Do You Have These Top Tech Stocks On Your September 2021 Watchlist?

While Chinese tech stocks

face regulatory woes, domestic names in the tech industry continue to shine. For the most part, this section of the

stock market today

remains active. Understandably, with the world’s increasing reliance on tech, this would make sense. If you think about it, tech is present in most facets of our lives. This includes our handheld electronics, cars, homes, and even critical infrastructure across nations to name a few. Given the vast applications of tech today, investors have plenty of

tech stocks

to choose from.

Not to mention, with Delta variant cases on the rise, more companies are delaying employees’ return to physical offices. As a result, we could also see continued momentum among enterprise software stocks. This would include companies such as

Fastly

(

NYSE: FSLY

) and

Twilio

(

NYSE: TWLO

) for example. To date, both FSLY stock and TWLO stock are now sitting on gains of over 180% since their pandemic era lows. Having read all of this, I could understand if you are interested in the top tech stocks in the

stock market

now. In that case, here are five worth noting.

Best Tech Stocks To Watch Right Now

-

Apple Inc.

(

NASDAQ: AAPL

) -

Coinbase Global Inc.

(

NASDAQ: COIN

) -

Microsoft Corporation

(

NASDAQ: MSFT

) -

Facebook Inc.

(

NASDAQ: FB

) -

Magnite Inc.

(

NASDAQ: MGNI

)

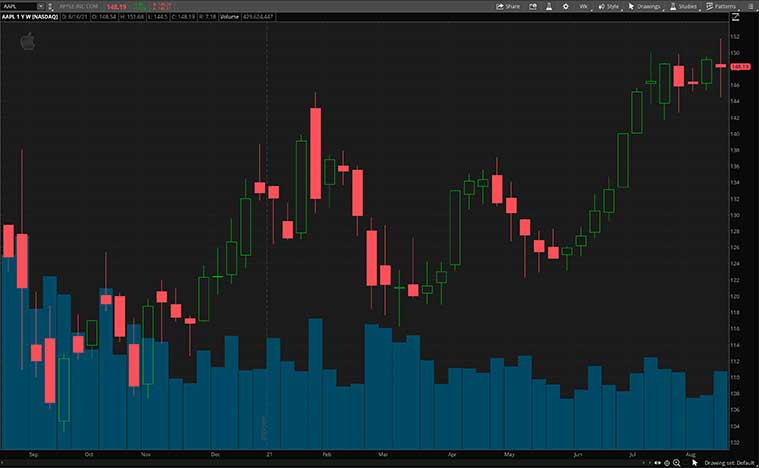

Apple Inc.

Apple

is a tech company that specializes in consumer electronics and online services. In fact, the company is one of the largest technology companies in the world by revenue and also one of the most valuable. On top of its premium line of smartphones and tablets, the company also provides a wide array of services like Apple Music and Apple TV. In late July, the company reported its third-quarter financials.

Diving in, it posted a record revenue of $81.4 billion for the quarter, increasing by 36% year-over-year. Also, Apple reported a quarterly earnings per diluted share of $1.30. The company says that subscription services reached an all-time high and that it reported revenue records in each of its geographic segments. It also saw double-digit growth in each of its product categories and a new all-time high for its installed base of active devices. All things considered, do you think AAPL stock is a top tech stock to watch right now?

Read More

-

4 Artificial Intelligence Stocks To Watch Right Now

-

Best Lithium Battery Stocks To Buy Now? 4 To Know

Coinbase Global Inc.

Coinbase

is a company that operates a cryptocurrency exchange platform. It allows its users to send and receive Bitcoin easily and securely. Impressively, it is one of the largest cryptocurrency exchanges in the U.S. by trading volume. With over 68 million verified users and having a quarterly traded volume of $462 billion, the company’s platform is available in over 100 countries. Last week the company announced an exciting piece of news.

To begin, Coinbase announced that it will be changing its investment policy. The company also says it has committed to invest $500 million of its cash and cash equivalents into crypto assets. Moving forward, it will also allocate 10% of its quarterly net income into a diverse portfolio of crypto assets. This would mean that the company will be the first publicly-traded company to hold Ethereum, Proof of Stake assets, DeFi tokens, and many other crypto assets supported for trading on its platform. With this exciting piece of news, will you consider watching COIN stock?

[Read More]

Best Communication Stocks To Watch Right Now

Microsoft Corporation

Next on this list, we have

Microsoft

, a multinational technology company that produces computer software and electronics. It is best known for its software products like the Microsoft Windows line of operating systems and also Microsoft Office, its productivity applications.

Last week, Thursday, the company said that it will be raising the prices of commercial subscriptions to its Microsoft 365 (formerly known as Office 365) bundles of productivity apps such as Word and Excel in 2022. The price increase will boost Microsoft’s total revenue and profit given how Office line remains the company’s top product in terms of sales and most Office revenue is also tied to business use. Notably, this will also be its first major price change since Microsoft launched the service in 2011. With that being said, will you watch MSFT stock?

[Read More]

Hot 5G Stocks To Buy As The Stock Market Rebounds? 3 In Focus

Facebook Inc.

Next, we will be taking a look at social media tech giant

Facebook

. As one of the major players in the social networking space now, Facebook’s core services remain relevant as ever. Through the company’s platform, people from across the globe can stay connected safely amidst the current pandemic. For a sense of scale, the company currently boasts a daily active user base of 1.91 billion. According to Facebook’s latest quarter fiscal, the average revenue per user came up to about $10.12 for the quarter.

While all this is great, Facebook is not resting on its laurels just yet. Earlier this week, David Marcus, head of Facebook’s fintech division made an exciting announcement. Namely, Marcus unveiled Novi, Facebook’s crypto-based digital wallet service.

In detail, Novi is fully approved in nearly every U.S. state and will offer peer-to-peer payments services. The likes of which span domestic and international transfers among other related solutions. With Facebook looking to branch into the crypto space, will you be keeping an eye on FB stock?

[Read More]

4 Robotics Stocks To Watch Amid Rising Shifts To Automation

Magnite Inc.

Topping off our list today is

Magnite

. In brief, the California-based company is a leading name in the online advertising industry. By Magnite’s estimates, it currently operates the world’s largest independent sell-side advertising platform. Through its ad-tech offerings, publishers can monetize their content across a wide variety of mediums. Now, with more consumers still homebound across the globe, Magnite’s services would be relevant. After all, companies would be interacting with potential customers in the digital space more than ever. Because of all this, I could see investors watching MGNI stock closely now.

Well, for one thing, Magnite appears to be kicking into high gear across the board now. For starters, the company reported stellar figures in its second-quarter fiscal posted earlier this month. Year-over-year, Magnite posted gains of 170% in total revenue, 194% in net income, and 172% in earnings per share.

Moreover, the company is also currently working with Merkle, a data-driven customer experience management firm. Through this partnership, Merkle’s identity resolution and data platform, Merkury, is now integrated with Magnite’s platform. With this, Magnite can now support targeted ads without relying on third-party cookies. All in all, would you consider adding MGNI stock to your watchlist?