This Post Was Syndicated Under License Via QuoteMedia

– Q4 2019 share repurchases reached $181.6 billion – 3.2% higher than Q3 2019, and 18.6% lower than the record Q4 2018. – Apple continued to lead, spending $22.1 billion – up from last quarter’s $17.6 billion, and ranking as the 3rd highest expenditure historically. – Buybacks remained top heavy with the top 20 companies accounting for 55.0% of the total, up from Q3 2019’s 50.4%, and the highest since the 59.8% in Q1 2010. – Buybacks for the full year 2019 were $728.7 billion – down 9.6% from the record $806.4 billion set in 2018. – Buyback impact remained broad as 20.8% of companies reduced their share count by at least four percent and increased their EPS. – 2020 has started to feel the COVID-19 impact on buybacks and dividends painting a different picture going forward.

NEW YORK, March 24, 2020 /PRNewswire/ — S&P Dow Jones Indices (“S&P DJI”) announced today that preliminary Q4 2019 S&P 500® stock buybacks, or share repurchases, were $181.6 billion – a 3.2% increase over Q3 2019’s $175.9 billion, but down 18.6% from Q4 2018’s $223.0 billion record.

Historical data on S&P 500 buybacks are available at www.spdji.com/indices/equity/sp-500.

Key Takeaways:

- Companies posted their second consecutive quarter of increased buyback expenditures after two quarters of declines from the record Q4 2018 expenditures. For the quarter, S&P 500 companies spent $181.6 billion on buybacks, up 3.2% from their Q3 2019 $175.9 billion mark, but down 18.6% from last year’s record Q4 2018 expenditure of $223.0 billion.

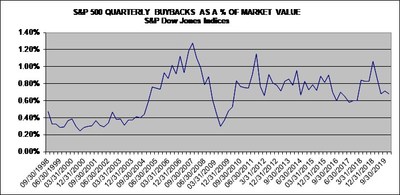

- For the full year 2019, companies spent $728.7 billion, down 9.6% from the record 2018 $806.4 billion ($519.4 billion in 2017), and ranking second highest in index history. The cumulative rolling four quarters of repurchases continued to impact EPS, as 20.8% of the issues reduced share counts by at least 4% year-over-year, down from Q3 2019’s 22.8%, but up from the 18.7% of Q4 2018.

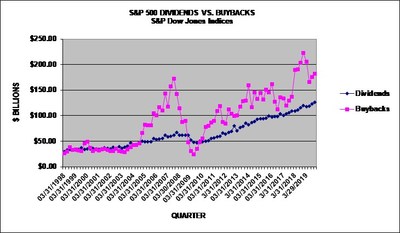

- S&P 500 Q4 2019 dividends set a quarterly record, increasing to $126.4 billion, up 5.5% from Q4 2018’s $119.8 billion; for 2019, dividends set a record with $485.5 billion, up 6.4% from the prior record, set in 2018, at $456.3 billion.

- Total shareholder return of buybacks and dividends for the quarter came in at $307.9 billion, up 3.0% from the Q3 2019 period expenditure of $299.0 billion and down 10.2% from the record $342.8 billion reported for Q4 2018.

- Total shareholder return for 2019 declined to $1.214 trillion from 2018’s record $1.263 trillion.

- Buybacks continued to be top heavy, with the top 20 issues accounting for 55% of the expenditures, up from last quarter’s 50.4% and the largest since the 59.8% in Q1 2010. The ten-year average is 44.9%.

“After lowering expenditures in the first half of 2019 from their tax-inspired record-setting buying spree of 2018, companies increased their share repurchases in Q3 by 6.3% and in Q4 by 3.2%,” said Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices. “While the levels are still shy of the 2018 record, they are significantly higher than the pre-2018 levels, and continued to surpass the hoped for $170 billion mark, which was seen as the level needed to support stocks and continue reduced share count EPS growth.”

2020 Outlook:

“COVID-19 has significantly changed the 2020 landscape, as dividends are under pressure and buybacks appear to be gasping for air,” said Silverblatt, who pointed out that buybacks must now compete with other corporate priorities as uncertainty over liquidity is at its highest since the 2008 financial crisis. For 2020:

- Buybacks appear to have moved to the backburner for most issues as companies appear to have reordered their short-term priorities:

- Controlling liquidity.

