Despite the coronavirus pandemic, which impacted the world on all levels, investor interest in nickel continued to increase in 2020.

Speculation about demand from the electric vehicle (EV) battery sector, paired with a recovery in China, helped the metal bounce back from the lows that it hit in March.

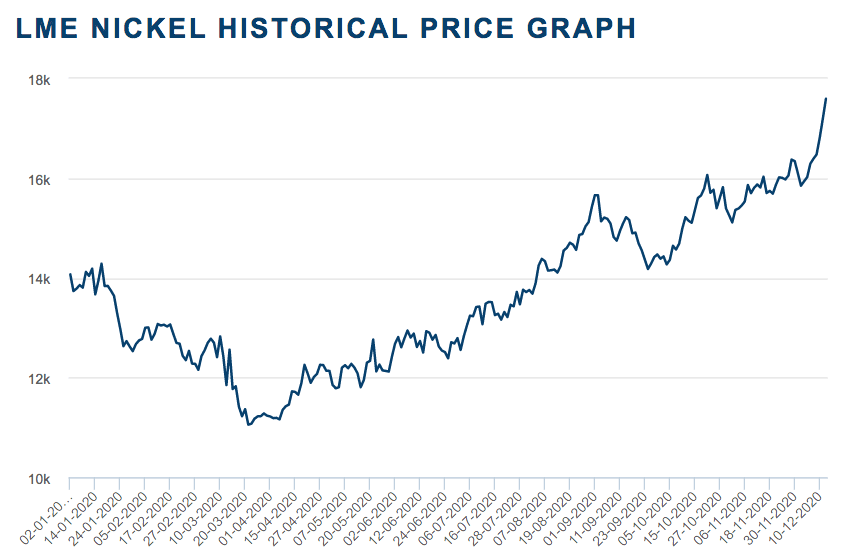

From US$11,055 per tonne on March 23 to a year-to-date high of US$17,650 on December 14, nickel prices experienced a sharp rebound in 2020.

To get a sense of what’s ahead for nickel, the Investing News Network (INN) reached out to companies in the space. Executives at

Blackstone Minerals

(ASX:

BSX

,OTCQB:BLSTF),

FPX Nickel

(TSXV:

FPX

) and

Tartisan Nickel

(CSE:

TN

) all offered their thoughts on 2020 and what to expect for the nickel market in 2021.

Nickel forecast 2021: Juniors optimistic

The coronavirus pandemic was without a doubt the main factor impacting commodities in 2020, and as mentioned nickel prices suffered during the first quarter of the year.

“COVID-19 had a massive impact on

base metal

prices … which was unpredictable,” Tessa Kutscher of Blackstone Minerals told INN.

From January to the end of March, nickel prices lost almost 34 percent, touching their lowest level of US$11,055 on March 23. But the rebound was even more impressive, with prices increasing by almost 60 percent from March 23 to their year-to-date peak on December 14.

2020 nickel price performance. Chart via the

London Metal Exchange

.

At the end of 2019, most companies were expecting nickel prices to surge after the metal had a bright year on the back of EV demand forecasts. That expectation became a reality in the second half of 2020.

“(I was) expecting rising commodity prices and a renewed focus (at the end of last year),” Mark Appleby, president and CEO of Tartisan Nickel, told INN.

Similarly, Martin Turenne, president and CEO of FPX Nickel, was anticipating modest price growth ― an expectation that was exceeded.

As mentioned, one of the most challenging aspects of the nickel space in 2020 were coronavirus containment measures and their impact on supply and demand dynamics. But 2020 also saw challenges for the nickel market that were not related to COVID-19.

For Appleby of Tartisan, the main issue was where investors were focusing; similarly, Kutscher of Blackstone mentioned

precious metals

prices going up due to uncertainty brought by COVID-19. When unrest rises, investors turn to safe haven assets like

gold

and

silver

and move away from riskier ones.

Looking at what could unfold for nickel in 2021, companies are expecting the market to be better than it was in 2020.

“I expect a better market with the growing demand for nickel from Southeast Asia’s battery manufacturers,” said Blackstone’s Kutscher.

In the summer, Tesla’s (NASDAQ:

TSLA

) Elon Musk put nickel under the spotlight after calling for companies to mine more nickel and promising a giant contract for those who could deliver.

Kutscher said that this move from the EV maker has helped the broader market get a better idea of the importance of mining nickel.

Appleby of Tartisan agreed, saying, “Battery metals are gaining mainstream acceptance.”

For his part, Turenne of FPX Nickel is expecting demand to grow on the back of a global economic recovery once the impact of the pandemic has been mitigated.

Nickel forecast 2021: What’s ahead

As 2021 kicks off, there are a few factors investors should be keeping an eye out for — in particular those looking at the prospects of nickel in the battery space.

Although it lags behind demand from the stainless steel sector, the battery segment continues to receive attention from nickel-focused investors. Expectations of increased demand as automakers move to higher-nickel cathodes for their EV batteries have continued to surge this year.

After Musk’s offer to provide a huge contract to nickel miners, many wonder if this is a trend the industry will see materialize next year.

“(In 2021,) I would expect to see automakers make more advances to locking in supplies of specific raw materials feeds,” Wood Mackenzie’s Adrian Gardner told INN. “I think initially we will see it in

lithium

/

cobalt

, as we have already, but nickel will also go the same way.”

Meanwhile, Jack Anderson of Roskill highlighted the deals the market has seen throughout 2020, such as the eight year supply deal between Indonesian prospective nickel producer PT Halmahera Persada Lygend and Chinese battery maker GEM (SZSE:

002340

).

“For the entire EV battery industry, deals like this again highlight the strategic importance of raw material security given the growing concerns on disruption risks in nickel and cobalt supply amid the ongoing COVID-19 pandemic. Vulnerable supply chains, compounded by environmental, social and governance (ESG) risks, could cause more volatility in the nickel market, at least in the short to medium term.”

Roskill believes the pinch point in the supply chain will be the supply of battery-grade intermediates to produce nickel sulfate for the battery industry. OEMs will be eager to address future supply security, and as a result the market will likely see partnerships and supply deals taking place over the course of 2021.

Looking at the issues the market could face going forward, Greg Miller of Benchmark Mineral Intelligence said that from a battery perspective, ramping up new projects will be one of the biggest challenges the industry faces. He also noted that ensuring the ESG credentials of new supply coming to market in 2021 and beyond will be a major hurdle.

“I think ultimately securing financing remains the biggest challenge for juniors,” he said.

“We continue to see midstream/downstream commitments in the battery supply; however, the COVID-19 pandemic has had a particularly negative effect on the upstream side of the industry where capital commitments for new projects have been reined in.”

Gardner also pointed to financing as a big challenge for junior miners. “They need to show that there is a market for their products, and the financial community is becoming more astute in asking, ‘Which type of nickel product do you intend to make and where do you think you can sell it?,’” he said.

When asked about what investors looking to enter the nickel market should pay attention to, Miller said it is crucial to follow where automakers and battery companies are committing capital.

“Whilst battery demand remains a small segment of overall nickel demand, it represents the primary prospects for long-term demand growth, and following such commitments provides a picture of how the long-term outlook from the EV industry is shaping up,” he added.

For Gardner, another area to keep an eye on is the battery recycling industry, which he believes should get more attention than it currently receives.

Don’t forget to follow us

@INN_Resource

for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Blackstone Minerals, FPX Nickel and Tartisan Nickel are clients of the Investing News Network. This article is not paid-for content.

The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.