Halliburton Company

HAL

announced the implementation of its SmartFleet intelligent fracturing system with a major operator in the Permian basin of West Texas.

In 2020, Halliburton introduced the SmartFleet system, which is the first intelligent automated fracturing system of the oil and gas industry. It incorporates intelligent automation and visualization, with subsurface measurements across multiple wells to respond to reservoir behavior.

The SmartFleet technology provides operators with real-time fracture control, while pumping through the integration of subsurface fracture measurements, live 3D visualization and real-time fracture commands. By means of the system, operators can drive improvements in completion execution and fracture outcomes.

In contrast to standard task automation, SmartFleet implements intelligence and measurements, which allow operators to make stage-level decisions to optimize completions in real-time. Beside optimizing fracture placement across every stage, the SmartFleet system provides real-time insights to manage frac hits and assess their consequences on fracture performance.

SmartFleet accomplished several groundbreaking achievements. Based on its effective runs across multiple basins so far, the SmartFleet system helped operators improve cluster uniformity up to 30%. It also helped optimize stage lengths, reduce completion costs up to 25% and achieve an increase in production of up to 20%.

With the SmartFleet intelligent fracturing system, operators can instantly see and control fracture outcomes that ultimately lead to improved asset economics.

Company Profile & Price Performance

Headquartered in Houston, TX, Halliburton is one of the largest oilfield service providers.

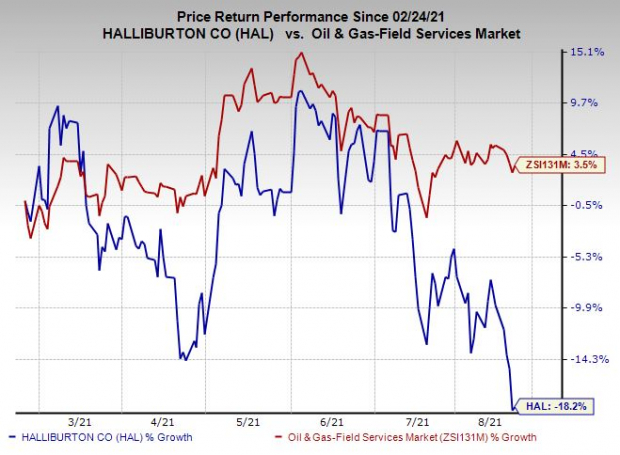

Shares of the company have underperformed the

industry

in the past six months. Its stock has declined 18.2% against the industry’s 3.5% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

The company currently carries a Zack Rank #3 (Hold).

Some better-ranked players in the energy space are

Chesapeake Energy Corporation

CHK

and

Cabot Oil & Gas Corporation

COG

, each currently flaunting a Zacks Rank #1 (Strong Buy), and

Delek Logistics Partners, L.P.

DKL

, carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Over the past 60 days, the Zacks Consensus Estimate for Chesapeake’s 2021 earnings has been raised by 21.8%.

Cabot’s earnings for 2021 are expected to increase 16.8% year over year.

Delek’s earnings for 2021 are expected to rise 15.7% year over year.

Tech IPOs With Massive Profit Potential:

Last years top IPOs surged as much as 299% within the first two months. With record amounts of cash flooding into IPOs and a record-setting stock market, this year could be even more lucrative.

See Zacks’ Hottest Tech IPOs Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report