- Maintaining business operations and retaining employees.

- Uncertainty over the length of virus and depth of the economic impact.

- Pre-COVID-19 estimates predicted 2020 buybacks would come close to or exceed the $806 billion record set in 2018. Today:

- Q1,’20 buybacks are expected to be down significantly.

- Q2,’20 is expected to be dismal, with corporate participation light.

- For 2020, buybacks may see a complete reversal of the 2018 buyback bonanza.

- Once the market believes we have hit bottom, buybacks may be slow to come back as companies set their catch-up priorities and may stringently control expenditures amidst:

- Potential restrictions on buybacks through government programs.

- Public image of buybacks when the economy is still recovering.

Q4 2019 GICS® Sector Analysis:

Information Technology buybacks reversed its prior two quarters of expenditure declines, spending $52.4 billion for the quarter, up 6.5% from the prior quarters $47.8 billion, but down 14.5% from the Q4 2018 $61.3 billion level. On a percentage basis, the sector represented 28.9% of all buybacks, up from the prior quarters 28.0%. For the year, the group spent $224.8 billion, representing 30.9% of the buybacks, down 19.3% from the 2018 $278.5 billion expenditure, which represented 34.5% of the buybacks.

Financials remained right behind Information Technology as they increased expenditures 5.1% to $50.2 billion, up from last quarter’s $47.8 billion, representing 27.6% of all buybacks, up from 27.2% in Q3 2019. For the year, the group spent $178.7 billion, representing 24.5% of all buybacks, up 19.1% from their 2018 expenditure of $150.1 billion, which represented 18.6% of the buybacks.

Health Care buybacks increased 25.2% to $20.0 billion from last quarter’s 16.0 billion, as the full year declined 22.8% to $83.9 billion from $108.7 billion in 2018.

Issues:

The five issues with the highest total buybacks for Q4 2019 are:

- Apple (AAPL) continued to lead, spending $22.1 billion in Q4 2019, ranking 3rd in S&P 500 history, as the level was up 25.2% from their Q3 2019 $17.6 billion expenditure and over double the Q4 2018 $10.1 billion. For the year, Apple has spent $81.7 billion on buybacks, up from 2018’s $74.2 billion. Over the five-year period, they have spent $264.3 billion and $342.0 billion over the ten-year period.

- Bank of America (BAC): $7.7 billion for Q4 2019, up from $7.6 billion for Q3 2019; in 2019 they spent $28.1 billion, up from $20.1 billion in 2018.

- Oracle (ORCL): $5.0 billion for Q4 2019, down from $5.5 billion in Q3 2019; 2019 was $26.9 billion down from $29.3 billion in 2018.

- Wells Fargo (WFC): $7.4 billion for Q4 2019, down from their $7.5 billion Q3 2019 expenditure; 2019 was $24.8 billion, up from $21.0 billion for 2018.

- JP Morgan (JPM): $6.8 billion for Q4 2019, down from the $6.9 billion spent in Q3 2019; 2019 was $24.0 billion, up from $20.0 billion for 2018.

For more information about S&P Dow Jones Indices, please visit www.spdji.com.

