined 0.5% at the close on Aug 23.

Image Source: Zacks Investment Research

Will the Crypto Rally Continue?

Apart from steady mainstream adoption, bitcoin’s momentum is expected to benefit from waning chances of tapering by the U.S. Federal Reserve in the near term due to rising cases of coronavirus in the United States.

Fed Chairman Jerome Powell is now expected to maintain his dovish stance at the upcoming Jackson Hole Economic Symposium. The Central bank is now likely to adopt a wait-and-watch policy before signaling a winding down of the stimulus program.

However, the Fed’s dovish stance is expected to hurt the U.S. dollar, which might prompt bargain-hunting investors to park their cash in cryptocurrencies like bitcoin or its better-performing peers like cardano (up 38.3% past week) and solana (up 24.6% past week).

Tech IPOs With Massive Profit Potential

In the past few years, many popular platforms and like Uber and Airbnb finally made their way to the public markets. But the biggest paydays came from lesser-known names.

For example, electric carmaker X Peng shot up +299.4% in just 2 months. Think of it this way…

If you had put $5,000 into XPEV at its IPO in September 2020, you could have cashed out with $19,970 in November.

With record amounts of cash flooding into IPOs and a record-setting stock market, this year’s lineup could be even more lucrative.

See Zacks Hottest Tech IPOs Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report