|

S&P Dow Jones Indices |

||||||||

|

S&P 500, $ U.S. BILLIONS |

(preliminary and estimates in bold) |

|||||||

|

PERIOD |

MARKET |

OPERATING |

AS REPORTED |

DIVIDEND & |

||||

|

VALUE |

EARNINGS |

EARNINGS |

DIVIDENDS |

BUYBACKS |

DIVIDEND |

BUYBACK |

BUYBACK |

|

|

$ BILLIONS |

$ BILLIONS |

$ BILLIONS |

$ BILLIONS |

$ BILLIONS |

YIELD |

YIELD |

YIELD |

|

|

2019 |

$26,759.69 |

$1,304.59 |

$1,158.72 |

$485.48 |

$728.74 |

1.81% |

2.72% |

4.54% |

|

2018 |

$21,026.90 |

$1,281.66 |

$1,119.43 |

$456.31 |

$806.41 |

2.17% |

3.84% |

6.01% |

|

2017 |

$22,821.24 |

$1,066.00 |

$940.86 |

$419.77 |

$519.40 |

1.84% |

2.28% |

4.12% |

|

2016 |

$19,267.93 |

$919.85 |

$818.55 |

$397.21 |

$536.38 |

2.06% |

2.78% |

4.85% |

|

2015 |

$17,899.56 |

$885.38 |

$762.74 |

$382.32 |

$572.16 |

2.14% |

3.20% |

5.33% |

|

12/31/2019 |

$26,760 |

$324.35 |

$294.78 |

$126.35 |

$181.58 |

1.81% |

2.72% |

4.54% |

|

9/30/2019 |

$24,707 |

$330.42 |

$282.12 |

$123.12 |

$175.89 |

1.94% |

3.12% |

5.06% |

|

6/28/2019 |

$24,423 |

$333.26 |

$290.00 |

$118.68 |

$165.46 |

1.93% |

3.27% |

5.20% |

|

3/29/2019 |

$23,619 |

$316.56 |

$291.82 |

$117.33 |

$205.81 |

1.97% |

3.49% |

5.45% |

|

12/31/2018 |

$21,027 |

$293.82 |

$242.91 |

$119.81 |

$222.98 |

2.17% |

3.84% |

6.01% |

|

9/30/2018 |

$24,579 |

$349.04 |

$306.70 |

$115.72 |

$203.76 |

1.81% |

2.93% |

4.75% |

|

6/30/2018 |

$23,036 |

$327.53 |

$288.55 |

$111.60 |

$190.62 |

1.89% |

2.80% |

4.69% |

|

3/29/2018 |

$22,496 |

$311.26 |

$281.28 |

$109.18 |

$189.05 |

1.90% |

2.56% |

4.46% |

|

12/29/2017 |

$22,821 |

$288.93 |

$230.12 |

$109.46 |

$136.97 |

1.84% |

2.28% |

4.12% |

|

9/29/2017 |

$21,579 |

$268.35 |

$243.68 |

$105.45 |

$129.17 |

1.92% |

2.40% |

4.32% |

|

6/30/2017 |

$20,762 |

$261.39 |

$231.40 |

$104.01 |

$120.11 |

1.96% |

2.41% |

4.37% |

|

3/31/2017 |

$20,276 |

$247.32 |

$235.65 |

$100.86 |

$133.15 |

1.98% |

2.51% |

4.49% |

|

12/31/2016 |

$19,268 |

$240.11 |

$207.93 |

$103.82 |

$135.29 |

2.06% |

2.78% |

4.85% |

|

9/30/2016 |

$18,742 |

$247.98 |

$219.46 |

$98.43 |

$112.20 |

2.10% |

2.92% |

5.01% |

|

6/30/2016 |

$18,193 |

$222.77 |

$201.79 |

$98.30 |

$127.50 |

2.14% |

3.22% |

5.36% |

|

3/31/2016 |

$17,958 |

$208.99 |

$189.37 |

$96.67 |

$161.39 |

2.15% |

3.28% |

5.43% |

|

S&P Dow Jones Indices |

|||||||||

|

S&P 500 SECTOR BUYBACKS |

|||||||||

|

SECTOR $ MILLIONS |

Q4,’19 |

Q3,’19 |

Q4,’18 |

12MoDec,’19 |

12MoDec,’18 |

5-YEARS |

10-YEARS |

Q4,’18 |

Q2,’09 |

|

(high) |

(recent low) |

||||||||

|

Consumer Discretionary |

$16,620 |

$18,372 |

$25,652 |

$68,476 |

$86,674 |

$420,287 |

$754,092 |

$25,652 |

$2,350 |

|

Consumer Staples |

$9,429 |

$7,509 |

$9,588 |

$33,838 |

$33,449 |

$206,448 |

$440,320 |

$9,588 |

$4,013 |

|

Energy |

$5,025 |

$4,880 |

$8,698 |

$18,750 |

$30,427 |

$82,926 |

$266,702 |

$8,698 |

$5,343 |

|

Financials |

$50,232 |

$47,789 |

$45,641 |

$178,685 |

$150,054 |

$652,120 |

$906,749 |

$45,641 |

$1,170 |

|

Healthcare |

$20,041 |

$16,007 |

$31,336 |

$83,864 |

$108,692 |

$415,445 |

$711,672 |

$31,336 |

$4,699 |

|

Industrials |

$10,218 |

$14,181 |

$23,026 |

$60,792 |

$78,239 |

$348,870 |

$563,488 |

$23,026 |

$1,681 |

|

Information Technology |

$52,432 |

$49,241 |

$61,298 |

$224,847 |

$278,526 |

$892,006 |

$1,410,197 |

$61,298 |

$4,757 |

|

Materials |

$3,117 |

$5,400 |

$5,857 |

$15,709 |

$14,391 |

$59,874 |

$116,194 |

$5,857 |

$159 |

|

Real Estate |

$573 |

$694 |

$1,480 |

$2,230 |

$3,768 |

$10,601 |

$10,601 |

$1,480 |

|

|

Communication Services |

$13,687 |

$11,028 |

$9,556 |

$38,192 |

$20,237 |

$65,665 |

$96,656 |

$9,556 |

$13 |

|

Utilities |

$211 |

$784 |

$850 |

$3,355 |

$1,952 |

$8,843 |

$18,082 |

$850 |

$10 |

|

TOTAL |

$181,583 |

$175,886 |

$222,980 |

$728,738 |

$806,408 |

$3,163,084 |

$5,294,754 |

$222,980 |

$24,195 |

|

SECTOR BUYBACK MAKEUP % |

Q4,’19 |

Q3,’19 |

Q4,’18 |

12MoDec,’19 |

12MoDec,’18 |

5-YEARS |

10-YEARS |

Q4,’18 |

Q2,’09 |

|

Consumer Discretionary |

9.15% |

10.45% |

11.50% |

9.40% |

10.75% |

13.29% |

14.24% |

11.50% |

9.71% |

|

Consumer Staples |

5.19% |

4.27% |

4.30% |

4.64% |

4.15% |

6.53% |

8.32% |

4.30% |

16.59% |

|

Energy |

2.77% |

2.77% |

3.90% |

2.57% |

3.77% |

2.62% |

5.04% |

3.90% |

22.08% |

|

Financials |

27.66% |

27.17% |

20.47% |

24.52% |

18.61% |

20.62% |

17.13% |

20.47% |

4.84% |

|

Healthcare |

11.04% |

9.10% |

14.05% |

11.51% |

13.48% |

13.13% |

13.44% |

14.05% |

19.42% |

|

Industrials |

5.63% |

8.06% |

10.33% |

8.34% |

9.70% |

11.03% |

10.64% |

10.33% |

6.95% |

|

Information Technology |

28.88% |

28.00% |

27.49% |

30.85% |

34.54% |

28.20% |

26.63% |

27.49% |

19.66% |

|

Materials |

1.72% |

3.07% |

2.63% |

2.16% |

1.78% |

1.89% |

2.19% |

2.63% |

0.66% |

|

Real Estate |

0.32% |

0.39% |

0.66% |

0.31% |

0.47% |

0.34% |

0.20% |

0.66% |

0.00% |

|

Telecommunication Services |

7.54% |

6.27% |

4.29% |

5.24% |

2.51% |

2.08% |

1.83% |

4.29% |

0.05% |

|

Utilities |

0.12% |

0.45% |

0.38% |

0.46% |

0.24% |

0.28% |

0.34% |

0.38% |

0.04% |

|

TOTAL |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

|

S&P Dow Jones Indices |

||||||||

|

S&P 500 20 LARGEST Q4 2019 BUYBACKS, $ MILLIONS |

||||||||

|

Company |

Ticker |

Sector |

Q4 2019 |

12-Months |

12-Months |

5-Year |

10-Year |

Indicated |

|

Buybacks |

Dec,’19 |

Dec,’18 |

Buybacks |

Buybacks |

Dividend |

|||

|

$ Million |

$ Million |

$ Million |

$ Million |

$ Million |

$ Million |

|||

|

Apple |

AAPL |

Information Technology |

$22,085 |

$81,685 |

$74,246 |

$264,340 |

$342,031 |

$14,559 |

|

Bank of America |

BAC |

Financials |

$7,748 |

$28,144 |

$20,094 |

$68,538 |

$73,433 |

$7,196 |

|

Wells Fargo |

WFC |

Financials |

$7,386 |

$24,835 |

$20,964 |

$73,407 |

$94,602 |

$9,481 |

|

Bristol-Myers Squibb |

BMY |

Health Care |

$7,000 |

$7,300 |

$320 |

$10,320 |

$14,958 |

$4,220 |

|

JPMorgan |

JPM |

Financials |

$6,751 |

$24,001 |

$19,983 |

$74,092 |

$97,156 |

$11,291 |

|

Alphabet |

GOOGL |

Communication Services |

$6,098 |

$18,396 |

$9,075 |

$37,790 |

$38,708 |

$0 |

|

Microsoft |

MSFT |

Information Technology |

$5,206 |

$19,504 |

$16,300 |

$77,549 |

$117,704 |

$15,563 |

|

Citigroup |

C |

Financials |

$5,127 |

$17,982 |

$10,327 |

$58,741 |

$63,012 |

$4,454 |

|

Oracle |

ORCL |

Information Technology |

$5,036 |

$26,857 |

$29,306 |

$77,431 |

$109,871 |

$4,775 |

|

Intel |

INTC |

Information Technology |

$3,523 |

$13,623 |

$10,730 |

$34,418 |

$69,168 |

$5,742 |

|

Procter & Gamble |

PG |

Consumer Staples |

$3,504 |

$9,504 |

$4,754 |

$25,719 |

$56,097 |

$7,432 |

|

Home Depot |

HD |

Consumer Discretionary |

$3,056 |

$6,965 |

$9,963 |

$38,808 |

$64,416 |

$6,545 |

|

Visa |

V |

Information Technology |

$2,517 |

$8,741 |

$7,914 |

$34,852 |

$48,690 |

$2,054 |

|

Charter Communications |

CHTR |

Communication Services |

$2,305 |

$6,873 |

$4,399 |

$24,587 |

$25,371 |

$0 |

|

U.S. Bancorp |

USB |

Financials |

$2,293 |

$4,525 |

$2,822 |

$14,724 |

$21,576 |

$2,883 |

|

Goldman Sachs Group |

GS |

Financials |

$2,166 |

$6,080 |

$4,412 |

$30,828 |

$57,343 |

$1,967 |

|

Biogen |

BIIB |

Health Care |

$2,093 |

$5,868 |

$4,353 |

$17,586 |

$22,434 |

$0 |

|

Berkshire Hathaway |

BRK.B |

Financials |

$2,043 |

$4,850 |

$1,346 |

$6,196 |

$6,263 |

$0 |

|

AT&T |

T |

Communication Services |

$2,008 |

$2,417 |

$609 |

$4,270 |

$31,667 |

$15,194 |

|

|

FB |

Communication Services |

$1,923 |

$6,539 |

$16,087 |

$27,854 |

$31,679 |

$0 |

|

Top 20 |

$99,868 |

$324,689 |

$268,004 |

$1,002,050 |

$1,386,179 |

$113,356 |

||

|

S&P 500 |

$181,583 |

$728,738 |

$806,408 |

$3,163,084 |

$5,294,754 |

$553,760 |

||

|

Top 20 % of S&P 500 |

55.00% |

44.55% |

33.23% |

31.68% |

26.18% |

20.47% |

||

|

Gross values are not adjusted for float |

||||||||

|

S&P Dow Jones Indices |

||||

|

S&P 500 20 Largest Quarterly Buybacks, $ Millions, as of Q4 2019; Apple added at #3 |

||||

|

$ MILLIONS |

QUARTER |

COMPANY |

SECTOR |

|

|

$23,811 |

Q1 2019 |

Apple |

Information Technology |

1 |

|

$22,908 |

Q1 2018 |

Apple |

Information Technology |

2 |

|

$22,085 |

Q4 2019 |

Apple |

Information Technology |

3 |

|

$21,860 |

Q2 2018 |

Apple |

Information Technology |

4 |

|

$21,162 |

Q2 2006 |

QUALCOMM |

Information Technology |

5 |

|

$19,364 |

Q3 2018 |

Apple |

Information Technology |

6 |

|

$18,154 |

Q2 2019 |

Apple |

Information Technology |

7 |

|

$18,036 |

Q1 2014 |

Apple |

Information Technology |

8 |

|

$17,635 |

Q3 2019 |

Apple |

Information Technology |

9 |

|

$17,319 |

Q3 2014 |

Apple |

Information Technology |

10 |

|

$16,413 |

Q2 2013 |

Apple |

Information Technology |

11 |

|

$15,707 |

Q3 2007 |

International Business Machines |

Information Technology |

12 |

|

$13,420 |

Q3 2015 |

Apple |

Information Technology |

13 |

|

$12,852 |

Q4 2013 |

Johnson & Johnson |

Healthcare |

14 |

|

$12,318 |

Q4 2016 |

Allergan plc (AGN) |

Healthcare |

15 |

|

$12,183 |

Q2 2012 |

Johnson & Johnson |

Healthcare |

16 |

|

$11,480 |

Q4 2016 |

Apple |

Information Technology |

17 |

|

$11,133 |

Q4 2017 |

Apple |

Information Technology |

18 |

|

$10,776 |

Q2 2016 |

Apple |

Information Technology |

19 |

|

$10,724 |

Q2 2015 |

Apple |

Information Technology |

20 |

|

S&P Dow Jones Indices |

||||

|

S&P 500 Q4 2019 Buyback Report |

||||

|

SECTOR |

DIVIDEND |

BUYBACK |

COMBINED |

|

|

YIELD |

YIELD |

YIELD |

||

|

Consumer Discretionary |

2.01% |

3.21% |

5.22% |

|

|

Consumer Staples |

4.03% |

1.95% |

5.98% |

|

|

Energy |

7.36% |

3.07% |

10.43% |

|

|

Financials |

3.22% |

6.90% |

10.11% |

|

|

HealthCare |

2.02% |

2.50% |

4.52% |

|

|

Industrials |

2.68% |

3.26% |

5.95% |

|

|

Information Technology |

1.53% |

3.95% |

5.49% |

|

|

Materials |

3.02% |

2.97% |

5.99% |

|

|

Real Estate |

3.60% |

0.31% |

3.91% |

|

|

Communications Services |

1.77% |

1.88% |

3.65% |

|

|

Utilities |

3.63% |

0.43% |

4.05% |

|

|

S&P 500 |

2.51% |

3.30% |

5.81% |

|

|

Uses full values (unadjusted for float) |

||||

|

Dividends based on indicated; buybacks based on the last 12-months ending Q4,’19 |

||||

|

Share Count Changes |

||

|

(Y/Y diluted shares used for EPS) |

>=4% |

<=-4% |

|

Q4 2019 |

7.68% |

20.81% |

|

Q3 2019 |

8.62% |

22.85% |

|

Q2 2019 |

7.98% |

24.15% |

|

Q1 2019 |

8.03% |

24.90% |

|

Q4 2018 |

8.45% |

18.71% |

|

Q3 2018 |

6.43% |

17.67% |

|

Q2 2018 |

6.20% |

15.60% |

|

Q1 2018 |

7.01% |

13.63% |

|

Q4 2017 |

6.83% |

15.06% |

|

Q3 2017 |

8.62% |

14.23% |

|

Q2 2017 |

10.00% |

14.00% |

|

Q1 2017 |

12.00% |

14.80% |

|

Q4 2016 |

10.48% |

19.35% |

ABOUT S&P DOW JONES INDICES

S&P Dow Jones Indices is the largest global resource for essential index-based concepts, data and research, and home to iconic financial market indicators, such as the S&P 500® and the Dow Jones Industrial Average®. More assets are invested in products based on our indices than products based on indices from any other provider in the world. Since Charles Dow invented the first index in 1884, S&P DJI has been innovating and developing indices across the spectrum of asset classes helping to define the way investors measure and trade the markets.

S&P Dow Jones Indices is a division of S&P Global (NYSE: SPGI), which provides essential intelligence for individuals, companies, and governments to make decisions with confidence. For more information, visit: www.spdji.com.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/sp-500-buybacks-up-3-2-in-q4-2019-full-year-2019-down-9-6-from-record-2018–as-companies-brace-for-a-more-volatile-2020–301028874.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/sp-500-buybacks-up-3-2-in-q4-2019-full-year-2019-down-9-6-from-record-2018–as-companies-brace-for-a-more-volatile-2020–301028874.html

SOURCE S&P Dow Jones Indices